|

Getting your Trinity Audio player ready...

|

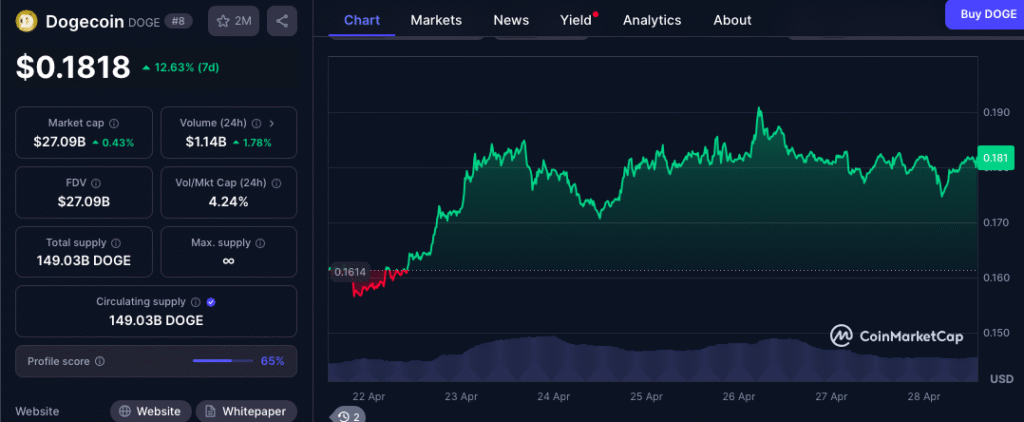

Dogecoin (DOGE), the popular memecoin, has captured significant attention recently, fueled by impressive upward momentum and substantial interest from large-scale investors. Over the past few days, DOGE successfully broke free from a descending trendline, signaling a potential shift in its price trajectory. However, at the time of writing, the cryptocurrency appeared to be in a phase of consolidation, leaving investors to ponder the next move.

Intriguingly, this period of price stability has coincided with a notable surge in whale transactions, hinting at possible accumulation by these major players. Data from the on-chain analytics firm IntoTheBlock reveals a dramatic increase in high-value transactions. Transactions ranging from $1 million to $10 million witnessed a staggering 540.47% jump, while those exceeding $10 million experienced an even more remarkable 8060% surge. This significant uptick in large transactions suggests heightened participation from whales and institutional investors during this consolidation phase.

Further on-chain metrics support this observation. Large transaction volumes over the last 24 hours have increased by 41.12%, and daily active addresses have also seen a substantial rise of 34.91% within the same period. The convergence of these indicators strongly suggests a renewed interest in Dogecoin from significant financial actors, potentially positioning themselves for future gains. Some speculate that these large investors may possess insights into upcoming developments or market shifts that could benefit the memecoin.

Despite the bullish signals emanating from whale activity, Dogecoin’s current price momentum reflects a degree of caution. At press time, DOGE was trading near $0.179, having experienced a 1.45% decline in the past 24 hours. Concurrently, its trading volume has decreased by 43%, indicating reduced participation from retail traders and smaller investors compared to previous days of heightened activity.

Nevertheless, sentiment among active traders remains largely optimistic. Data from Coinglass indicates a strong bullish bias, with the Binance DOGEUSDT long/short ratio standing at a significant 2.15. This reveals that 68.28% of top Dogecoin traders on the Binance platform are currently holding long positions, while only 31.72% are positioned to profit from a price decrease.

Technical analysis from AMBCrypto suggests that Dogecoin is currently navigating a crucial juncture. The cryptocurrency has been consolidating within a narrow range between $0.175 and $0.185 for the past five trading days. According to their analysis of the daily chart, a decisive breakout above the $0.185 mark, confirmed by a daily candle close, could pave the way for a potential 10% upward surge towards the $0.205 level.

Conversely, a breakdown below the $0.175 support could exert downward pressure, potentially pushing Dogecoin’s price down by approximately 7.5% to the next support level around $0.162. Investors and traders are keenly observing these levels as Dogecoin navigates this period of consolidation, with whale activity providing an intriguing backdrop to the unfolding price action.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Dogecoin ($DOGE) Breakout Alert: Analysts Eye 150% Surge to $0.40+

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!