|

Getting your Trinity Audio player ready...

|

By 2025, the cryptocurrency market could look very different than today if current adoption and development trends continue. What lies ahead for flagship cryptos like Bitcoin and Ethereum as well as emerging challengers over the next 1-2 years? Let’s consult the crypto crystal ball.

Bitcoin: The unyielding store of value

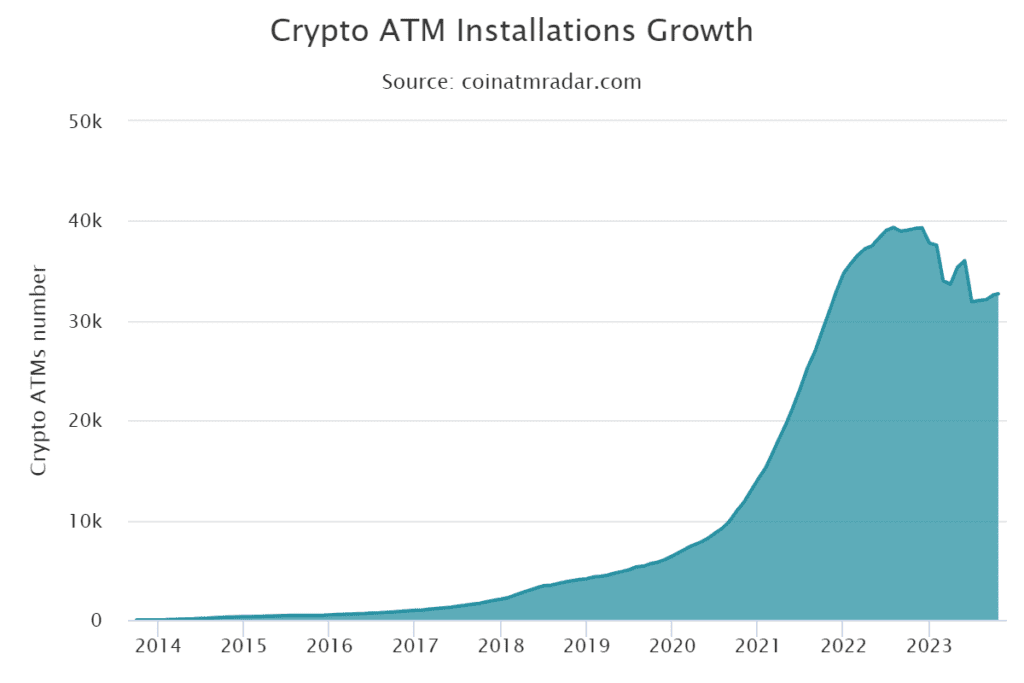

Bitcoin’s fixed supply and growing adoption as “digital gold” suggest its price could keep ascending, with some models forecasting $100,000+ per BTC by 2025. This is supported by the fact that the number of Bitcoin ATMs has increased from 6,000 in 2020 to 32,000 in 2023, demonstrating a clear increase in demand for easy access to Bitcoin.

However, tighter regulations and fierce competition from altcoins could restrain Bitcoin’s dominance over the broader crypto market. A safer bet is for Bitcoin to reach $75,000 by 2025 based on past price cycles and maturing store of value credentials.

Ethereum: The Scalable Smart Contract Platform

With the successful completion of The Merge, Ethereum has undergone its most radical transformation to date. The transition to proof-of-stake has not only supercharged Ethereum’s throughput and efficiency but has also drastically slashed its environmental impact. This has led to a surge in demand for ETH, as evidenced by the increase in total value locked (TVL) in decentralized finance (DeFi) protocols from $10 billion in 2020 to $100 billion in 2023.

If Ethereum can scale without compromising decentralization, price forecasts of $20,000+ per ETH are feasible given its utility as the preeminent smart contract platform.

