|

Getting your Trinity Audio player ready...

|

Cardano (ADA) has once again caught the attention of cryptocurrency whales, with significant purchases totaling 100 million ADA tokens, leading to a notable price surge. The price jumped from $0.998 to $1.11, reflecting the impact of large holders on the network. This surge follows a broader market rebound, suggesting the potential for further gains if whale activity continues.

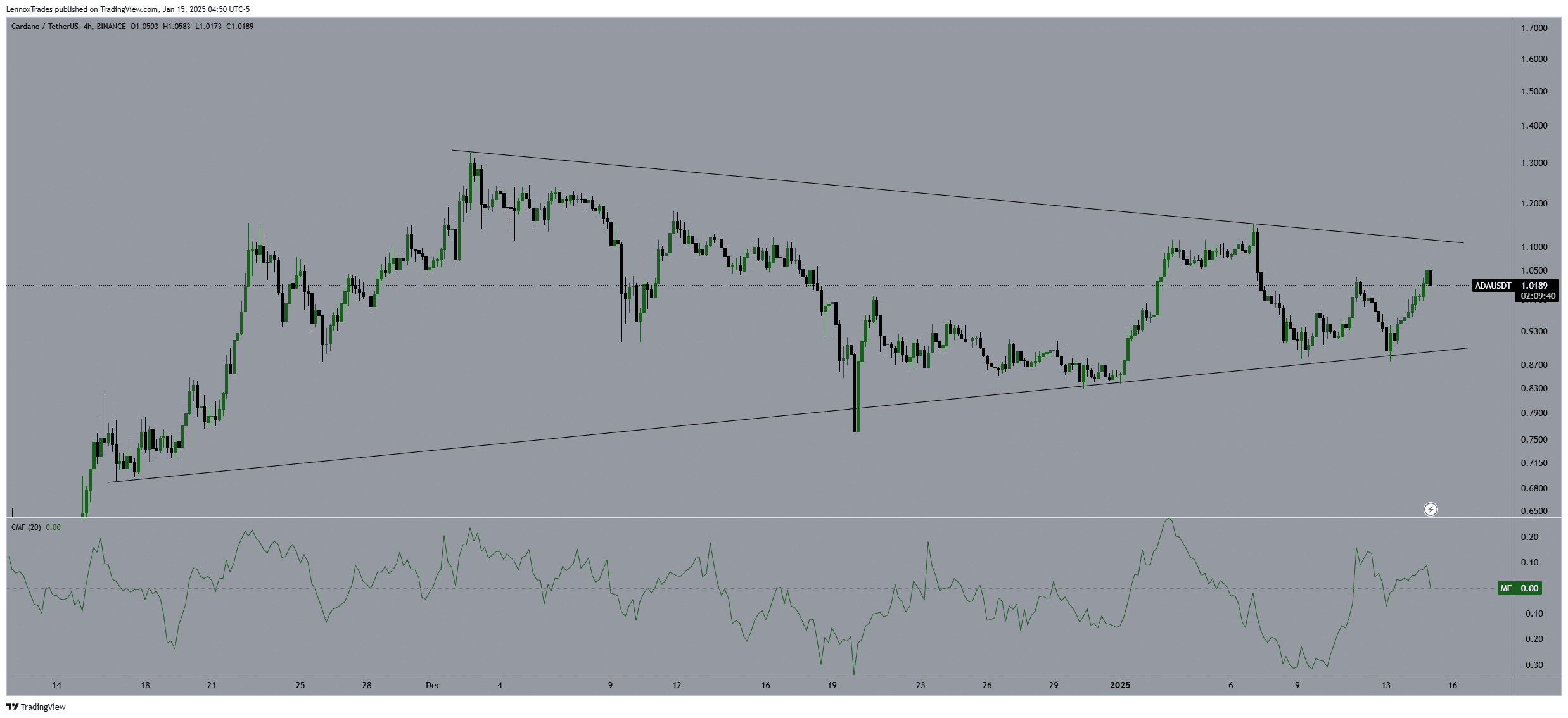

As large investors re-enter the scene, Cardano’s price has seen a strong uptrend, breaking past the crucial $1.00 threshold. This indicates a robust buying momentum and the possibility of ADA challenging higher resistance levels, particularly the $1.50 mark. The asset has been trading within a bullish pennant pattern on the 4-hour chart, with the current price around $1.08, just shy of a breakout above the $1.10 resistance.

