|

Getting your Trinity Audio player ready...

|

Blockchain banking platform Bleap has announced a strategic partnership with payments giant Mastercard to integrate stablecoin payments directly into traditional financial infrastructure. The alliance, revealed exclusively to The Block, marks a significant milestone in making blockchain-native assets usable in everyday transactions.

Founded by former Revolut employees Joao Alves and Guilherme Gomes, Bleap launched its beta in December 2024 with a mission to streamline DeFi access and enhance stablecoin usability. The company raised $2.3 million in pre-seed funding last year — led by Consensys founder Joe Lubin’s Ethereal Ventures — achieving a $10 million post-money valuation. Since then, Bleap has processed over $5 million in transactions, claiming to have saved users more than $100,000 in fees.

Now, with Mastercard on board, Bleap is poised to scale globally. According to the company, the collaboration will enable other wallet providers to plug directly into Mastercard’s global payment rails using Bleap’s proprietary tech — bypassing centralized intermediaries and preserving self-custody for users.

“We’re enabling stablecoins to be spent directly onchain — without conversions, intermediaries or loss of custody,” said Bleap CEO Joao Alves. “It’s a frictionless bridge between DeFi and traditional finance.”

Reinventing Crypto Payments with Stablecoins

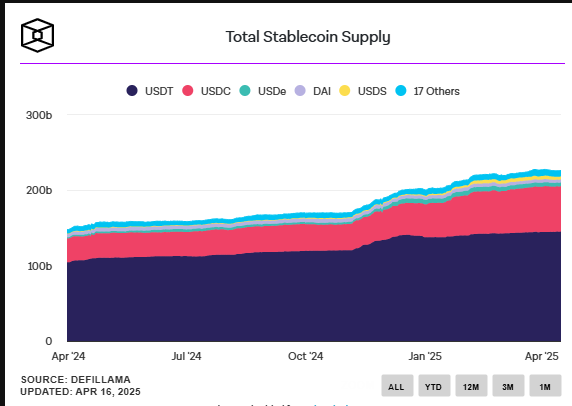

The partnership arrives as stablecoins emerge as a core component of the digital economy. Analysts at Bitwise reported that stablecoins processed over $5.1 trillion in global transactions in the first half of 2024 — nearly rivaling Visa’s $6.5 trillion over the same period. With Tether alone holding over $115 billion in U.S. Treasuries, these digital dollars are now reshaping cross-border payments, remittances, and online commerce.

Mastercard’s Web3 Card Program — which also includes partnerships with MetaMask, Ledger, and Baanx — is part of its broader strategy to integrate digital currencies into global finance. “Helping people and businesses embrace digital currencies by simplifying how they can be spent is essential,” said Scott Abrahams, Mastercard EVP of Global Partnerships.

How Bleap Works

Built on Ethereum Layer 2 Arbitrum, Bleap delivers gasless transactions, multi-currency smart wallets, and a non-custodial experience powered by account abstraction (ERC-4337). Seed phrases are replaced by PortalHQ’s MPC technology, allowing users to access their wallets via social logins while retaining full control over their assets.

Users can purchase stablecoins fee-free, receive 2% cashback using the Mastercard-powered debit card, and manage assets across supported networks like Ethereum, Solana, Polygon, BNB, and Bitcoin.

The most innovative feature? Unlike traditional crypto cards, Bleap does not require upfront crypto-to-fiat conversion. When a user makes a payment — say, $5 at Starbucks — Bleap verifies the balance, executes the transaction onchain in USDC or USDT, and handles fiat settlement with Mastercard in real-time.

“The key challenge was connecting a public blockchain to Mastercard in a fast, cost-efficient, and regulatory-compliant way,” said Alves.

What’s Next for Bleap?

With Mastercard’s backing, Bleap plans to focus on European expansion before targeting Latin America, where alternative financial tools are in high demand. The company also confirmed plans to launch its native token in 2026, with further details to be revealed closer to launch.

As stablecoin legislation looms in the U.S. and more financial institutions explore blockchain integration, Bleap’s frictionless, non-custodial approach may well define the future of crypto banking.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!