|

Getting your Trinity Audio player ready...

|

The highly anticipated launch of the first U.S. Bitcoin ETFs on February 1st sparked a record-breaking $4 billion trading volume, with Grayscale, BlackRock, and Fidelity leading the charge. However, despite this initial excitement, BTC prices have struggled to break above their yearly high of $48,000 and have even retreated to $42,500, raising concerns among investors.

Is the Bull Run Stalled?

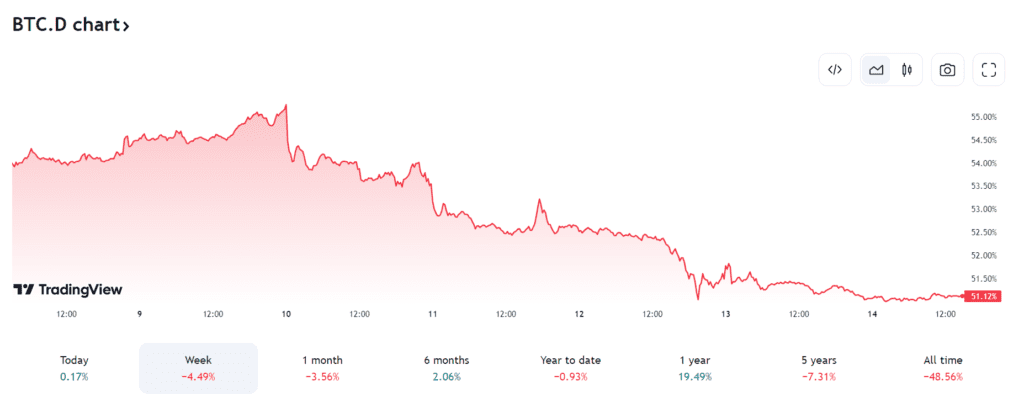

Analysts point to several factors behind the current price stagnation. Firstly, Bitcoin dominance has dipped from 55% to 51% in the past 1 week, suggesting investors are shifting their focus towards altcoins like Ethereum, which has surged 13% in the past week. This could be a classic “buy the rumor, sell the news” scenario, where investors cash out after the initial hype surrounding the ETF launch.

Furthermore, data shows that 94% of the Bitcoin supply is currently in profit, leading some to believe profit-taking might be fueling the downward pressure. Some of this profit may be flowing back into exchanges after a two-year bear market.

Related: Bitcoin ETFs: A Golden Dawn or a Modest Glow? Comparing Crypto to Gold’s Historic Move

Long-Term Outlook Remains Bullish

Despite the short-term dip, most experts remain optimistic about Bitcoin’s future. Renowned analyst PlanB believes the ETF approval is a bullish catalyst and predicts BTC will reach $55,000 soon, eventually climbing above $100,000 by year’s end and surpassing $500,000 by 2025. Other prominent figures like Vivek and Cathie Wood share similar bullish sentiments, with Wood predicting a potential $1.5 million price point by 2030.

The Halving: A Potential Game Changer

The upcoming Bitcoin halving in April, which historically coincides with significant price increases, adds further fuel to the bullish fire. PlanB sees this event as a key driver for reaching the $100,000 mark. Vivek also anticipates a $150,000 surge post-halving.

Also Read: Gold Rush 2.0? Bitcoin ETFs Set to Spark a New Investment Frenzy

Conclusion: A Short-Term Blip or a Change in Tide?

While the current price dip might raise concerns, it’s crucial to remember that long-term Bitcoin predictions remain overwhelmingly optimistic. The ETF launch, upcoming halving, and continued institutional interest paint a promising picture for the digital asset’s future. However, investors should be mindful of short-term volatility and potential profit-taking, especially in light of the recent altcoin surge.

I’m the cryptocurrency guy who loves breaking down blockchain complexity into bite-sized nuggets anyone can digest. After spending 5+ years analyzing this space, I’ve got a knack for disentangling crypto conundrums and financial markets.