|

Getting your Trinity Audio player ready...

|

A groundbreaking report by Standard Chartered suggests the U.S. government is considering Bitcoin as a modern hedge, potentially selling a portion of its massive $800 billion gold reserves to acquire the cryptocurrency. This move, if executed, could send shockwaves through both the gold and cryptocurrency markets, altering the global financial landscape.

Bitcoin vs. Gold: A Shift in Strategy?

Gold has long been the backbone of central bank reserves, prized for its stability. However, Bitcoin’s rising institutional adoption and fixed supply present a compelling alternative. With only 21 million Bitcoins ever to exist, the digital asset offers scarcity-driven value similar to gold but with the added advantage of portability and security. Unlike gold, Bitcoin can be transferred instantly across borders without physical limitations, making it a more flexible reserve asset in the modern economy.

The growing acceptance of Bitcoin among major corporations and financial institutions bolsters its legitimacy. If the U.S. officially recognizes Bitcoin as a strategic reserve asset, other nations may follow suit, reshaping global monetary policies.

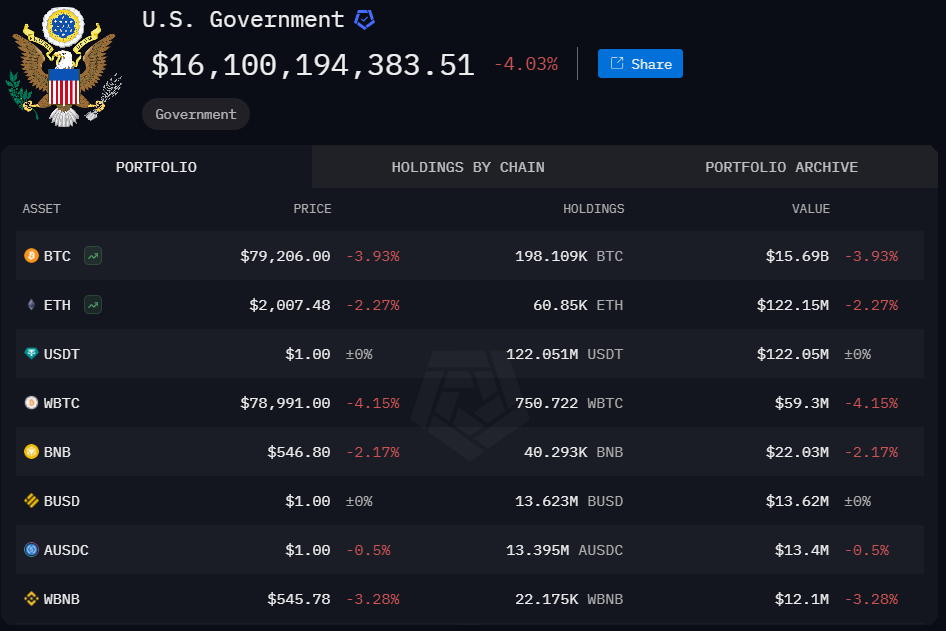

US Government’s Existing Bitcoin Holdings

Currently, the U.S. government holds approximately 198,109 BTC, valued at around $15.7 billion, according to Arkham. These assets stem primarily from legal seizures and remain largely unsold due to regulatory restrictions. This significant Bitcoin reserve signals that the government has already engaged with cryptocurrency on a meaningful level.

Apart from selling gold, analysts point to the Exchange Stabilization Fund (ESF), which holds $39 billion in net assets, as a potential alternative funding source for Bitcoin acquisitions. Traditionally used for financial crisis management, reallocating ESF funds could allow the U.S. to accumulate Bitcoin without direct gold liquidation.

Bitcoin Act 2024: A Game-Changer?

A major legislative proposal, the Bitcoin Act 2024, introduced by Senator Cynthia Lummis, seeks to integrate Bitcoin into the U.S. financial system. The bill outlines purchasing 200,000 BTC annually over five years, ensuring a systematic accumulation strategy. If structured effectively, this initiative could be executed without disrupting public finances while cementing Bitcoin’s role as a reserve asset.

With the White House Digital Assets Summit approaching, President Donald Trump’s stance on a Strategic Bitcoin Reserve remains a key focus. Bitcoin is currently trading between $80,000 and $95,000, reflecting heightened market anticipation over potential policy shifts. If the U.S. embraces Bitcoin at an institutional level, a global domino effect could unfold, accelerating cryptocurrency adoption worldwide.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Crypto Market Bloodbath: Nearly $1B Liquidated as Whales Dump Bitcoin and Ethereum

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!