|

Getting your Trinity Audio player ready...

|

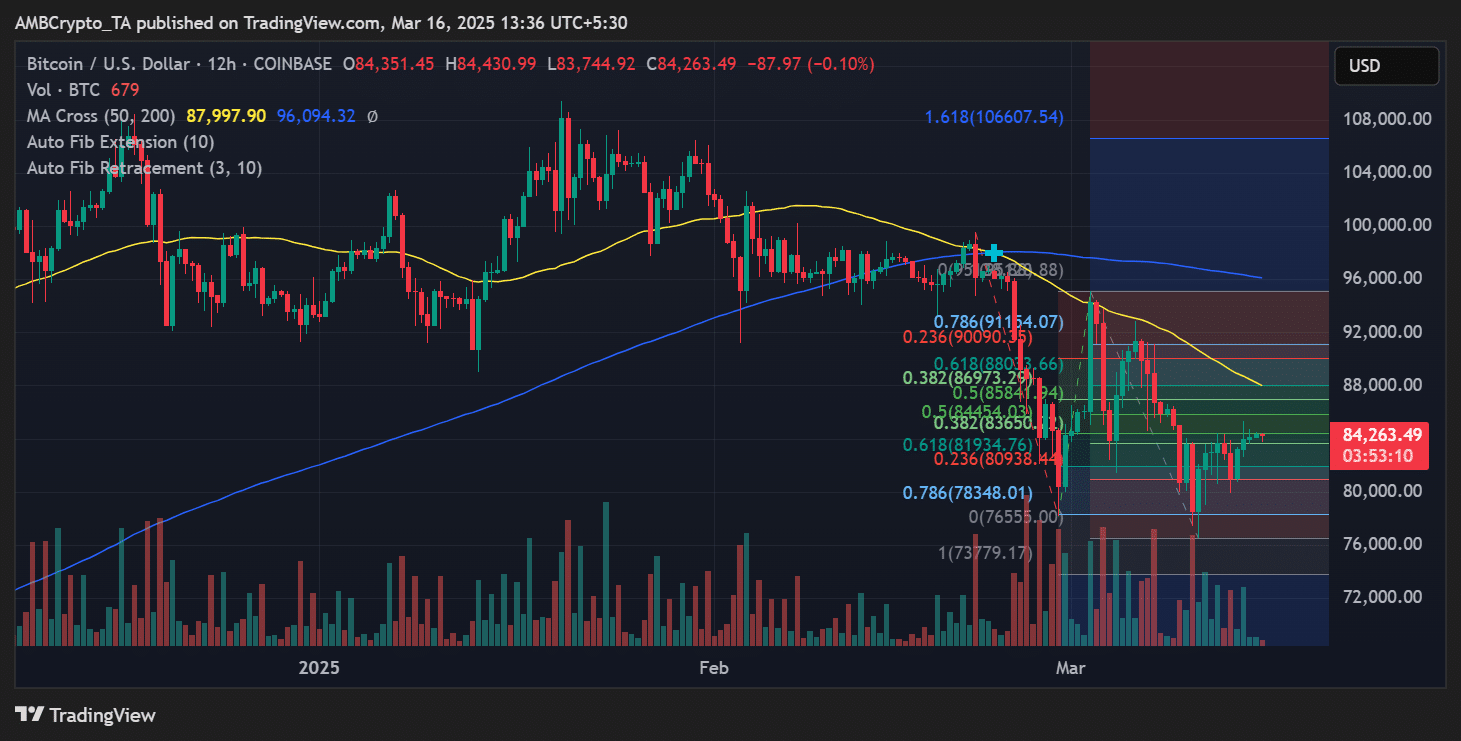

Bitcoin (BTC) continues to consolidate within a rising wedge pattern, approaching a critical resistance level at $86,400. After successfully breaching and retesting the $83,800 support, BTC now stands at a pivotal juncture that could determine its short-term trajectory.

Bitcoin’s Position in the Rising Wedge

The rising wedge pattern seen on lower timeframes presents a mixed outlook. While typically associated with bullish momentum, it also carries the risk of a bearish breakdown. At press time, BTC was trading at $84,263, steadily approaching the upper boundary of the wedge.

Volume analysis suggests declining activity, indicating that buying pressure may be fading. The Relative Strength Index (RSI) remains near neutral, suggesting neither overbought nor oversold conditions. However, a push toward $86,400 could shift RSI into overbought territory, increasing the likelihood of a rejection.

Key Resistance and Support Zones

Immediate resistance is found at $86,400, a critical barrier that traders are watching closely. A successful breakout above this level could propel BTC toward $90,000 and even $95,000 if momentum holds.

On the downside, $83,800 now serves as a key support level. A failure to hold this zone may lead BTC to revisit $81,700 or even dip below $80,000. Fibonacci retracement levels further reinforce these zones, with the 0.618 level aligning near $86,900 and the 0.786 level providing strong support at $78,300.

Potential Breakout or Breakdown?

If BTC clears $86,400 decisively, it could invalidate bearish concerns and trigger a rally toward $90,000. However, if the wedge structure collapses, BTC may face a sharp decline, with immediate targets at $81,700 and $78,300.

Also Read: Trump Administration Eyes XRP for U.S. Bitcoin Reserve Strategy, SEC Proposes Legal Clarity

Traders should closely monitor trading volume and RSI behavior for confirmation. With Bitcoin at a crucial turning point, the coming days will be instrumental in determining whether it can sustain its bullish trend or face a significant pullback.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!