|

Getting your Trinity Audio player ready...

|

The crypto market witnessed an explosive rally in late 2024, pushing Bitcoin to a new all-time high (ATH). With an altcoin season expected in early 2025, investors are speculating on potential gains for major altcoins like Cardano (ADA). So, is Cardano a good investment? Can ADA reach $10? Let’s analyze expert forecasts and market trends.

ADA Price Prediction 2025

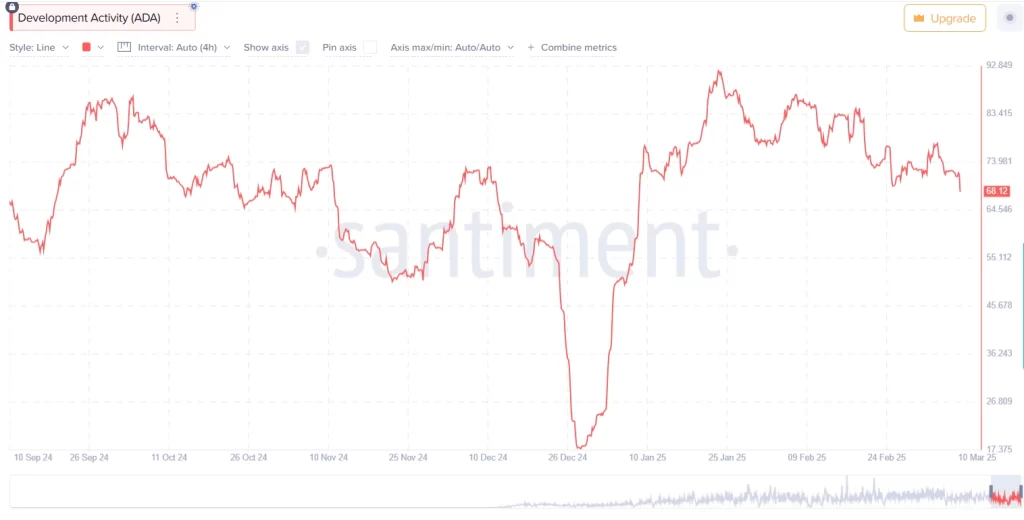

As a development-focused blockchain, Cardano continues to evolve, increasing its adoption rate. Market analysts suggest that ADA could see significant growth in 2025. According to on-chain data from Santiment, Cardano’s network expansion aligns with growing bullish sentiment. ADA’s price is projected to hit an annual high of $2.62, while a bearish trend could push it down to $1.81. The expected average price for the year stands at $2.10.

Cardano Price Forecast 2026-2030

Looking ahead, ADA’s bullish momentum is likely to continue:

- 2026: Price range between $2.76 – $3.30, with an average of $3.03.

- 2027: Expected to surge between $4.56 – $5.03, averaging $4.79.

- 2028: Forecasted to trade between $5.29 – $5.73, with a median price of $5.51.

- 2029: Price range could hit $6.68 – $7.79, averaging $7.23.

- 2030: A major rally could push ADA to $9.12 – $10.32, with an average of $9.72.

Long-Term Cardano Price Predictions (2031-2050)

If Cardano maintains its technological advancements and adoption increases, ADA could see long-term price appreciation. Historical market cycles suggest that by 2040-2050, ADA might reach double-digit valuations, potentially exceeding $15-$20, depending on market conditions.

Also Read: Cardano Whales Accumulate 180M ADA—Is a 4,000% Rally on the Horizon? – Analyst

Should You Buy Cardano Before Altcoin Season?

With an anticipated bull run and renewed investor interest, ADA remains a strong contender in the altcoin space. Investors considering Cardano should watch network upgrades, adoption rates, and macroeconomic trends that could influence its price trajectory.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!