|

Getting your Trinity Audio player ready...

|

Key Takeaways:

- Institutional interest is growing, reinforcing XRP’s relevance in cross-border payments.

- Legal clarity has improved sentiment, but regulatory risks and market competition remain.

- Price forecasts are optimistic, with projections up to $3 by December 2025—but volatility remains a concern.

Ripple’s XRP token is back in the spotlight as market sentiment begins to shift favorably despite its ongoing legal entanglements with the U.S. Securities and Exchange Commission (SEC). While the SEC case has slowed XRP’s potential breakout, the token continues to attract institutional interest, bolstering optimism for future gains. The burning question for investors: can XRP finally overcome the elusive $2 mark, and should holders stay the course?

Institutional Support Could Fuel a Breakout

Analyst Jeremy Britton from Finder points to growing institutional interest in XRP as a potential game changer. As Ripple strengthens ties with banks and financial institutions, its utility in cross-border payments is becoming more appealing.

“XRP seems to be the choice for many institutions. It is arguably no longer a cryptocurrency, and its ethos is almost gone, but its value is in the eye of the banker,” Britton noted.

Joseph Raczynski, futurist at JT Consulting, echoed similar sentiments, suggesting that favorable U.S. crypto tax policies could give XRP an edge. If the U.S. exempts domestic cryptocurrencies from taxes, “XRP will be the winner,” he claimed.

Legal Clarity Boosts Sentiment—but Risks Remain

Sathwik Vishwanath emphasized that XRP’s success hinges on legal clarity and broader adoption for international payments. While Ripple’s legal victories have helped improve market sentiment, competition from stablecoins and other digital assets may limit XRP’s growth trajectory.

Still, not all analysts are bullish. Josh Fraser offered a contrarian view, urging caution.

“Stablecoins are much more practical for institutional use. I do not see long-term value in holding Ripple,” he said, advising investors to consider exiting their positions.

Short-Term Targets Show Promise, But Volatility Persists

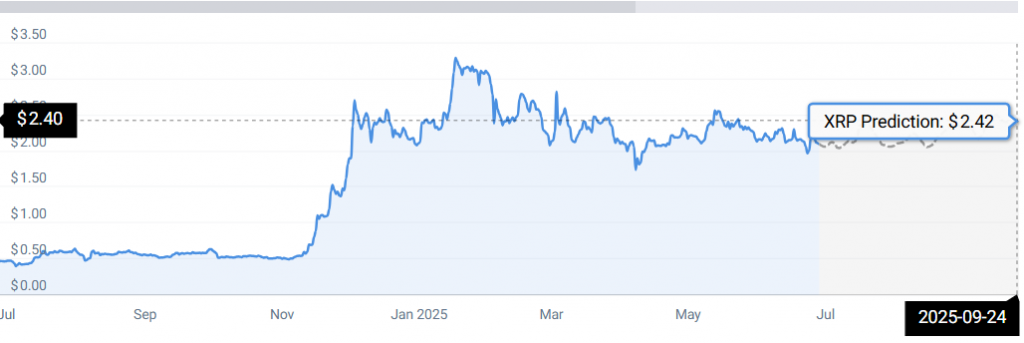

According to data from CoinCodex, XRP is projected to hit $2.43 by September 25, 2025, representing a 15.22% gain from current levels. By December 24, 2025, analysts estimate the token could climb to $3.00, assuming favorable market conditions prevail.

Despite this bullish outlook, sentiment remains mixed. Technical indicators suggest a bearish short-term trend, with XRP showing green on only 43% of the last 30 trading days. The Fear & Greed Index currently sits at 65 (greed), indicating potential for short-term spikes but also increased risk.

For now, XRP appears to be in a consolidation phase, with analysts split between bullish optimism and cautious skepticism. While legal challenges persist, institutional partnerships and potential regulatory tailwinds could propel XRP toward the $2–$3 range in late 2025.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses

Also Read: Ripple Faces XRP Sales Ban After Judge Torres’ Ruling in SEC Lawsuit

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.