|

Getting your Trinity Audio player ready...

|

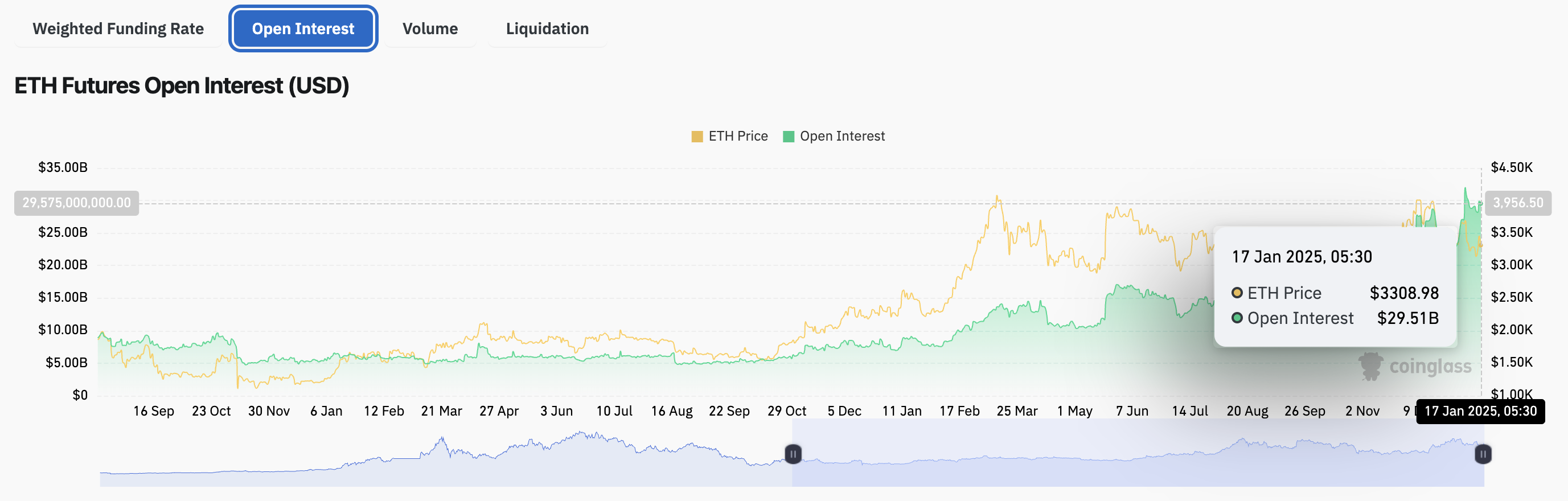

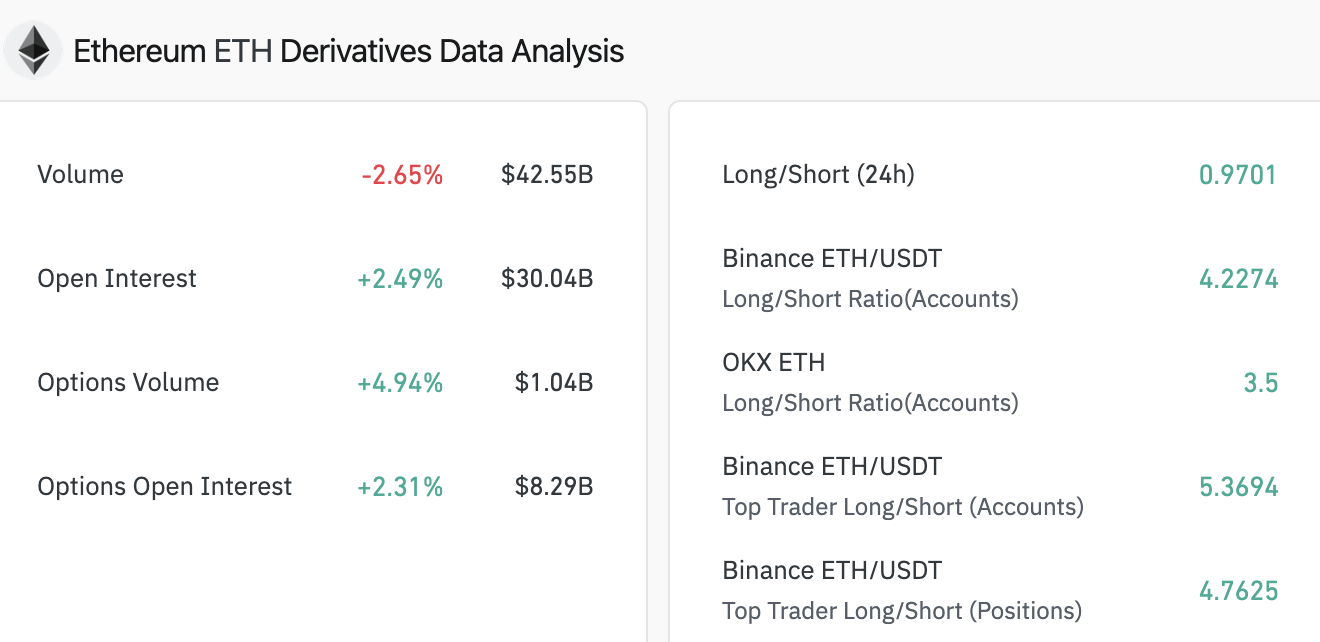

Ethereum (ETH) continues to hold firm above $3,300, despite a relatively lackluster performance in 2024. As crypto traders gear up for President-elect Donald Trump’s inauguration, Ethereum has seen a surge in bullish sentiment, particularly from derivatives traders. Open interest in Ether’s derivatives contracts surged past $30 billion by Friday, signaling strong market interest.

