|

Getting your Trinity Audio player ready...

|

Dogwifhat (WIF), the popular Solana-based memecoin, has been on a downward spiral in recent days. The price has plunged 12.7% in the last 24 hours alone, extending its weekly decline to a staggering 19.2%. This slump has also impacted the market capitalization, which has shrunk by 12.43% to $2.1 billion within the same timeframe.

While the trading volume has surged by a surprising 69.96% in the last 24 hours, reaching $496 million, it’s unclear whether this signifies genuine buying interest or a fire sale. The circulating supply of WIF currently sits at 998 million.

Technical Indicators Flash Red

Analysts have observed a concerning trend for WIF. After weeks of stagnant price movement, a brief attempt at reversal on June 16th ultimately failed, leading to a further 50.88% price drop. As of now, WIF is trading at a mere $2.12, a far cry from its recent high of $4.05.

Technical indicators like the RSI (Relative Strength Index) paint a bleak picture. The RSI is currently hovering near the oversold zone at 34, suggesting the market might be oversold. However, a simultaneous crossover below the Moving Average (MA) indicates strong bearish momentum. This aligns with the RSI-based MA, which has been consistently bearish since June 5th. Reversing this trend will require a significant shift in support levels.

Also Read: Dogwifhat (WIF) Crashes 10%: Meme Coin Faces “Catastrophic” Levels, Will it Bounce Back?

Waning Investor Confidence

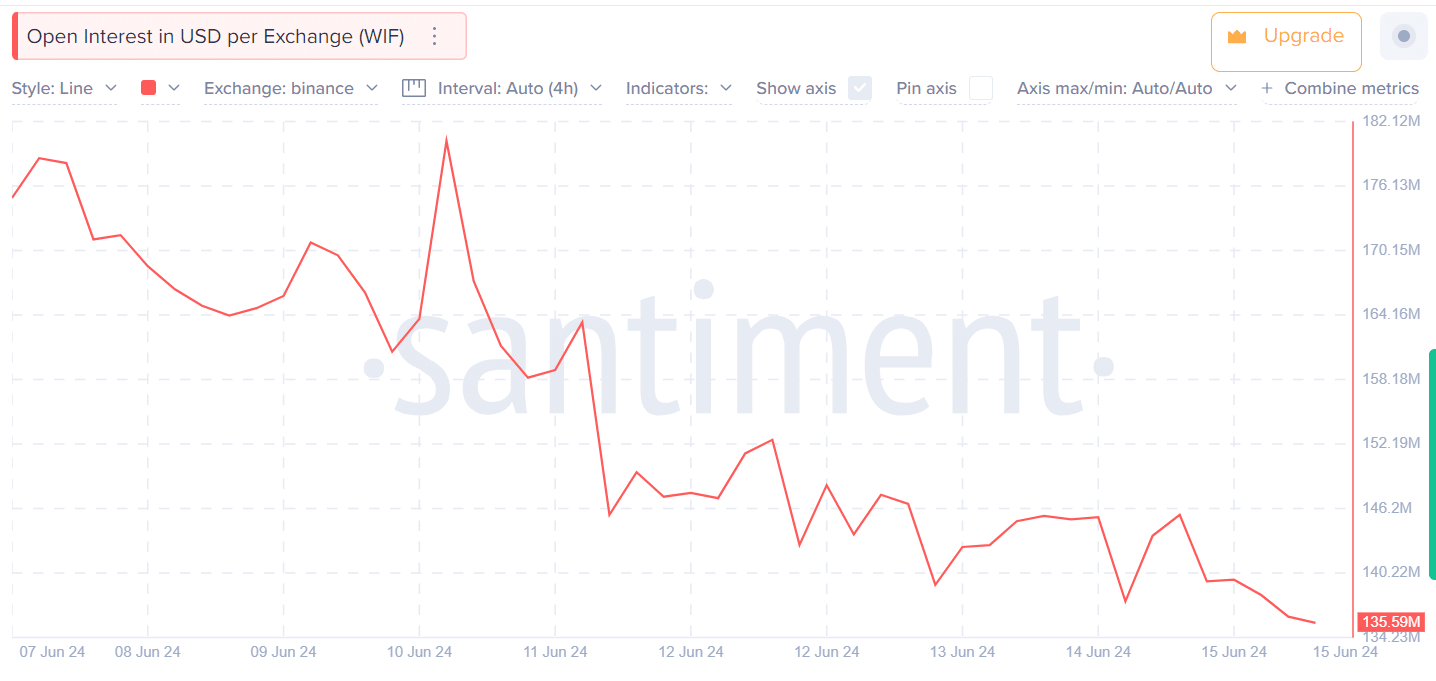

Santiment’s data reveals another worrying sign: declining open interest in WIF. Open interest, which reflects the total value of outstanding futures contracts, has shrunk from $180 million on June 10th to a mere $135 million at press time. This indicates that traders are hesitant to enter new positions, reflecting a lack of confidence in the current trend. Existing positions are being closed, further contributing to the price decline.

Funding Rate Hints at Bearish Sentiment

Coinglass data highlights another bearish factor: the volume-weighted funding rate for WIF. This metric reflects the cost of holding short positions. A negative funding rate suggests that traders are paying to short the coin, signifying a belief in its price decline. The continuous decline in WIF’s funding rate since June 15th further reinforces the bearish sentiment.

The current market sentiment surrounding WIF is undoubtedly pessimistic. Various indicators point towards a potential continuation of the downtrend, with a possible drop to $1.79 if negative sentiment persists. However, a reversal is not entirely out of the picture. If bulls regain control and a pattern shift occurs, WIF could attempt to climb back to $4.06, establishing a new support level around $2.3.

The coming days will be crucial for WIF. Whether the memecoin manages to bounce back or succumbs to the bearish pressure remains to be seen.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.