|

Getting your Trinity Audio player ready...

|

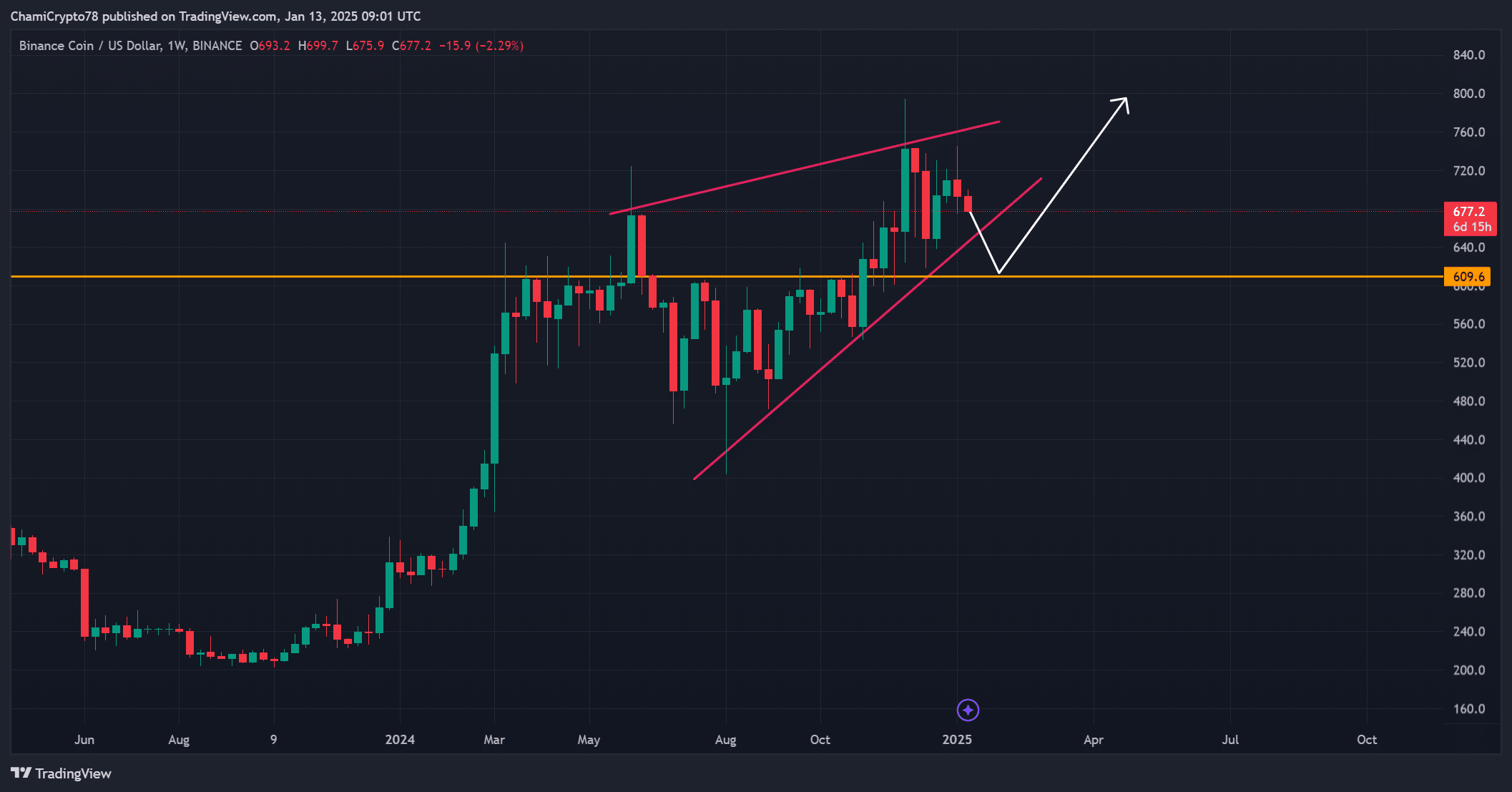

Binance Coin (BNB) finds itself at a crucial crossroads, grappling with a bearish rising wedge pattern on its weekly chart. This technical structure, known for signaling potential downtrends, has traders on edge as BNB struggles to maintain its footing amid increasing resistance levels.

