|

Getting your Trinity Audio player ready...

|

- Ethereum (ETH) Price Forecast: Bullish Momentum Could Drive 97% Gain by Q1 2025

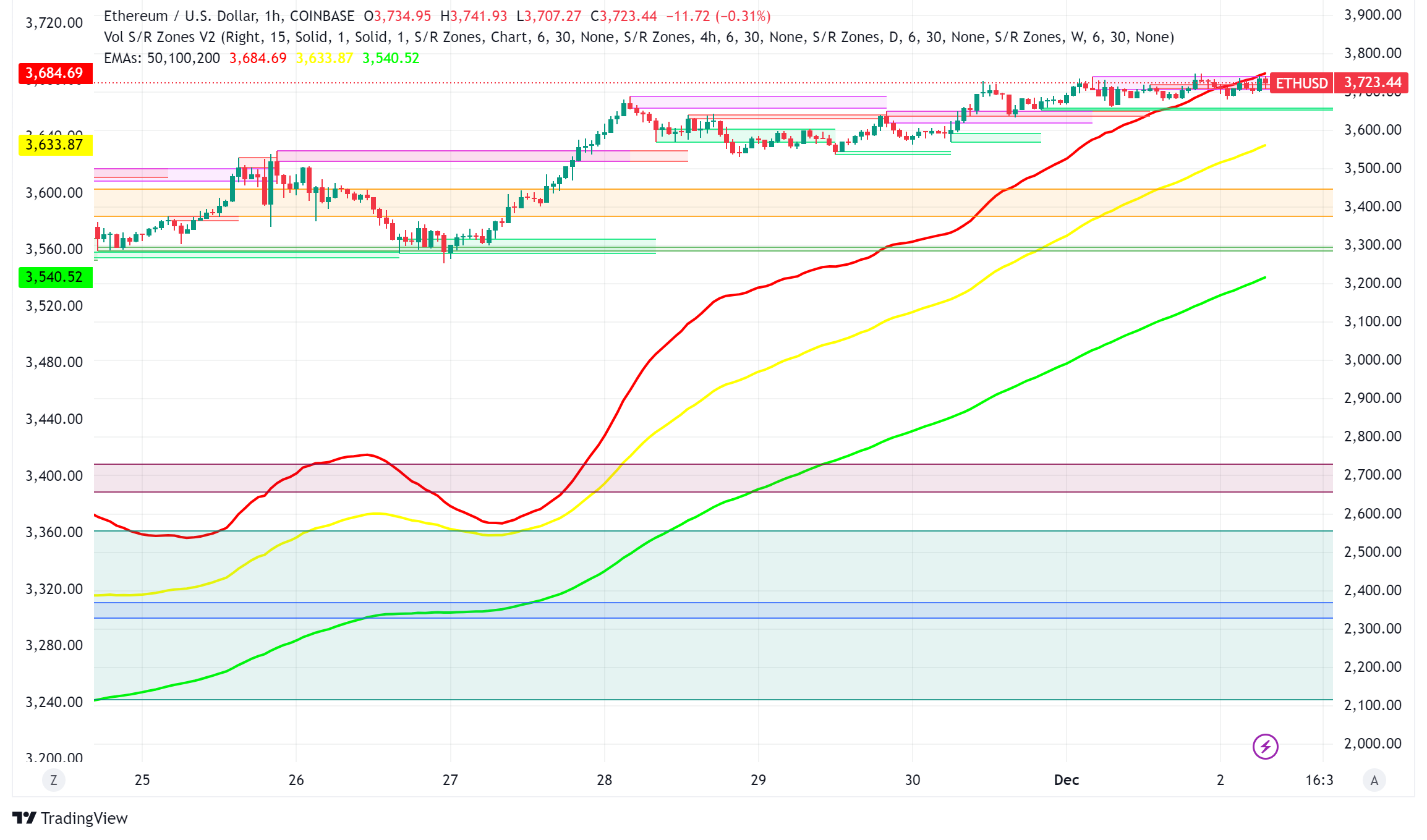

Ethereum (ETH/USD) has captured the attention of cryptocurrency analysts with a promising price forecast, projecting a potential 97% price increase by the first quarter of 2025. In the past week alone, Ethereum has surged by over 11%, bringing its current price to approximately $3,700. With technical indicators and a surge in institutional interest pointing toward continued bullish momentum, many believe Ethereum is poised for significant gains.

Ethereum’s Technical Analysis and Price Predictions

Ethereum’s current price movement has caught the eye of pseudonymous cryptocurrency analyst Venturefounder, who has identified a rare three-year “cup and handle” pattern forming on Ethereum’s charts. As this pattern nears completion, analysts are eyeing aggressive price targets for Ethereum, with the first target set at $5,349. The second target is even more ambitious, at $6,457, while the final target hovers around $7,238. If Ethereum can maintain the critical support level of $3,800, these predictions suggest the token could nearly double in value over the coming months.

What’s Driving Ethereum’s Bullish Sentiment?

Several factors are contributing to Ethereum’s rising price momentum. First, the market has seen a surge in institutional interest, particularly with Ethereum ETFs. On November 29, Ethereum ETFs in the U.S. reached a new daily inflow record of $332.9 million, surpassing the previous high of $295.5 million. The iShares Ethereum Trust from BlackRock led the charge with a massive $250 million inflow, while the Fidelity Ethereum Fund followed with $79 million. These inflows indicate strong demand and growing confidence in Ethereum from institutional investors.

Additionally, Ethereum whales, or large investors, have been actively accumulating the cryptocurrency. In just four days, whales holding between 100,000 and 1,000,000 ETH acquired approximately 280,000 ETH, worth nearly $1 billion. This accumulation signals that major investors are confident in Ethereum’s future prospects.

Ethereum’s CME futures open interest has also hit an all-time high of $2.8 billion, further reflecting strong institutional interest. The futures premium has increased to 14%, signaling optimism among traders.

Potential Roadblocks for Ethereum’s Rally

Despite the bullish outlook, there are some potential hurdles that could dampen Ethereum’s price growth. One key factor is the U.S. Dollar Index (DXY), currently trading at 105.78. Some analysts, including Venturefounder, believe that a breakdown in the DXY could trigger a significant price surge for Ethereum, but the timing of such a breakdown remains uncertain.

Another concern is the increasing open interest in Ethereum futures without a corresponding price increase. Analyst ShayanBTC warns that this imbalance could lead to heightened volatility and potential liquidation cascades if the market experiences a sudden downturn.

Ethereum Price Predictions

Several analysts are echoing Ethereum’s bullish potential. Titan of Crypto has set a price target of $5,800, citing the bullish Ichimoku Golden Cross pattern forming on Ethereum’s weekly chart. Meanwhile, Trader Wolf is predicting even higher targets, forecasting Ethereum to reach between $9,000 and $10,000 by May 2025. Doctor Profit has also weighed in, suggesting that current prices below $4,000 represent a “mid-term gift” for long-term investors.

Ethereum’s strong bullish momentum, driven by institutional interest, whale accumulation, and technical indicators, positions it for substantial gains in the coming months. While potential challenges like the U.S. Dollar Index and increasing futures open interest may create volatility, the overall outlook remains positive. With aggressive price targets and a growing institutional footprint, Ethereum could be one of the top-performing cryptocurrencies in the next year.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!