|

Getting your Trinity Audio player ready...

|

Cardano (ADA), the native token of the Cardano blockchain platform, has experienced a significant price surge in recent weeks. This uptrend follows a strategic accumulation by whales (large investors) during a price correction, highlighting their confidence in ADA’s long-term potential.

Whales Accumulate, Support Levels Strengthen

Crypto analyst Ali reported that whales scooped up over 130 million ADA tokens during a price dip to around $0.30. This aggressive buying spree during a downtrend is often seen as a bullish indicator for smaller investors, suggesting whales are taking a long-term view on the asset. Notably, the $0.30 price level, where the accumulation happened, now appears to be a strong support zone, with ADA’s price stabilizing and recovering above $0.35. The next key price movement could be determined by resistance near the $0.36-$0.38 range, with the psychological barrier of $1.00 acting as the next major milestone for the token.

#Cardano whales bought over 130 million $ADA during the recent price dip! pic.twitter.com/VHg93o3WP5

— Ali (@ali_charts) November 27, 2024

Market Performance Reflects Strong Demand

At the time of writing, ADA is trading at $0.9898, representing a 6.19% increase in the last 24 hours and an impressive 18.47% gain over the past week. Its 24-hour trading volume sits at a healthy $3.11 billion, reflecting strong demand and active trading. With a circulating supply of 36 billion tokens, ADA’s market capitalization reaches approximately $35.39 billion, solidifying its position as a major player in the cryptocurrency market. The recent price data, with a seven-day range stretching from $0.773 to $1.12, underscores the robust demand and investor interest in ADA.

Technical Indicators Point Towards Bullish Continuation

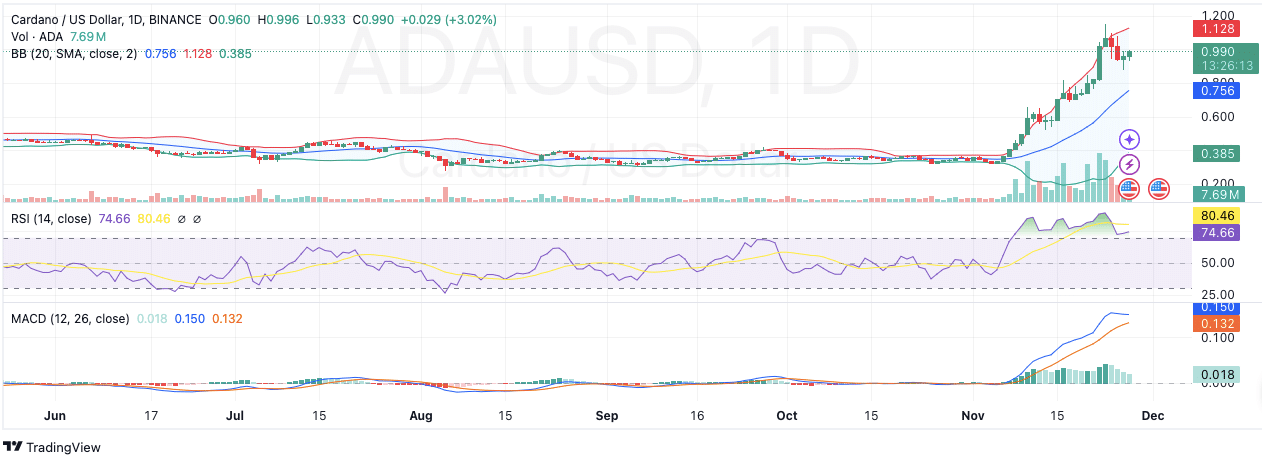

Examining the technical indicators, we see further evidence supporting the bullish sentiment surrounding ADA. The daily chart reveals that ADA is comfortably positioned above the 20-day Simple Moving Average (SMA) at $0.756, which acts as a crucial dynamic support level. Bollinger Bands are widening, indicating increased volatility as ADA approaches the key resistance at $1.00. The Relative Strength Index (RSI) currently sits at 74.66, placing ADA in the overbought zone. While this might suggest potential short-term resistance due to profit-taking, an RSI above 70 also signifies continued bullish momentum. Additionally, the MACD indicator displays a bullish crossover, with the MACD line positioned above the signal line and a positive histogram, confirming upward momentum for ADA.