At press time, BNB was trading at $676.54, reflecting a 2.38% decline in the last 24 hours. The token’s precarious position has prompted widespread speculation about whether it will succumb to bearish pressure or stage an unexpected recovery.

BNB Price Analysis: A Test of Key Support

The rising wedge pattern underscores weakening price momentum for BNB. Coupled with repeated failures to breach critical resistance levels, this has fueled uncertainty among investors.

All eyes are now on the $609.6 support level, a potential short-term safeguard against further losses. However, escalating selling pressure could trigger an accelerated decline, potentially confirming a broader bearish trend.

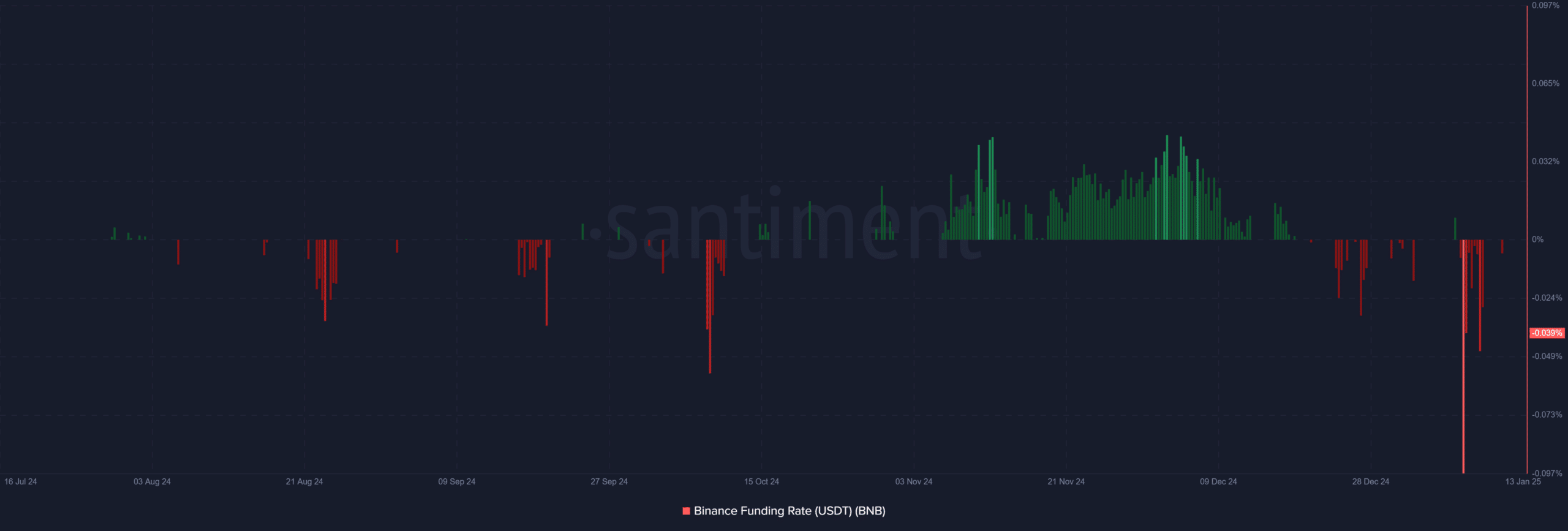

Funding Rates Turn Negative

Market sentiment is also leaning bearish, with BNB’s funding rates on Binance at -0.0389%, reflecting a surge in short positions. Prolonged negative funding rates often amplify downside risks, though a sudden short squeeze could reverse this trend if bullish traders regain control.

