|

Getting your Trinity Audio player ready...

|

- ETH ETFs received $360M in inflows, surpassing Bitcoin.

- Whale accumulation hits highest level since Feb 2023.

- Fed rate cut expectations may fuel ETH momentum.

Stay ahead with real-time updates and insights—Join our Telegram channel!

Ethereum (ETH) appears poised for a significant price move after weeks of consolidation. Strong institutional demand, highlighted by record inflows into Ethereum ETFs, combined with expectations of a Federal Reserve rate cut, is fueling bullish sentiment in the market. Currently, ETH trades above $4,500, but momentum could push it toward new highs in the near term.

Institutional Appetite Shifts Toward Ethereum

Data from SosoValue shows Ethereum ETFs received $360 million in inflows on September 15, surpassing Bitcoin ETFs, which saw $260 million. This marks the fifth consecutive day of net inflows for ETH ETFs, signaling growing institutional preference.

CoinShares reports that ETH-focused digital asset investment products attracted $646 million over the same period. James Butterfill, CoinShares Head of Research, noted that this reverses prior outflows and underscores renewed confidence in Ethereum.

These sustained inflows highlight Ethereum’s rising appeal as a preferred allocation among large investors, hinting at potential upward pressure on spot prices.

Macro Tailwinds Boost ETH Momentum

Market watchers are also eyeing the upcoming Federal Open Market Committee (FOMC) meeting on September 17. Expectations of a 25 basis point rate cut could inject liquidity into markets, reduce borrowing costs, and increase appetite for risk-on assets like Ethereum.

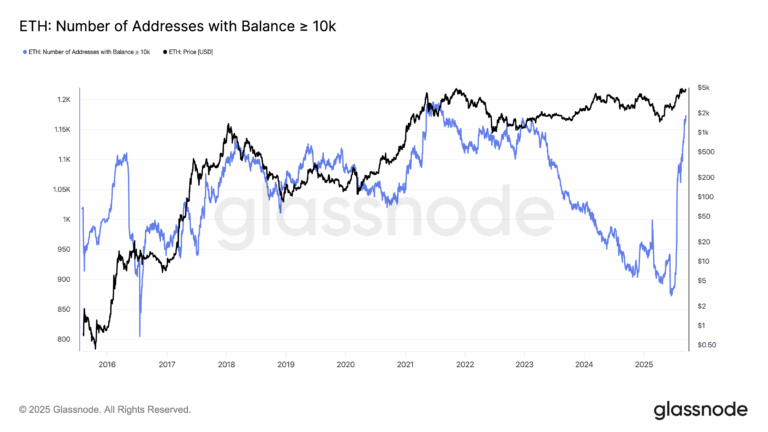

Glassnode data shows that addresses holding over 10,000 ETH—the so-called whales—have surged to levels not seen since February 2023. Whale accumulation historically precedes major rallies, suggesting a potential tightening of supply that could amplify price gains.

Technical Indicators Signal Breakout Potential

From a technical perspective, Ethereum maintains a bullish flag formation, supported by a Money Flow Index (MFI) of 67.38. Analysts indicate that a successful breakout above $4,967 could set the stage for a cycle top near $7,127.

Also Read: Tom Lee Predicts Ethereum Could Soar to $62,000 by 2035 Amid Stablecoin and AI Boom

However, the outlook remains sensitive to macro conditions. Should the Fed delay or cancel the anticipated rate cut, ETH could face a pullback toward $4,203, with deeper support near $3,603 at the 0.618 Fibonacci retracement.

Ethereum’s combination of ETF inflows, whale accumulation, and favorable macro conditions positions it for a potential breakout. Investors are watching closely as ETH tests resistance levels above $4,500, with the possibility of reaching new highs if bullish momentum holds.

Stay ahead with real-time updates and insights—Join our Telegram channel!

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.