On-Chain Metrics Reflect Investor Confidence

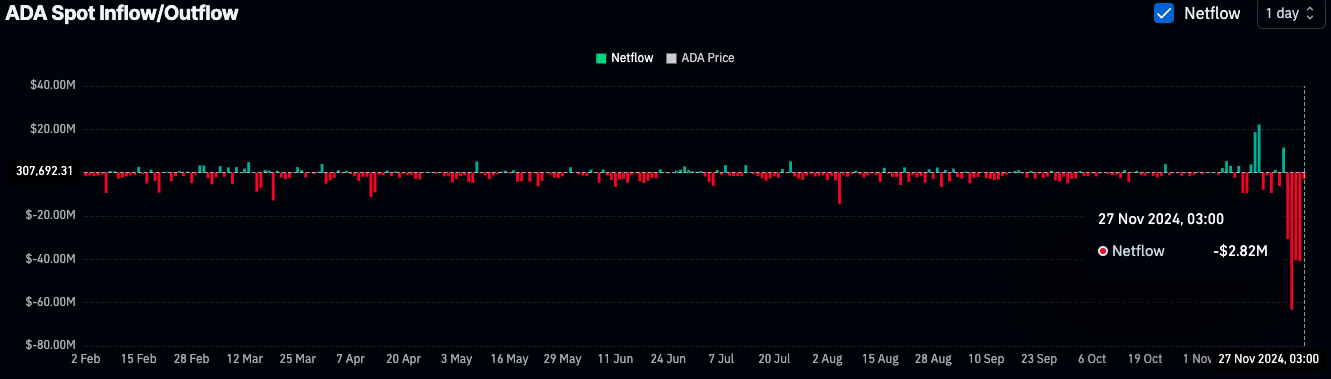

On-chain metrics provide further insight into the market’s confidence in ADA. According to Coinglass, ADA experienced a net outflow of $2.82 million on November 27th, 2024. This indicates that more tokens are leaving exchanges and being transferred to private wallets, potentially reducing selling pressure in the market.

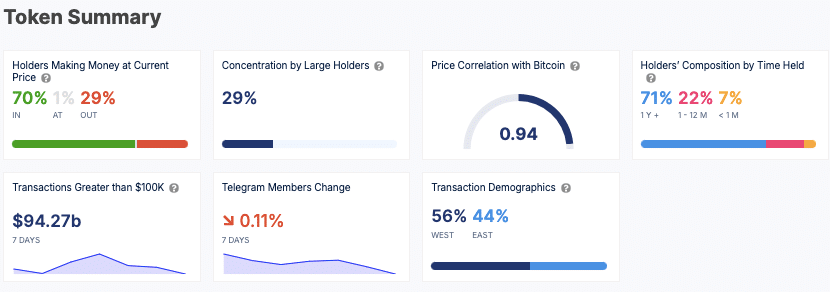

Furthermore, data from IntoTheBlock reveals that 70% of ADA holders are currently in profit, while only 29% are at a loss. This suggests a positive sentiment among investors. Additionally, 71% of ADA holders have held their tokens for more than a year, indicating a long-term commitment to the project.

It’s important to note that ADA’s price also exhibits a 0.94 correlation with Bitcoin. This means that ADA’s price movement often closely follows broader market trends, with Bitcoin’s recent positive performance further influencing ADA’s upward trajectory.

Also Read: Cardano (ADA) Drops 13.82% Below $1 – Can It Reclaim $1 or Fall to $0.80 This Week?

The recent whale accumulation, strengthening support levels, positive technical indicators, and on-chain metrics reflecting investor confidence all paint a bullish picture for Cardano. While short-term volatility is always a possibility in the cryptocurrency market, the current market sentiment suggests that ADA could be poised for continued growth in the near future.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

With a keen eye on the latest trends and developments in the crypto space, I’m dedicated to providing readers with unbiased and insightful coverage of the market. My goal is to help people understand the nuances of cryptocurrencies and make sound investment decisions. I believe that crypto has the potential to revolutionize the way we think about money and finance, and I’m excited to be a part of this unfolding story.