The increase in derivative trading volume is noteworthy. According to data from Coinglass, options trade volume for Ethereum surged nearly 47% in just 24 hours, with options volume crossing the $1 billion mark. Ethereum’s derivatives market remains robust, with open interest reaching new highs despite a recent pullback from its January 7 peak of $31.99 billion.

A key indicator, the long/short ratio, has surpassed 1 on major exchanges like Binance and OKX, suggesting that derivatives traders are overwhelmingly bullish on Ethereum’s price movement. As the market positions itself ahead of political developments, these bullish signals reinforce expectations of future gains in Ether’s price.

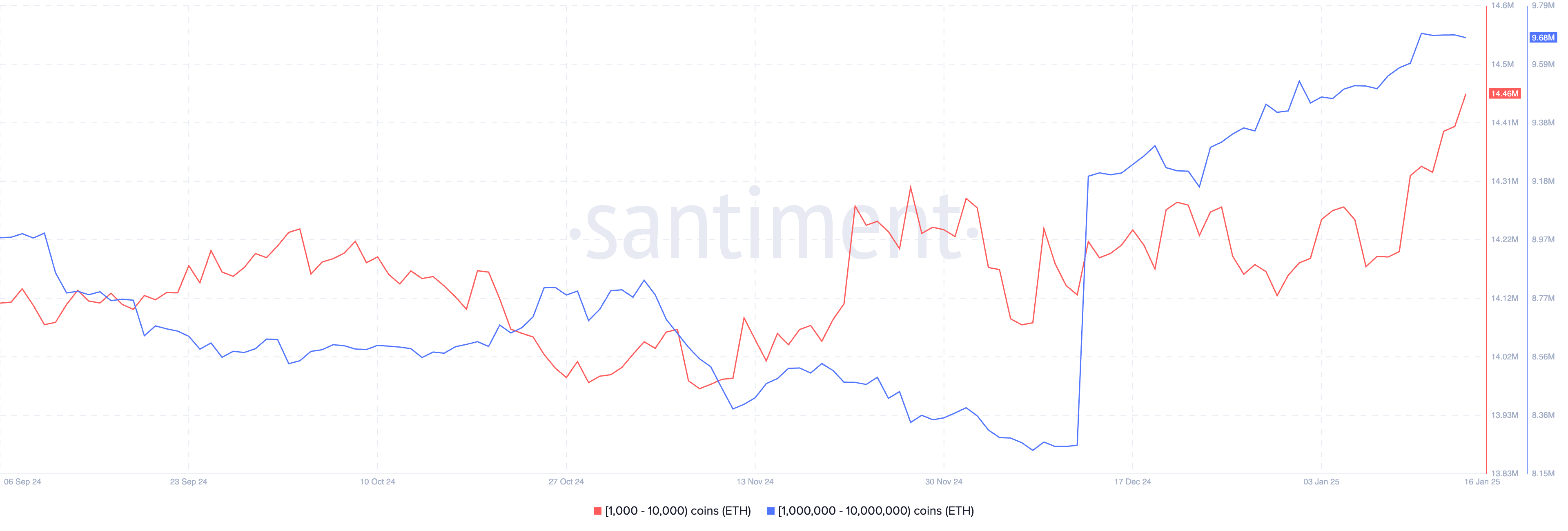

On-chain analysis adds to the optimistic outlook. Data from Santiment reveals that Ethereum’s large wallet investors continue to accumulate the token, even as its price struggles. This persistent buying behavior among holders with significant positions signals confidence in Ethereum’s long-term potential.

Moreover, Ethereum’s total funding rate has remained positive throughout January 2025, signaling trader optimism for price appreciation. Investors with 1,000 to 10,000 ETH, as well as those holding 1 million to 10 million ETH, have been steadily increasing their holdings. This accumulation, particularly among large holders, indicates that the bullish sentiment seen in Ethereum’s derivatives market is supported by strong on-chain fundamentals.

With derivatives traders betting on Ethereum’s future price movement and large holders continuing to accumulate, Ethereum is poised for potential gains, especially if the broader crypto market continues to rally. As attention shifts toward the upcoming inauguration, Ethereum’s price stability above $3,300 could set the stage for further bullish momentum in the weeks to come.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Ethereum Surges Past $3,400 Amid Political Shifts and Upcoming Pectra Upgrade

A lifelong learner with a thirst for knowledge, I am constantly seeking to understand the intricacies of the crypto world. Through my writing, I aim to share my insights and perspectives on the latest developments in the industry. I believe that crypto has the potential to create a more inclusive and equitable financial system, and I am committed to using my writing to promote its positive impact on the world.