|

Getting your Trinity Audio player ready...

|

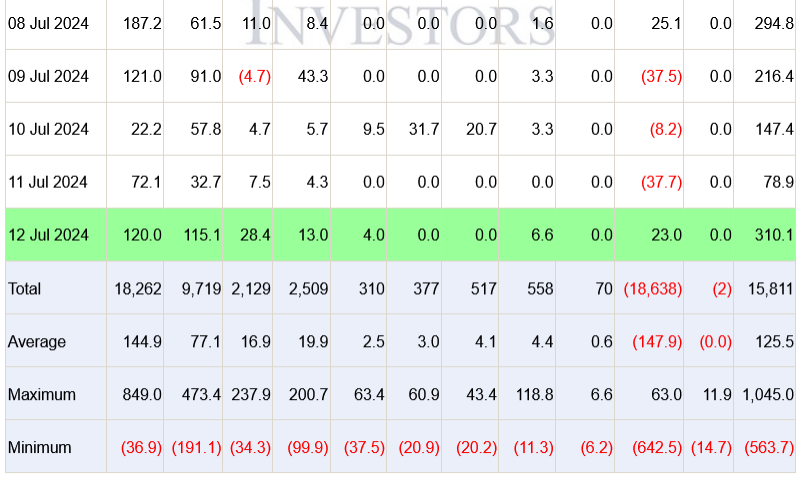

In a sign of renewed institutional interest in the cryptocurrency, United States-based spot Bitcoin exchange-traded funds (ETFs) recorded their best day since early June, pulling in over $310 million on July 12th. This surge in investment highlights a potential shift in sentiment towards the world’s leading digital asset.

BlackRock’s iShares Bitcoin Trust (IBIT) and the Fidelity Wise Origin Bitcoin Fund (FBTC) were the biggest beneficiaries, attracting a combined $235.1 million. The Bitwise Bitcoin ETF also saw a significant inflow of $28.4 million. Notably, even Grayscale Bitcoin Trust (GBTC), which primarily operates as a trust and not an ETF, witnessed a rare inflow day at $23 million.

This surge in inflows follows a strong week for spot Bitcoin ETFs. With Friday’s tally, these investment products have amassed over $1.04 billion in inflows this week alone.

Since launching a little over six months ago, spot Bitcoin ETFs have accumulated a staggering $15.8 billion in net inflows. This figure includes over $18.6 billion that flowed out of Grayscale’s flagship Bitcoin product, likely converting to spot holdings following the US Securities and Exchange Commission’s (SEC) approval in January.

While most spot Bitcoin ETFs enjoyed positive inflows, the Hashdex Bitcoin ETF (DEFI) remains the only one with a net outflow, albeit a relatively small $2 million.

Despite the positive news for spot Bitcoin ETFs, the underlying asset itself, Bitcoin (BTC), has seen a mixed performance. Over the past 24 hours, Bitcoin has gained a modest 1.1%, but it remains nearly 15% down over the last month and a significant 21% away from its all-time high.

Looking ahead, the future seems bright for the spot Bitcoin ETF space. With the US securities regulator expected to finalize approvals soon, several issuers are gearing up to launch spot Ether (ETH) ETFs as early as next week. This could further fuel investor interest in the cryptocurrency market through a regulated investment vehicle.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!