|

Getting your Trinity Audio player ready...

|

- XRP ETFs logged 30 consecutive days of net inflows, an industry first

- Regulatory clarity has unlocked new institutional demand

- Inflows suggest long-term positioning, not short-term speculation

While much of the crypto ETF market struggled to keep investor capital in recent weeks, spot XRP ETFs quietly moved in the opposite direction. For 30 consecutive trading days, XRP-linked exchange-traded funds recorded net inflows, setting a new industry record and standing apart from Bitcoin and Ethereum products that saw persistent withdrawals.

The streak highlights a growing divide within the crypto ETF space — and signals where institutional confidence is currently concentrating.

A Rare Streak in a Risk-Off Market

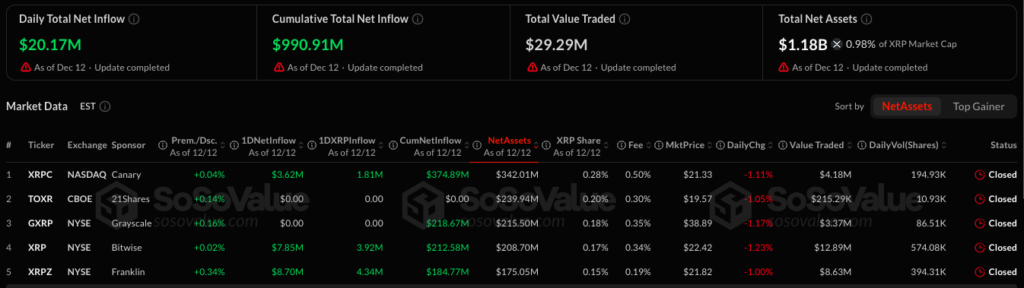

Spot XRP ETFs have now gone an entire month without a single day of net outflows. Since the launch of the first U.S. spot XRP ETF in mid-November, cumulative inflows have climbed to just under $1 billion, pushing total assets under management to around $1.18 billion.

That consistency is notable given the broader context. Over the same period, Bitcoin ETFs posted repeated weekly outflows, while Ethereum and Solana products struggled to maintain stable demand amid macro uncertainty. XRP ETFs were the only major crypto ETF category to sustain uninterrupted daily inflows through November and early December.

Why Capital Is Rotating Toward XRP

Several forces appear to be driving the divergence. Regulatory clarity sits at the top of the list. The conclusion of Ripple’s long-running legal battle with U.S. regulators — and the classification of XRP as a non-security in secondary markets — removed a major overhang that had kept many institutions on the sidelines.

That clarity paved the way for spot ETF approvals and gave investors something scarce in crypto markets: legal certainty.

Timing has also worked in XRP’s favor. As investors reduced exposure to higher-volatility assets, XRP ETFs offered a way to rotate into crypto exposure without leaning further into Bitcoin or Ethereum, both of which faced heavier selling pressure.

Also Read: Memecoins Go Quiet as $239B Floods Into Leveraged ETFs

Utility Over Speculation

XRP’s positioning also differs from most major tokens. Its close link to Ripple’s cross-border payments network gives it a clear real-world use case, one already adopted by financial institutions globally. In a cautious market, that utility narrative appears to resonate more than pure price momentum.

Importantly, the steady inflows have not sparked a sharp rally in XRP’s spot price. That disconnect suggests investors are building longer-term positions rather than chasing short-term gains — a pattern more typical of institutional allocation than speculative trading.

The 30-day inflow streak does not guarantee XRP’s immunity from broader market swings. Macro pressures remain, and price action is still subdued. But the behavior of XRP ETFs sends a clear message: when capital fled much of the crypto ETF market, XRP attracted steady, conviction-driven inflows.

For now, XRP ETFs represent one of the few pockets of resilience in an otherwise uneven landscape — and a signal that institutional preferences inside crypto are becoming more selective.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.