|

Getting your Trinity Audio player ready...

|

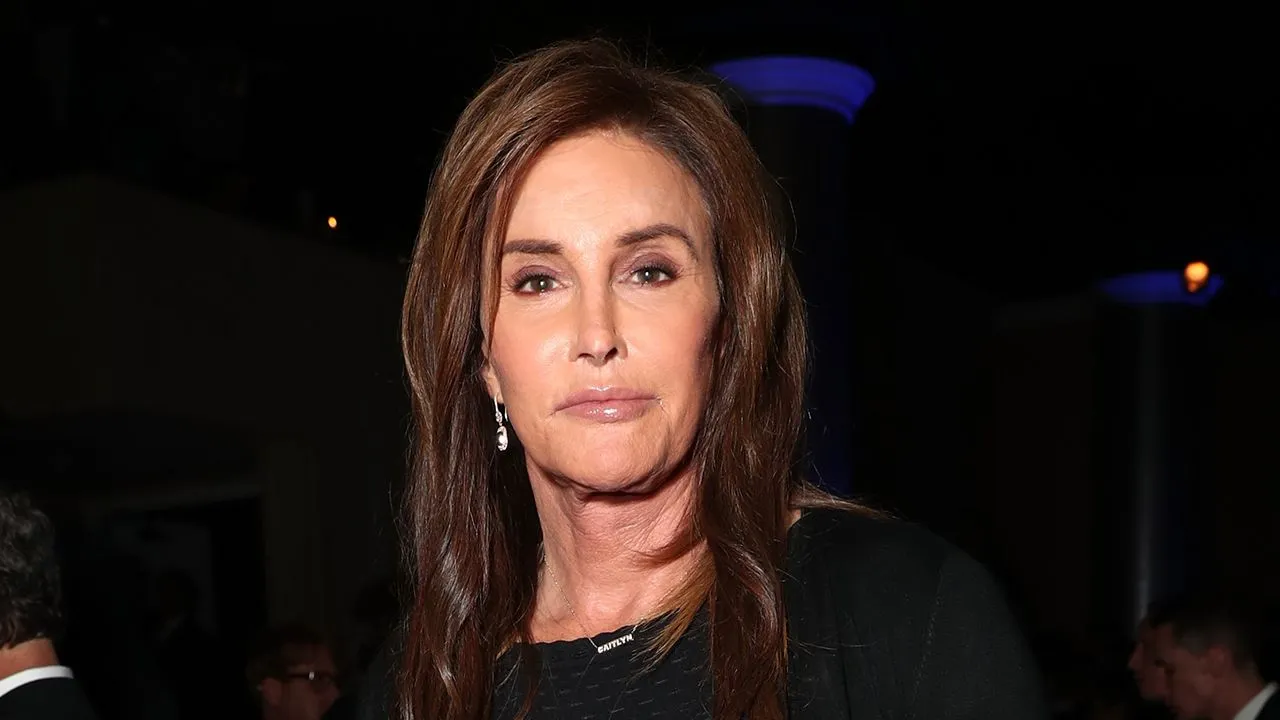

Caitlyn Jenner, Olympic gold medalist and media personality, recently ignited a firestorm in the cryptocurrency world. Reports suggest Jenner launched a dozen “meme coins” on the Solana blockchain, pocketing a cool $405,000 within days. This aggressive move has sparked a heated debate about the ethics and potential pitfalls of celebrity involvement in the crypto market.

Jenner’s strategy, according to blockchain analysis firm Lookonchain, involved creating a token named “JENNER” on the pump.fun platform, followed by the creation of multiple new wallet addresses and the launch of an additional 12 meme coins. By strategically buying and selling these self-created tokens, Jenner allegedly profited handsomely.

This incident isn’t an isolated one. Celebrities like rapper Iggy Azalea and singer Davido have also faced scrutiny for their involvement in cryptocurrencies, with concerns surrounding insider trading and potential pump-and-dump schemes.

The impact of celebrity endorsements in the crypto space is a double-edged sword. Proponents argue that it can bring much-needed mainstream adoption to digital currencies. Increased exposure, they believe, can attract a wider audience and fuel market growth. However, critics raise serious ethical concerns. They view celebrity involvement as exploitative, potentially misleading investors and undermining the credibility of the entire cryptocurrency industry.

Jenner’s case took an even murkier turn when her wallet address was linked to another compromised account promoting an adult content creator’s token. This connection fueled suspicions about the legitimacy of celebrity-backed cryptocurrencies and highlighted the need for increased vigilance.

Also Read:Memecoin Mayhem: Normie Hack Negotiations in Limbo After Token 99% Crash

The rise of meme coins and celebrity endorsements in the crypto market presents a complex scenario. While it can generate excitement and attract new investors, it also raises critical questions about ethics, security, and potential scams. Fortunately, blockchain technology offers a silver lining. Its inherent transparency allows for greater scrutiny and aids in identifying suspicious activity. Investors, however, must remain vigilant. Thorough research and a healthy dose of skepticism are crucial for navigating the often-uncertain waters of the cryptocurrency market.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses

With a keen eye on the latest trends and developments in the crypto space, I’m dedicated to providing readers with unbiased and insightful coverage of the market. My goal is to help people understand the nuances of cryptocurrencies and make sound investment decisions. I believe that crypto has the potential to revolutionize the way we think about money and finance, and I’m excited to be a part of this unfolding story.