|

Getting your Trinity Audio player ready...

|

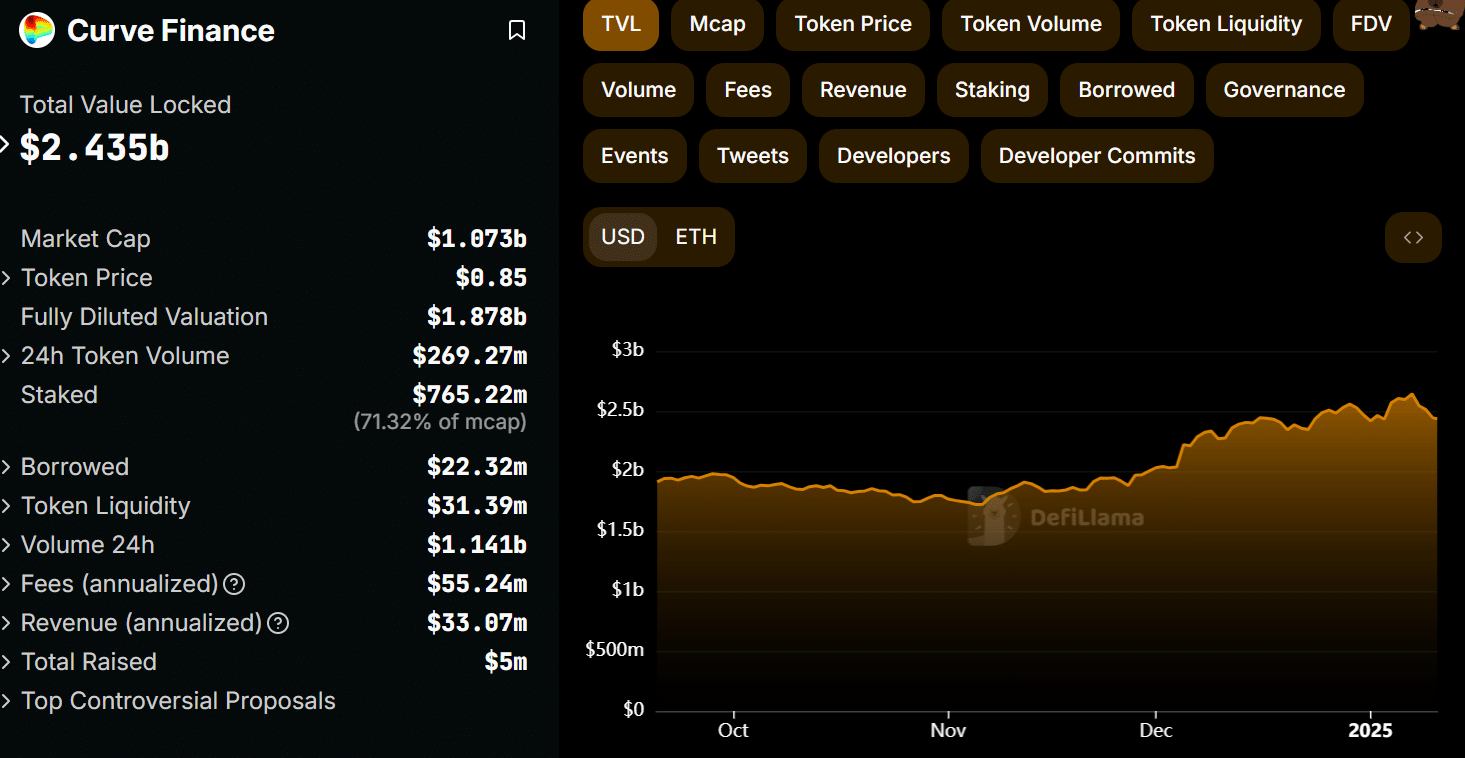

Curve Finance, a leading decentralized exchange (DEX), saw a significant surge in its user base and total value locked (TVL), solidifying its position as a prominent player in the DeFi space. According to a recent AMBCrypto report, Curve’s unique user count more than doubled year-on-year, rising from 30,000 in 2023 to 60,000 in 2024, reflecting a remarkable 105% increase. This growth is a testament to the DEX’s expanding popularity and its ability to attract both individual and institutional investors.

Curve’s TVL also saw a significant jump, increasing from $1.7 billion in early November to $2.4 billion by early January. This spike in locked capital underscores growing investor confidence and trust in the platform. Key factors driving this growth include the introduction of new product features and heightened institutional interest. Notably, BlackRock’s decision to use Curve for liquidity and trading of its tokenized asset, BUIDL, highlighted the increasing appeal of decentralized platforms for traditional financial institutions.

However, despite the surge in adoption and market interest, Curve’s native token, CRV, is currently experiencing a pullback. After its impressive pump in November, where CRV logged nearly 500% gains, the token has faced some price corrections. As of now, CRV holds around 280% of those November gains, with recent price action forming a triangle pattern. A bullish breakout could see CRV targeting $1.5, while a bearish move might push it down to $0.26.

The token’s 30-day Market Value to Realized Value (MVRV) is currently negative, suggesting that CRV is relatively cheap at its current price, presenting potential opportunities for investors. At the same time, the 60-day MVRV remains positive, indicating that those who held CRV for longer periods are still in profit.

Curve Finance’s growth trajectory and the promising outlook for CRV suggest that while short-term price fluctuations persist, the platform’s expanding user base and institutional interest could set the stage for long-term success.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.