The Chaikin Money Flow (CMF) index, which measures market pressure, hovers around the neutral line, signaling a balanced market. This suggests the possibility of sustained upward movement, especially if buying pressure persists. However, if the breakout fails to materialize, ADA could face a pullback, testing lower support levels. A failure to break past $1.10 could lead to consolidation or even a decline toward the $0.87 support.

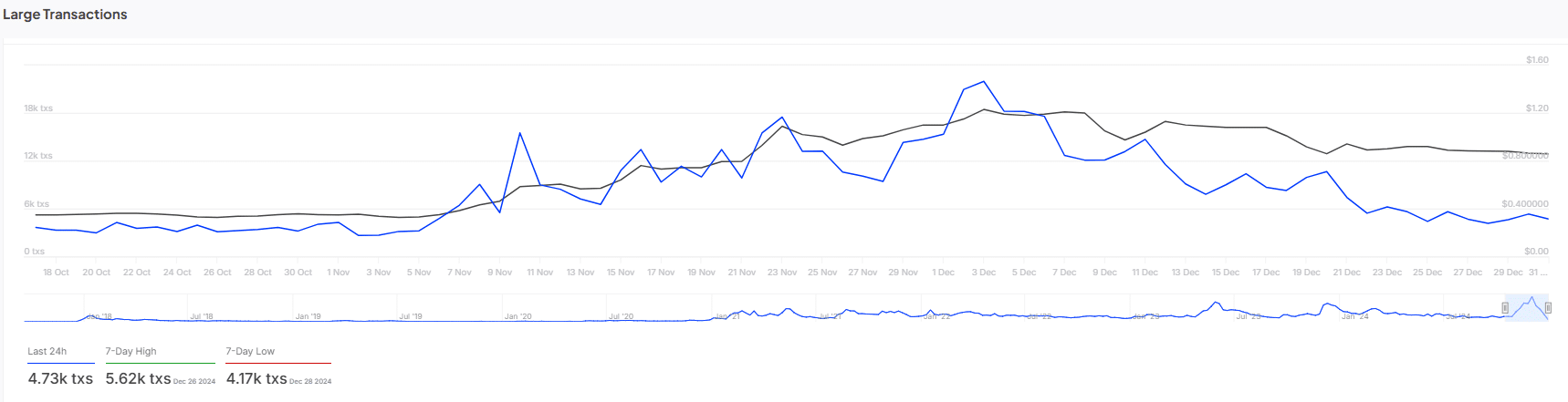

One key factor influencing ADA’s price trajectory is whale transactions. A surge in large transactions was recorded in early December, with a peak of 5.62k transactions on December 3. However, this has since slowed, with recent large transaction volumes dropping to a 7-day low of 4.17k. This decrease in whale activity could signal a potential cooling-off period, capping short-term gains.

Cardano’s future price trajectory depends on sustained whale interest and broader market sentiment. If large transactions ramp up again, ADA could break through the $1.10 resistance and target $1.50. On the other hand, a continued slowdown in whale activity could lead to a period of consolidation, with ADA struggling to hold above its current levels.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

With a keen eye on the latest trends and developments in the crypto space, I’m dedicated to providing readers with unbiased and insightful coverage of the market. My goal is to help people understand the nuances of cryptocurrencies and make sound investment decisions. I believe that crypto has the potential to revolutionize the way we think about money and finance, and I’m excited to be a part of this unfolding story.