The Rise of the Ethereum Killers

However, the smart contract race has intensified lately, with nimble “Ethereum killers” like Solana, Avalanche, and Polkadot threatening Ethereum’s dominance. These challengers offer faster speeds and lower fees than Ethereum, which could attract users away from the platform. Additionally, the development of interoperability bridges and layer-2 solutions is pointing towards an increasingly multi-chain future. This means that there is room for multiple smart contract networks to coexist, but Ethereum must avoid stagnation to retain its first-mover lead.

Regulatory Clarity: A Double-Edged Sword

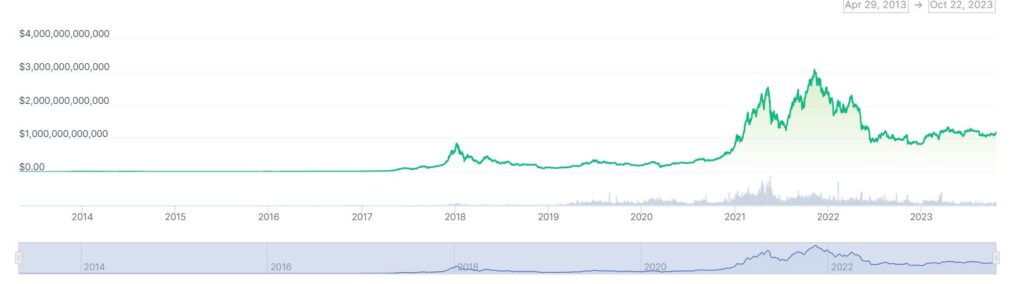

Greater regulatory clarity could also boost institutional investment, helping mature the volatile crypto market. However, overly burdensome controls could severely stifle innovation and adoption. Thoughtful guardrails that protect investors while preserving permissionless innovation are essential. If balanced regulation is achieved, the total crypto market capitalization could reach $5-10 trillion by 2025 through growing mainstream trust.

At time of writting the global cryptocurrency market cap is $1.17 Trillion, the market cap of Bitcoin (BTC) is at $583 Billion, representing a Bitcoin dominance of 49.66%. , Stablecoins’ market cap is at $124 Billion and has a 10.58% share of the total crypto market cap.

The Wildcards: DAOs, NFTs, and the Metaverse

Of course, technological, economic, or regulatory shocks could abruptly alter these outlooks. The development of quantum computing, for example, could pose a threat to the security of Bitcoin and other cryptocurrencies. Additionally, a global recession could lead to a decline in investor appetite for risky assets like cryptocurrency. Finally, the implementation of central bank digital currencies (CBDCs) could challenge the role of cryptocurrencies as a form of digital money.

Related: IOTA: The Role of DLT Platforms Like IOTA in the Development of CBDCs

New innovations like decentralized autonomous organizations (DAOs), non-fungible tokens (NFTs), and the Metaverse are also huge wildcards whose impacts are difficult to predict right now. DAOs have the potential to revolutionize the way organizations are governed, while NFTs could create new asset classes and markets. The Metaverse could eventually become a major part of our lives, with people spending significant amounts of time and money in virtual worlds.

The global metaverse market was accounted for USD 68.49 billion in 2022 and it is estimated to surpass around USD 1.3 trillion by 2030 with a registered CAGR of 44.5% during the forecast period 2022 to 2030

The Long-Term Outlook: Crypto as a Pillar of Web3

While short-term price moves remain unpredictable, the fundamental utility and advantages of cryptocurrencies continue maturing. As globally accessible, decentralized, and programmable forms of money controlled entirely by users, crypto assets are cementing their place in the future financial system. The long-term outlook remains bullish. By 2025, today’s speculative digital assets could transform into trusted everyday utilities and pillars of web3.

I’m the cryptocurrency guy who loves breaking down blockchain complexity into bite-sized nuggets anyone can digest. After spending 5+ years analyzing this space, I’ve got a knack for disentangling crypto conundrums and financial markets.