|

Getting your Trinity Audio player ready...

|

Ethena [ENA] has endured a challenging month, losing 22.58% of its value amid prevailing bearish sentiment. However, the token recently experienced a brief rally, climbing 10.66% in the last 24 hours, with trading volume surging 53.77%, hinting at a possible sentiment shift.

Despite this uptick, sustained selling pressure from large investors, particularly whales, has stifled ENA’s potential recovery. Whales—key market participants—continue to exert downward pressure, limiting the asset’s ability to sustain gains.

Whales Amplify Selling Pressure

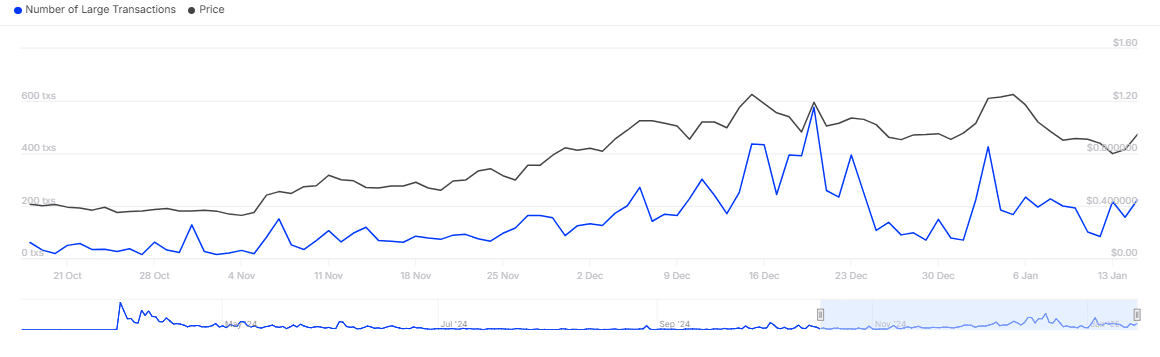

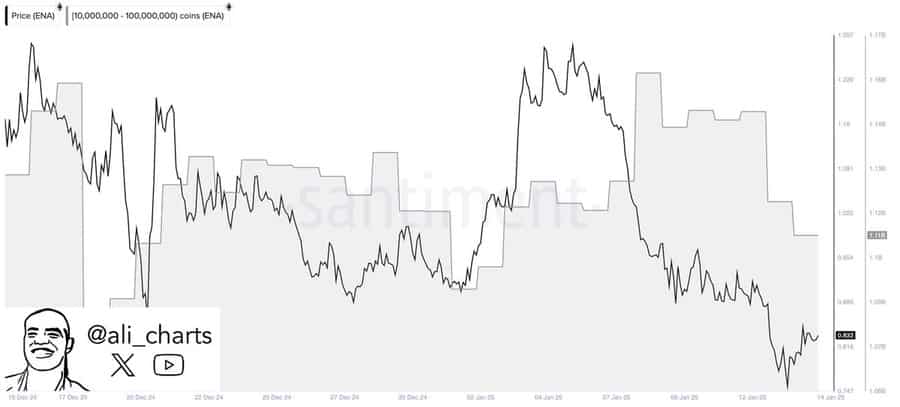

Recent reports reveal that a major investor, holding between 0.1% and 1% of ENA’s total supply, sold $6.46 million worth of tokens, triggering a 9.84% price decline. Over the last 24 hours, whales offloaded more than 50 million ENA tokens, valued at approximately $47.9 million, according to data from Santiment.

Santiment further identified large investors with holdings between 10 and 100 million ENA as driving these sell-offs, contributing to the token’s downward momentum. These whale-driven transactions peaked at 224 in the past week, the highest level recorded, signaling intensifying bearish pressure.

Declining Market Participation

While the number of active addresses increased over the last day, it remains 19.27% lower than the previous week. A notable 11.81% drop in new addresses further reflects waning market confidence. Retail participants appear to be mirroring whale activity, intensifying the bearish trend.

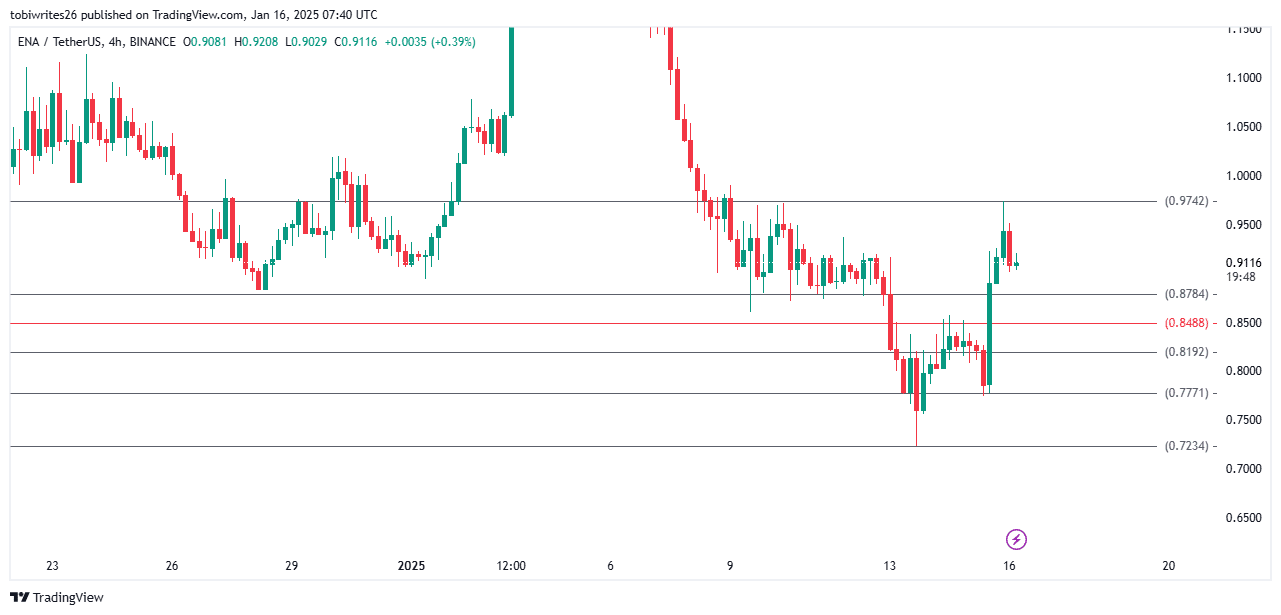

Critical Support Levels in Focus

ENA’s price rally stalled near the $0.9742 resistance level, as identified by Fibonacci retracement. The token is now approaching a crucial support level at $0.8784. A failure to hold or rebound from this level could erode trader confidence, driving the price toward lower supports at $0.7771 or $0.7234.

If whale sell-offs persist and retail interest continues to decline, ENA faces the risk of further depreciation. Investors and traders should monitor these critical levels as the token navigates an uncertain market landscape.

Also Read: Ethena Token (ENA) Faces 35% Drop: Can Whale Movements Spark a Recovery Amidst Market Downturn?

While ENA’s recent uptick offers a glimmer of hope, bearish sentiment and whale activity remain dominant forces, threatening further losses unless market dynamics shift in favor of buyers.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

With a keen eye on the latest trends and developments in the crypto space, I’m dedicated to providing readers with unbiased and insightful coverage of the market. My goal is to help people understand the nuances of cryptocurrencies and make sound investment decisions. I believe that crypto has the potential to revolutionize the way we think about money and finance, and I’m excited to be a part of this unfolding story.