|

Getting your Trinity Audio player ready...

|

Cardano (ADA), the native token of the Cardano blockchain platform, has experienced a recent price dip, falling close to the $1 mark. This comes amidst a broader crypto market correction, where investors are adopting a cautious approach before significant economic data releases. However, despite the short-term slump, some prominent analysts remain optimistic about ADA’s future, predicting a potential surge towards $4.

Crypto Market Correction Triggers Cardano Price Drop

The recent crypto market downturn, characterized by a staggering $1.76 billion in liquidations within 24 hours, has exerted immense selling pressure across the board. Bitcoin and major altcoins, including ADA, have borne the brunt of this correction. Cardano witnessed a price drop of nearly 10% at the time of writing.

Top Analyst Sees $4 in ADA’s Future

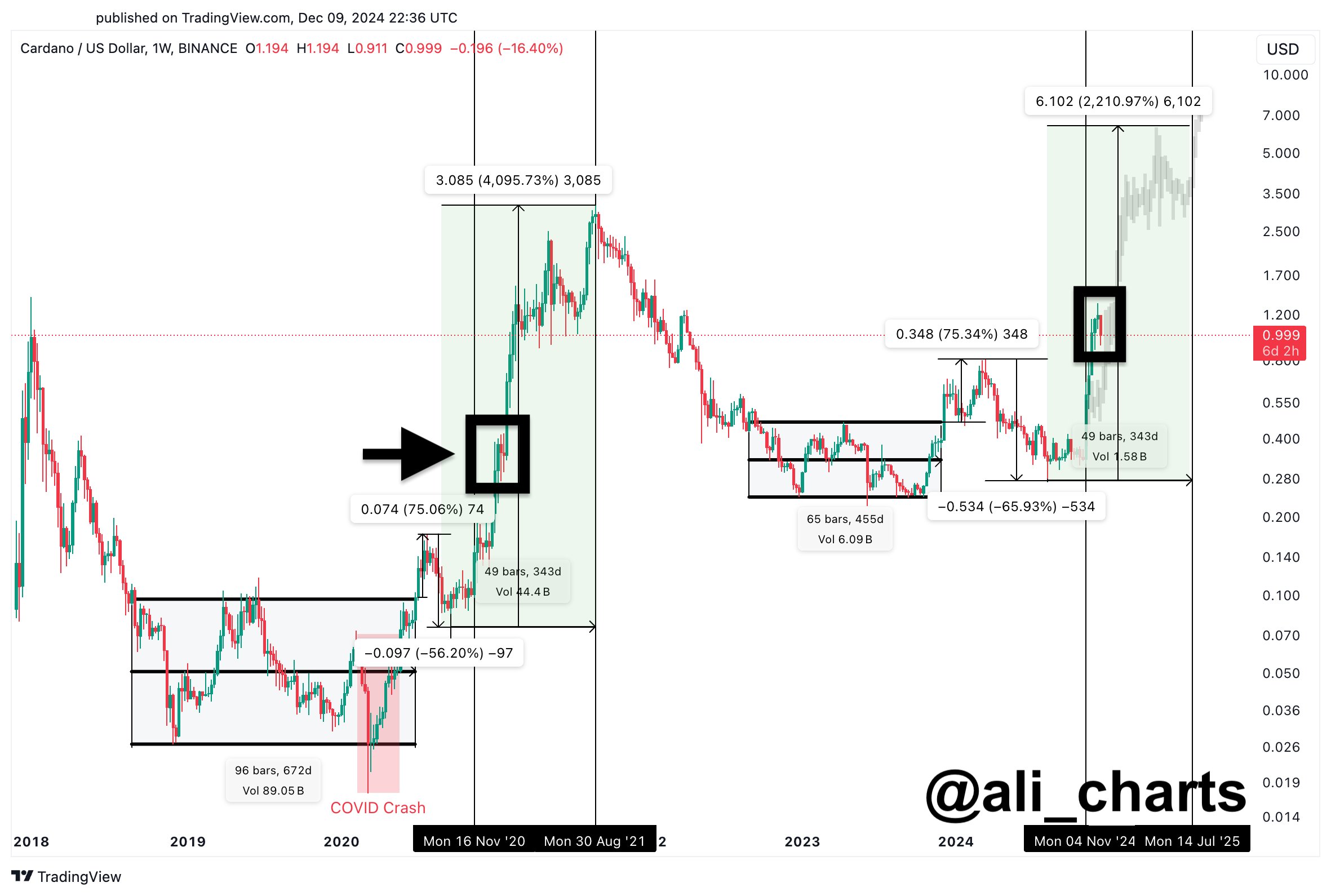

Despite the temporary setback, leading crypto analysts continue to express bullish sentiment regarding Cardano’s long-term prospects. Ali Martinez, a well-respected figure in the crypto space, recently compared ADA’s current price movements to its historical performance in 2020. He believes the current dip is a buying opportunity and plans to accumulate even if the price dips further. Martinez even hinted at a potential price surge towards $4 or even $6, presenting a lucrative profit-taking opportunity for traders.

Cardano’s Mixed Signals: Volume Up, Interest Down

While ADA’s price declined, its trading volume witnessed a significant spike of 122%, reaching $3.88 billion. This could indicate that investors are actively trading the dip, potentially accumulating ADA at the lower price point. Additionally, Cardano boasts a 75% monthly gain, highlighting its overall positive performance despite the recent correction.

However, CoinGlass data reveals a 25% decrease in Cardano Futures Open Interest, reflecting a diminished risk appetite among investors during the market crash. The Relative Strength Index (RSI) for ADA sits at 53, indicating a neutral market sentiment. This suggests the possibility of further price increases, but also leaves room for potential volatility.

Crucial Support Level and Recent Hack

Martinez has identified a critical support level of $1.20 for Cardano. He highlights that around 93,000 addresses had previously purchased a significant amount of ADA (2.54 billion) at this price point. If the price falls below this level, it could potentially trigger further selling pressure. Currently, the next support zone for ADA appears to be around $1.

Adding to the recent market jitters, the Cardano Foundation X account was compromised. Hackers promoted a fake token, falsely claiming a US SEC crackdown and potential restrictions on ADA withdrawals. The Cardano team swiftly addressed the issue, mitigating the negative impact on market sentiment.

While Martinez predicts a potentially steeper rise, other analyses suggest a more moderate price target of $2 for ADA in the near future. These analyses maintain a bullish outlook for Cardano as long as the price remains above $0.644, indicating a potential rally in the coming days.

Also Read: Cardano (ADA) at a Crossroads: Will Consolidation Breakout Propel Prices Above $1?

The recent dip in Cardano’s price reflects the broader market correction currently underway. However, leading analysts remain confident in ADA’s long-term prospects. While some predict a significant surge towards $4, others envision a more modest price increase to $2. With a key support level to hold and ongoing development within the Cardano ecosystem, ADA’s future trajectory remains to be seen. Only time will tell how the price reacts to the current market climate and future economic data releases.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

With a keen eye on the latest trends and developments in the crypto space, I’m dedicated to providing readers with unbiased and insightful coverage of the market. My goal is to help people understand the nuances of cryptocurrencies and make sound investment decisions. I believe that crypto has the potential to revolutionize the way we think about money and finance, and I’m excited to be a part of this unfolding story.