|

Getting your Trinity Audio player ready...

|

The market sentiment surrounding Dogecoin (DOGE) remains notably bullish, with 76.65% of traders on Binance Futures holding long positions. This indicates strong expectations for an upward price movement in the short term. However, a high concentration of long positions could also signal overconfidence, increasing the risk of forced liquidations if the price does not meet traders’ expectations.

Key Support Levels Hold the Spotlight

At press time, Dogecoin was trading at $0.1809, reflecting a 7.96% decline in the last 24 hours. The meme coin is currently testing a crucial support level at this price range. Should this support hold, DOGE could break past resistance at $0.208, potentially triggering a rally. Conversely, a failure to maintain support could lead to further losses, making this a critical level to monitor.

Network Activity Shows Low Engagement

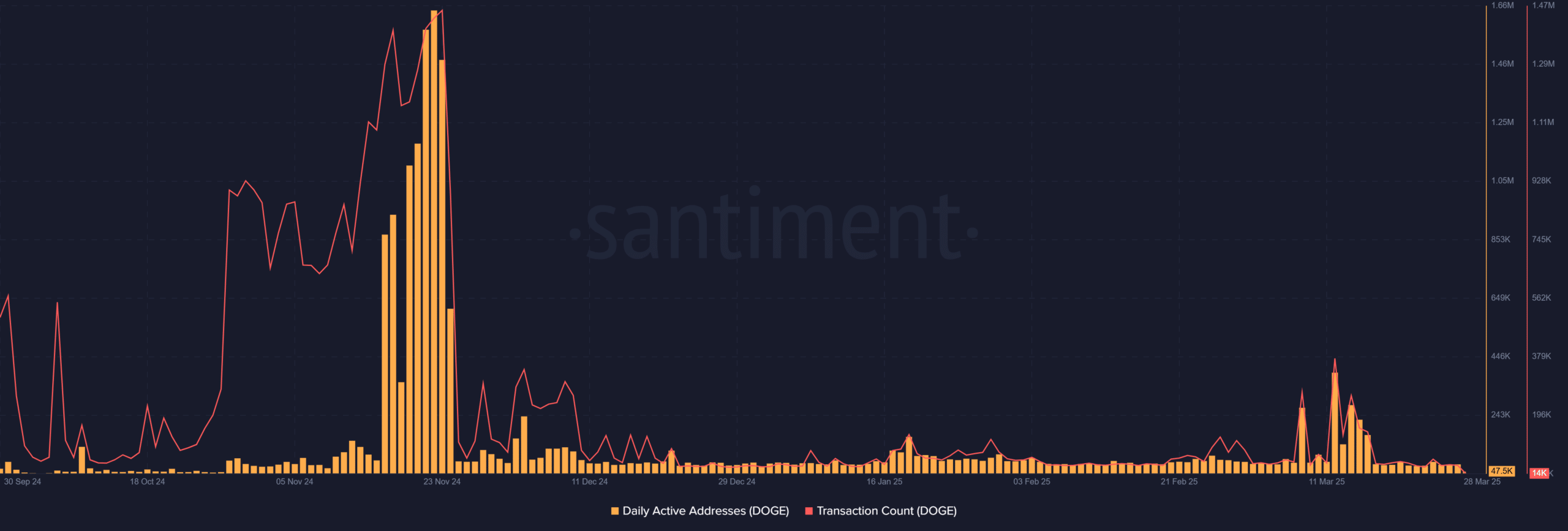

Despite bullish expectations in the futures market, Dogecoin’s network metrics paint a different picture. As of March 28, 2025, the network recorded 47,577 active addresses and just 14,020 transactions, signaling relatively weak engagement. This lack of demand and activity could hinder the sustainability of any price rally.

Liquidation Data Hints at Market Fragility

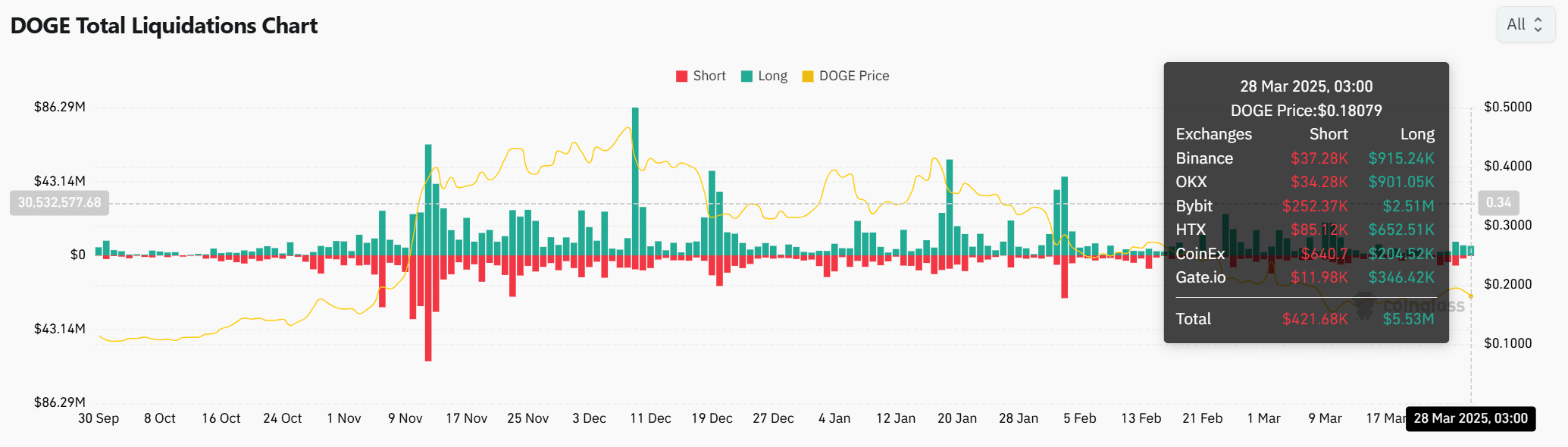

Liquidation trends show that long positions are dominating, with $5.53 million in long liquidations compared to only $421,680 in short liquidations. This suggests that bullish traders are facing mounting pressure as the price struggles to gain traction. The dominance of long liquidations raises concerns that the market is more prone to further declines rather than an immediate surge.

Dogecoin’s Market Value to Realized Value (MVRV) ratio stands at 0.546, implying that DOGE may be slightly overvalued. This means the asset might struggle to gain significant momentum unless new catalysts emerge to boost investor interest. Without an increase in buying pressure, DOGE could experience prolonged consolidation or further downward movement.

Also Read: Dogecoin Price Prediction: Analyst Sees 4,259% Surge to $8—Here’s Why

While traders remain optimistic, technical indicators and market data suggest caution. The significant liquidation of long positions, combined with weak network activity and overvaluation concerns, makes a strong price surge unlikely in the near term. Traders should keep a close eye on the key support at $0.1809 to gauge the next move in Dogecoin’s price action.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.