|

Getting your Trinity Audio player ready...

|

The Ondo (ONDO) price attempted a comeback after dipping below the critical $1.00 mark. However, this short-lived rally faces headwinds as investors prioritize securing profits over supporting the recovery.

Profit Taking Trumps Recovery Efforts

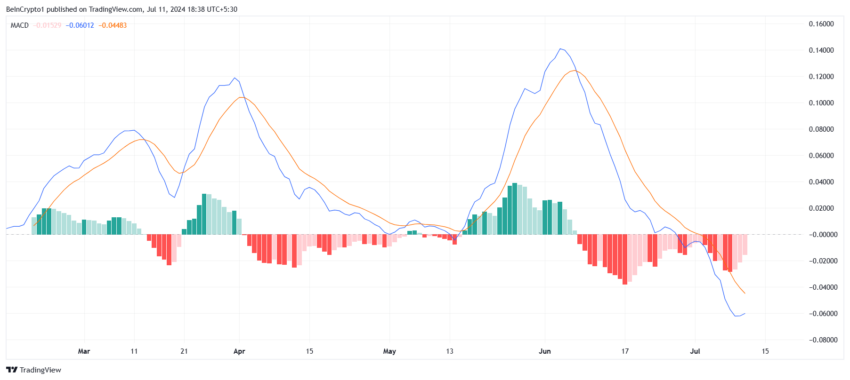

While the Moving Average Convergence Divergence (MACD) indicator hinted at a potential easing of bearish pressure on Ondo, this positive shift failed to hold for the third time in the past month. The culprit? A surge in profit-taking activity. Investors, eager to lock in their gains, are aggressively selling their Ondo holdings. This increased selling pressure acts as a counterweight to any potential upward momentum, hindering sustained price growth.

The combined forces of persistent selling and profit-taking leave Ondo highly susceptible to corrections. Any emerging bullish trends are quickly undermined by these dynamics. While the MACD may show signs of weakening bearish dominance, the repeated failures to maintain this shift and the significant profit-taking paint a clear picture: Ondo remains under considerable pressure.

All-Time High Dreams Fading

With the current price hovering around $0.99, Ondo sits a staggering 42% away from its all-time high of $1.48. The recent price action suggests that achieving this milestone again seems increasingly unlikely in the near future.

A Tough Climb Reclaiming $1

The immediate resistance level for Ondo stands at $1.07. Previously, this price point, along with $1.24, formed a three-week consolidation zone for the altcoin. Following the recent dip, Ondo is likely to re-enter a consolidation phase, this time with boundaries of $1.07 and $0.90. A breach of the lower support at $0.90 could trigger further losses, potentially pushing the price down to $0.73, effectively invalidating any current bullish or neutral predictions.

Also Read: XRP ETF: VanEck Expert Says Solana (SOL) 80% More Likely Due To Lackluster Demand (70%)

Investor sentiment plays a crucial role in Ondo’s price movements. With profit-taking taking precedence over recovery efforts, the altcoin faces an uphill battle in the short term.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!