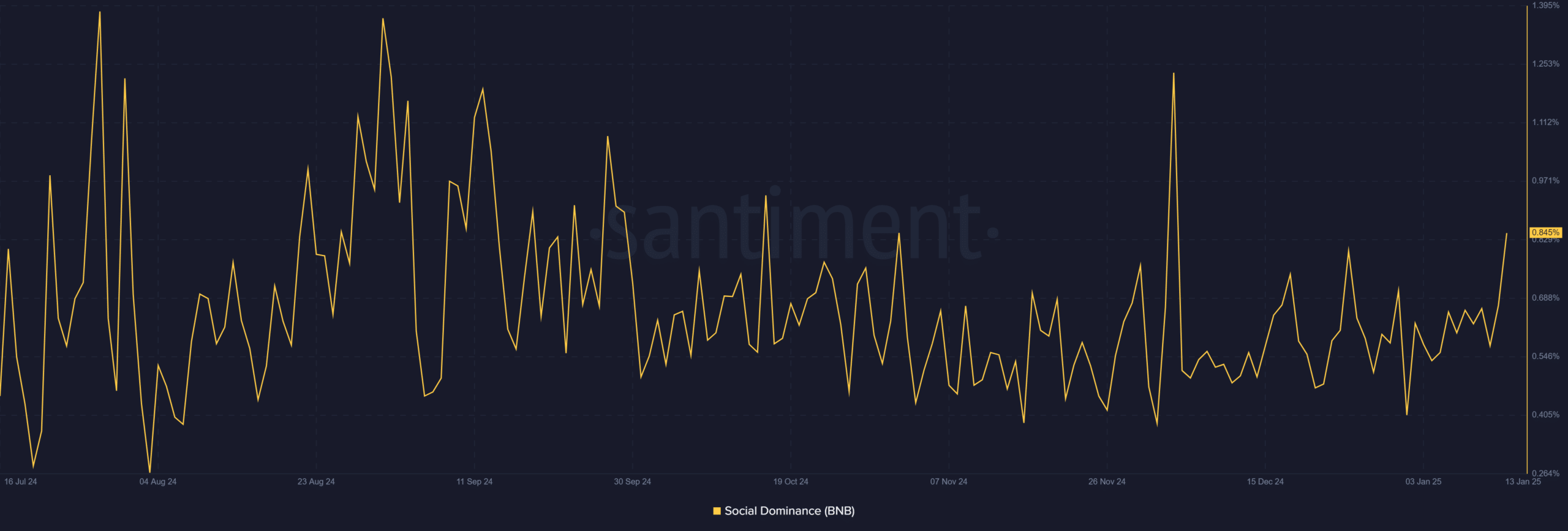

Social Dominance Spikes

BNB’s social dominance has surged to 0.845%, the highest in recent months, highlighting intense market attention. Increased social chatter typically drives speculative trading, leading to heightened volatility. However, whether this surge in attention will spark renewed buying interest or deepen bearish sentiment remains uncertain.

The derivatives market presents a mixed outlook. BNB‘s trading volume soared by 83.47%, hitting $531.76 million, while options volume skyrocketed by 1,536.55%. Despite these indicators of growing trader involvement, the negative funding rates cast a shadow over optimism.

BNB is under mounting pressure as bearish signals dominate its technical and market metrics. The rising wedge pattern, negative funding rates, and heightened social activity suggest a potential breakdown. While derivatives data hint at trader anticipation, the overall outlook remains bearish unless BNB can invalidate these patterns and regain momentum.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: XLM Soars After Binance Launches JPY Trading Pairs: What It Means for Stellar’s Future

With a keen eye on the latest trends and developments in the crypto space, I’m dedicated to providing readers with unbiased and insightful coverage of the market. My goal is to help people understand the nuances of cryptocurrencies and make sound investment decisions. I believe that crypto has the potential to revolutionize the way we think about money and finance, and I’m excited to be a part of this unfolding story.