|

Getting your Trinity Audio player ready...

|

Bitcoin (BTC) has experienced a significant surge in recent weeks, surpassing the $60,000 threshold for the first time since November 2021. This impressive leap has sparked renewed interest and raised questions about the forces fueling this latest Bitcoin rally.

Institutional Investors Pile In

One of the key drivers behind this surge appears to be the recent approval of the first spot Bitcoin exchange-traded funds (ETFs) in the United States. These ETFs act as investment vehicles that track the price of Bitcoin without requiring investors to directly hold the underlying asset. This development has opened the door for institutional investors, who typically face regulatory hurdles and operational complexities when dealing with cryptocurrency directly, to easily enter the Bitcoin market. This influx of institutional capital has demonstrably boosted demand for Bitcoin, pushing its price upwards.

Halving Hype Fueling Long-Term Optimism

Another potential factor contributing to the rally is optimism surrounding the upcoming Bitcoin halving scheduled for April 2024. This event, occurring roughly every four years, reduces the amount of Bitcoin rewarded to miners by half. This decrease in supply, coupled with the ever-increasing demand, could potentially lead to a price increase in the long term. While the exact impact of the halving on price is still debated, the anticipation surrounding this event is believed to be fueling some of the current market enthusiasm.

Beyond these specific factors, broader market conditions also play a role in Bitcoin’s price movements. Geopolitical uncertainties and rising inflation have prompted some investors to seek alternative assets perceived as hedges against inflation and economic instability.

Bitcoin, with its finite supply and decentralized nature, has attracted a portion of these investors seeking diversification and potential protection against traditional financial fluctuations.

However, it’s crucial to remember that the cryptocurrency market remains highly volatile. While the current surge paints a positive picture, historical trends demonstrate that significant price drops can occur swiftly. Potential investors are strongly advised to conduct thorough research, understand the inherent risks involved, and exercise caution before entering the cryptocurrency market.

Related: Bitcoin Soars 93% in Daily Volume as Spot ETFs See Record $673 Million Inflow

Market OutLook

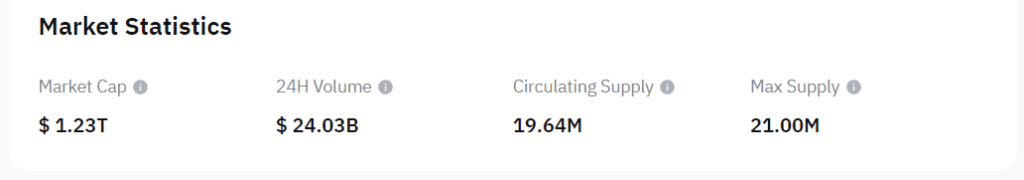

At the time of writing, the global cryptocurrency market is experiencing a positive swing, with the market capitalization reaching $1.23 trillion, reflecting a 1.22% increase over the past 24 hours. Bitcoin (BTC), the leading cryptocurrency by market cap, is currently trading at $62,880.00, having gained 1.30% in the last day. Its 24-hour trading volume sits at $24.03 billion.

A lifelong learner with a thirst for knowledge, I am constantly seeking to understand the intricacies of the crypto world. Through my writing, I aim to share my insights and perspectives on the latest developments in the industry. I believe that crypto has the potential to create a more inclusive and equitable financial system, and I am committed to using my writing to promote its positive impact on the world.