|

Getting your Trinity Audio player ready...

|

Ethereum (ETH) has suffered a steep decline of 11.8% over the past week, with technical indicators signaling that bearish momentum remains strong. Whale transfers to exchanges have further reinforced the negative market sentiment, raising concerns over further price deterioration.

Ethereum Breaks Below Early March Support

ETH’s price trajectory has remained firmly bearish on the daily timeframe. It continues to trade below the 20-day moving average, a sign that selling pressure has not subsided. This prolonged decline suggests that buyers have yet to regain control of the market.

Additionally, Ethereum has slipped below the critical $2,000 psychological level, intensifying fears of further losses. The On-Balance Volume (OBV) indicator reflects a consistent downtrend, with lower highs and lower lows. This confirms steady selling pressure, further eroding investor confidence.

Key Support Levels and Potential Price Targets

As ETH struggles to find stability, analysts are eyeing the next key support levels at $1,824 and $1,550—both of which held strong in October and November 2023. With Ethereum closing below $1,824 in a recent daily trading session, bears appear to have the upper hand. The $1,850 zone, which previously acted as support in mid-March, has now flipped into resistance, reinforcing the bearish outlook.

The 4-hour chart also highlights a failed rally attempt toward $2,128, which reversed at $2,100. Notably, the $1,950 higher low was left undefended, signaling further weakness. Similarly, OBV on the 4-hour chart continues its downward trajectory, aligning with the bearish trend seen on the daily timeframe.

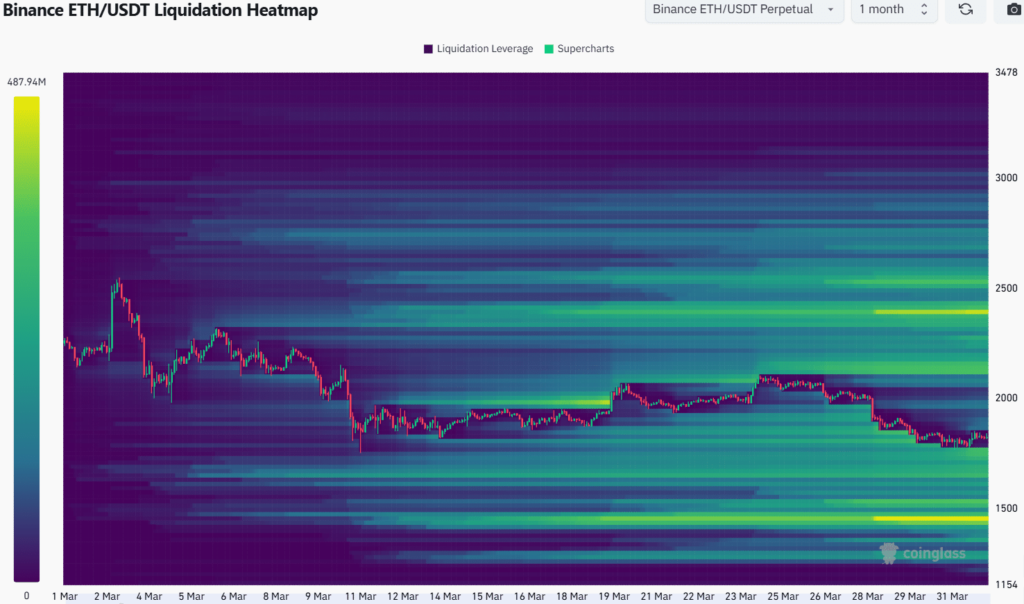

Liquidation Heatmap Points to Further Declines

According to the liquidation heatmap, the $2,150 zone presents a potential magnet for price rebounds. However, the stronger liquidity pocket lies between $1,760 and $1,640, suggesting Ethereum is more likely to slide toward the $1.6K region in the near term.

Also Read: BlackRock’s Bullish Bet on Ethereum: Will ETH Outshine Bitcoin?

With persistent selling pressure, ETH‘s short-term outlook remains bleak. Unless bulls can reclaim key resistance levels, further losses toward $1,550 could be imminent. Long-term trends also show no signs of reversal, keeping investors on high alert as Ethereum navigates this bearish phase.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.