|

Getting your Trinity Audio player ready...

|

Despite a minor 1.01% dip in the price of Aave (AAVE) over the last 24 hours, the broader narrative around the token remains optimistic. This decline comes after an impressive 30.47% surge over the past week, suggesting that short-term fluctuations might not overshadow the token’s long-term potential. Analysts from AMBCrypto believe that rising interest and improving liquidity could soon drive a price recovery, solidifying Aave’s position in the decentralized finance (DeFi) sector.

Supply Cap Reached: Implications for AAVE

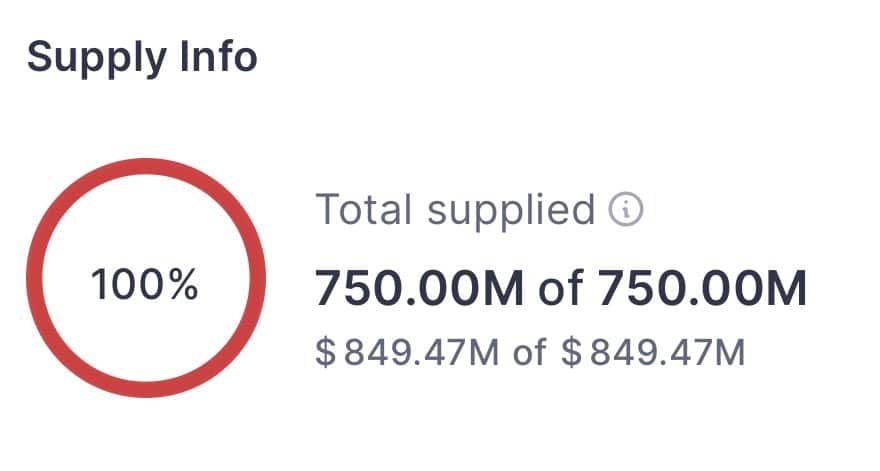

A critical development fueling optimism is the rapid adoption of Aave’s native stablecoin, sUSDe. Within 24 hours, its market supply cap of $850 million was maxed out. According to Macro Mate on X (formerly Twitter), this strategic supply limitation ensures risk management and enhances the stablecoin’s utility. However, it has also led to a surge in borrowing costs, reflecting heightened demand.

Such robust activity underscores increasing user engagement on the Aave protocol—a key driver for token demand. High user participation often correlates with positive price movements, setting the stage for a potentially bullish trajectory for AAVE.

Total Value Locked (TVL) Hits Record High

Recent data from DeFiLlama highlights a significant milestone for Aave: the protocol’s total value locked (TVL) has reached $21.55 billion, its highest level since inception. This surge indicates growing confidence among investors, who are actively staking and locking assets within the ecosystem.

As AAVE remains integral to these activities, the token is poised to benefit from rising investor interest. Analysts expect a wave of accumulation in the coming days, which could further bolster the token’s market performance.

Derivatives and Spot Markets Signal Bullish Sentiment

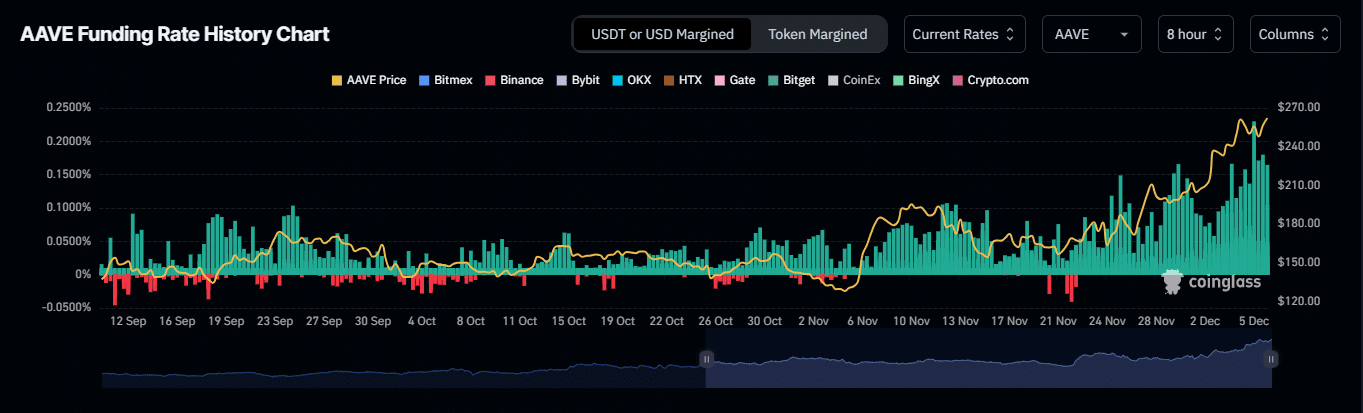

The optimism surrounding AAVE isn’t limited to its ecosystem developments. Data from Coinglass reveals that long traders are increasingly betting on the token, with a funding rate of 0.0393% suggesting strong bullish sentiment. Positive funding rates typically indicate that traders expect the price to climb, as long positions outpace shorts.

Spot markets are also aligning with this trend. Over the past 48 hours, $3.372 million worth of AAVE has been withdrawn from exchanges into private wallets, signaling potential long-term holding. This movement could result in a supply squeeze, increasing demand and driving up the token’s price.

Outlook for AAVE

As liquidity improves and demand surges, Aave appears well-positioned for continued growth. If these trends persist, the token’s recent dip could be a temporary setback before a potential rally. With an ecosystem flourishing across multiple metrics, AAVE may soon reclaim its upward momentum, cementing its role as a key player in the DeFi space.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!