|

Getting your Trinity Audio player ready...

|

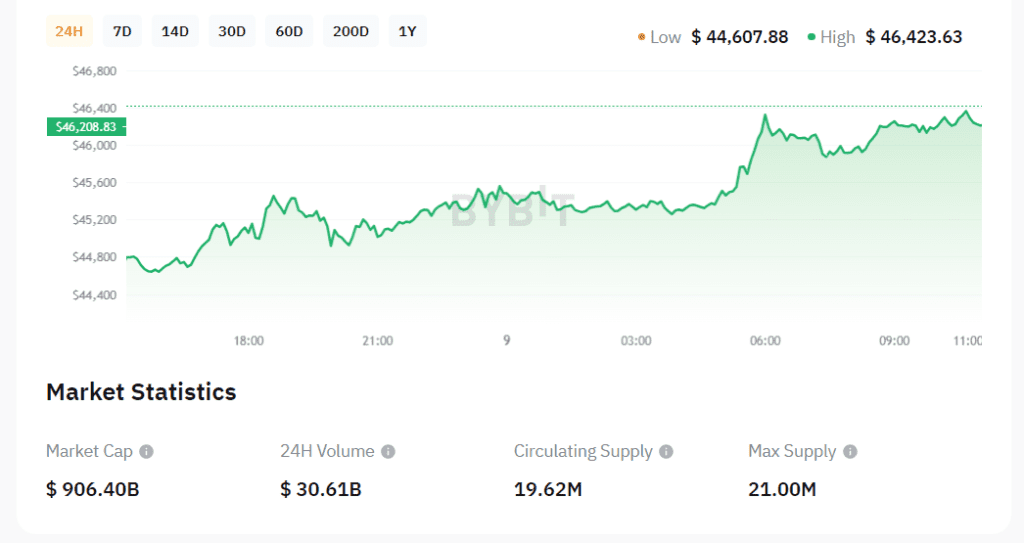

Bitcoin’s recent slumber may be over, replaced by a sudden surge that’s left both investors and traders scrambling. In the past 48 hours, the world’s leading cryptocurrency has seen two impressive rallies, pushing its price past $46,000 and leaving over $100 million in short positions liquidated.

Bitcoin’s Bullish Roar

This bullish resurgence comes after a period of stagnation following the US SEC’s approval of nearly a dozen spot Bitcoin ETFs in January. The initial excitement quickly waned, leading to a $10,000 price drop and a bottoming out at $38,500 on January 23rd. However, the bulls returned, pushing BTC back to $43,000 where it remained for a week.

The tide turned yesterday, with Bitcoin climbing to $45,000, a monthly high at the time. The past 12 hours have been even more dramatic, with the price surpassing another monthly peak by reaching over $46,000.

This volatility wasn’t just confined to Bitcoin. Altcoins like SOL and ADA also experienced significant gains, highlighting the renewed momentum in the cryptocurrency market.

However, the rapid price swings haven’t been kind to over-leveraged traders. Data reveals over 37,000 liquidations in the past day, with a total value exceeding $115 million. Short positions bore the brunt of this carnage, accounting for over $80 million of the losses. The single largest liquidation, exceeding $5 million, occurred on Bitmex for the BTC/USD trading pair.

This recent surge raises several questions: Is this the beginning of a sustained bull run for Bitcoin? Or is it merely a temporary reprieve before another correction? Analysts are divided, with some citing positive technical indicators and increased institutional interest as reasons for optimism. Others remain cautious, pointing to the potential for regulatory hurdles and broader market volatility to dampen the rally.

Related: Bitcoin Steals Gold’s Thunder? Cathie Wood Sees Crypto as the New “Flight to Safety”

Regardless of the future, one thing is clear: Bitcoin is back in the spotlight, and its price action is captivating the attention of investors and traders alike. Whether it’s a victory lap or a brief intermission remains to be seen, but one thing’s for sure: the cryptocurrency rollercoaster is far from over.

Crypto Market and BTC Price Outlook

The global cryptocurrency market is on an upswing, with the total market cap reaching $906.4 billion as of February 9, 2024. This represents a 3.88% increase in the last 24 hours. Bitcoin (BTC), the leading cryptocurrency by market cap, is currently trading at $46,157.00, up 3.83% from the previous day. Its 24-hour trading volume sits at $30.61 billion. With a circulating supply of 19.62 million BTC coins and a maximum supply capped at 21 million, Bitcoin continues to be a dominant force in the crypto landscape.

I’m the cryptocurrency guy who loves breaking down blockchain complexity into bite-sized nuggets anyone can digest. After spending 5+ years analyzing this space, I’ve got a knack for disentangling crypto conundrums and financial markets.