|

Getting your Trinity Audio player ready...

|

Stay ahead with real-time updates and insights—Join our Telegram channel!

- Canary Capital filed for a Trump Coin ETF, giving investors regulated access to the $1.6B memecoin.

- A second “American-Made Crypto ETF” (MRCA) will track U.S.-rooted tokens excluding memecoins.

- SEC delays on crypto ETFs continue, with new deadlines pushed into October 2025.

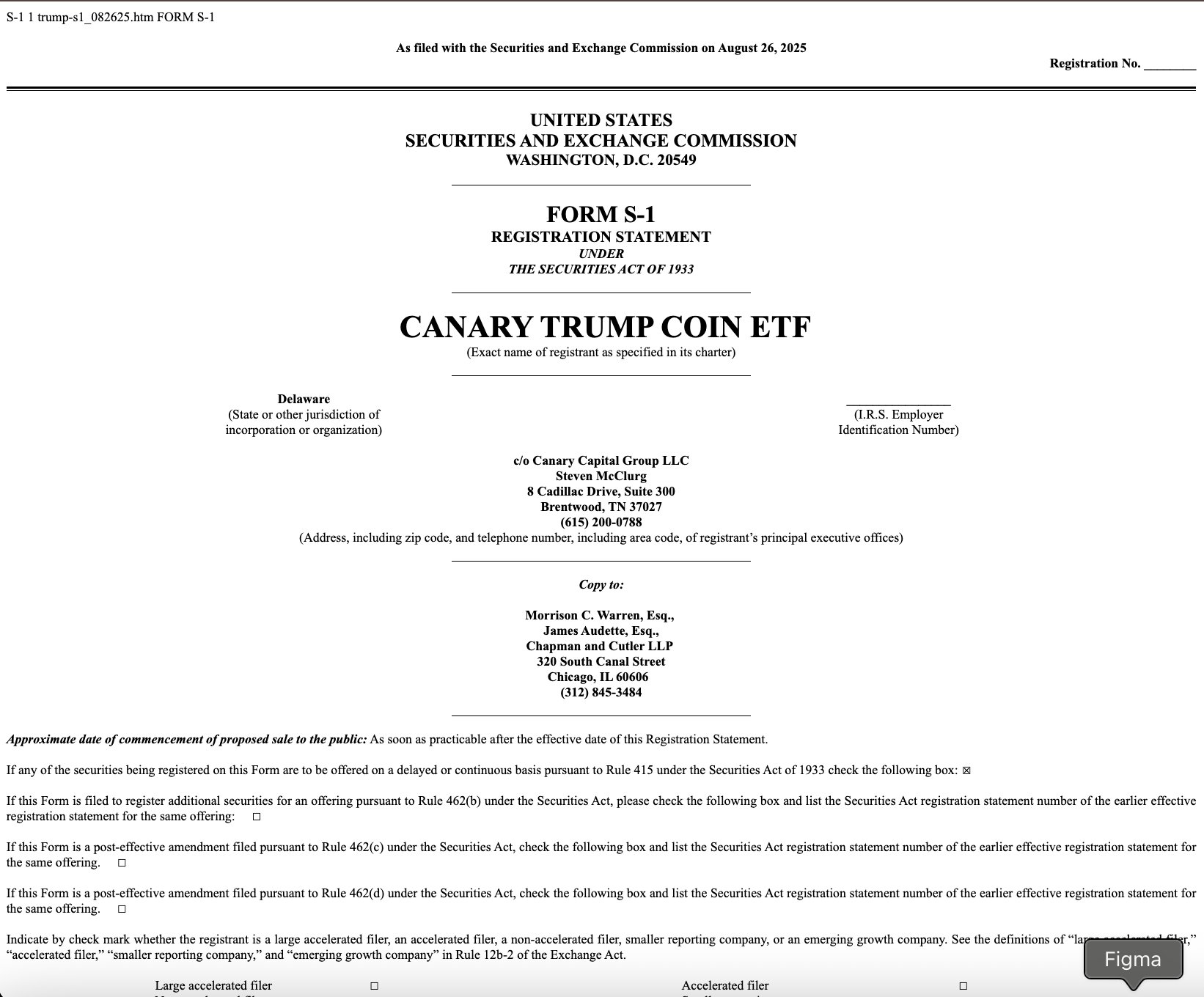

Asset manager Canary Capital has filed an S-1 registration with the U.S. Securities and Exchange Commission (SEC) for a Trump Coin ETF, aiming to give traditional investors regulated exposure to one of the most politically charged memecoins on the market. The filing highlights the growing intersection of politics and digital assets, even as regulators remain cautious on crypto-based funds.

Trump Coin ETF Proposal

The proposed ETF would track the price of TRUMP, a memecoin launched in January ahead of Donald Trump’s inauguration. With a current market capitalization of $1.67 billion and a price of $8.37, TRUMP ranks among the six largest meme coins. At its peak earlier this year, the coin surged to $75, briefly becoming the second-largest meme coin behind Dogecoin, before plummeting nearly 89% from its all-time high.

If approved, the ETF would allow investors to gain exposure to TRUMP through traditional brokerage accounts, bypassing the need for crypto exchanges. However, Canary’s filing did not reveal details about fees, listing venues, or timelines.

Broader ETF Strategy: American-Made Crypto Fund

In addition to the Trump Coin ETF, Canary filed for an “American-Made Crypto ETF” under the ticker MRCA. This product would track an index of U.S.-rooted cryptocurrencies such as XRP, Solana, Cardano, Chainlink, and Stellar, while explicitly excluding memecoins, stablecoins, and pegged tokens.

The MRCA fund would integrate staking rewards into its net asset value via third-party providers, with custody managed by a South Dakota trust company and most assets stored in cold wallets.

Stay ahead with real-time updates and insights—Join our Telegram channel!

SEC Delays and Regulatory Landscape

The filings arrive as the SEC continues to delay decisions on multiple crypto ETF applications, including those linked to XRP, Solana, and Truth Social. New review deadlines extend into October 2025. Canary Capital itself has several pending ETF proposals tied to SOL, XRP, SUI, TRX, and PENGU, all awaiting regulatory clarity.

Also Read: Pi Network to Unlock 116M Tokens in September – Can Price Hit $1.70?

While the SEC has offered new guidance on staking and custody, approvals remain slow, keeping investors and asset managers in limbo. The Trump Coin ETF, if approved, could mark a milestone in blending U.S. politics with crypto markets—though the timing of such approval remains uncertain.

Canary Capital’s Trump Coin ETF filing highlights both the demand for novel crypto products and the challenges posed by regulatory delays. Whether the SEC greenlights TRUMP exposure for mainstream investors may set a precedent for future politically or culturally driven digital asset funds.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.