|

Getting your Trinity Audio player ready...

|

In a time of market uncertainty, where most cryptocurrencies face selling pressure and notable price declines, Dogecoin (DOGE) is drawing significant attention from investors. Recent on-chain data highlights bullish activity surrounding the largest meme coin, despite its short-term price drop.

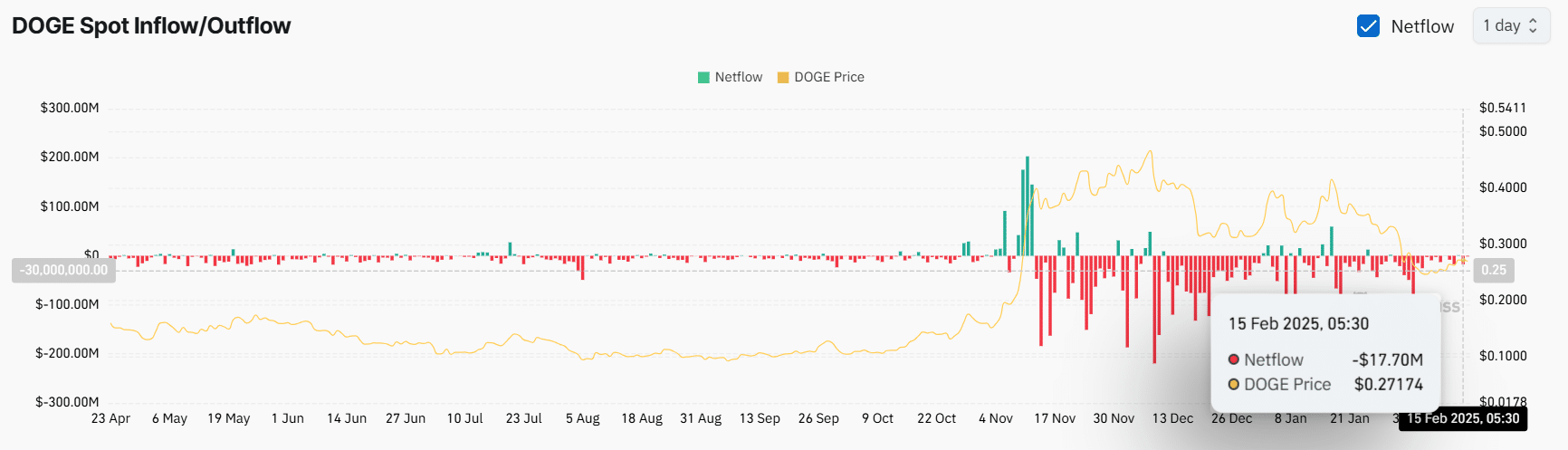

$18 Million Worth of DOGE Leaves Exchanges

On February 16, data from on-chain analytics platform Coinglass revealed a significant $18 million outflow of DOGE from exchanges. This trend suggests accumulation by investors, which could create strong buying pressure in the coming days. The reduction in exchange reserves often signals investor confidence and a potential upward price movement.

76% of DOGE Traders Take Long Positions

Market sentiment among traders remains highly optimistic. Binance’s DOGE/USDT long/short ratio stood at 3.15, meaning for every 3.15 long positions, there was only one short position. Additionally, 76% of top traders on Binance were holding long positions, further reinforcing a bullish outlook.

DOGE’s Price Action and Market Sentiment

Despite the bullish indicators, DOGE’s price remains subdued. At the time of writing, the meme coin was trading around $0.26, experiencing a 3.5% decline in the last 24 hours. Trading volume also dipped by 45%, indicating reduced market participation compared to the previous day.

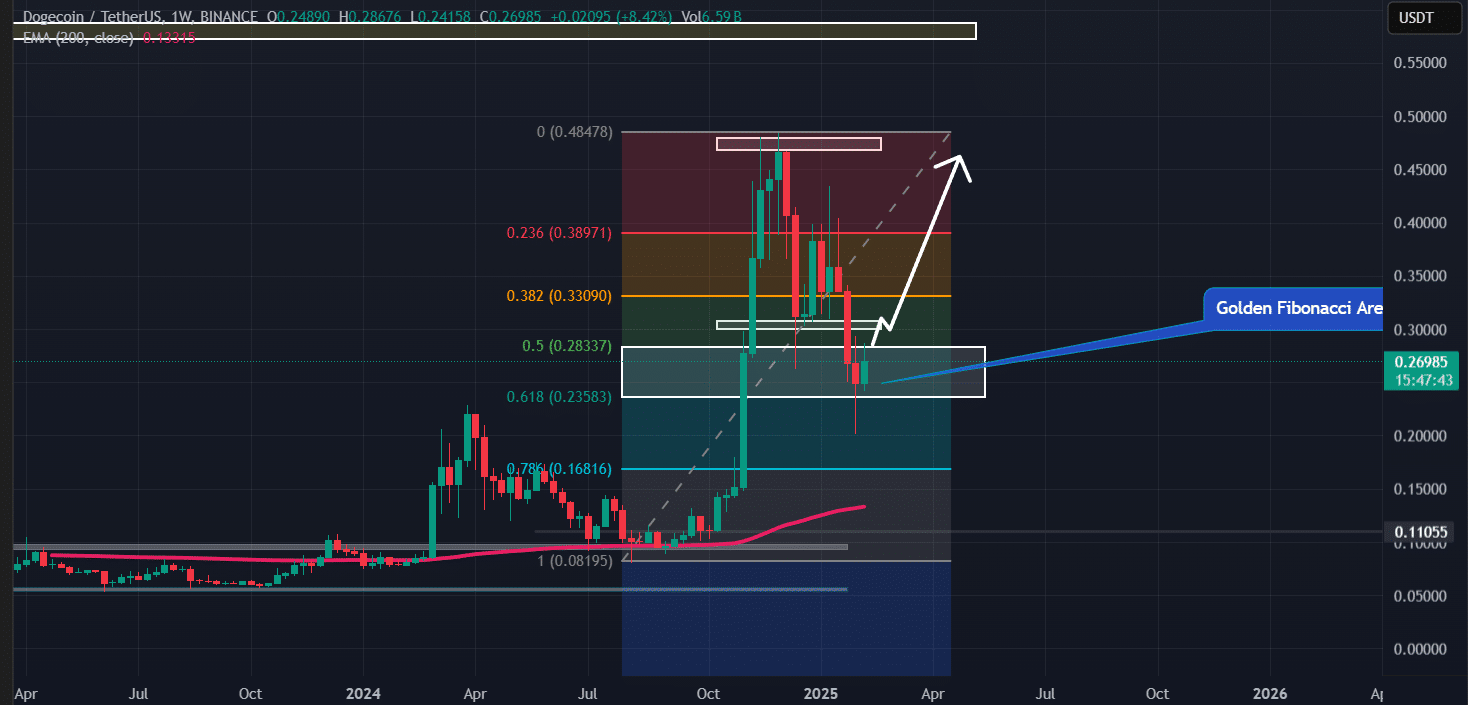

DOGE is currently trading within the golden Fibonacci zone (50%-61.8% retracement level), a key area where traders often anticipate bullish reversals. However, the market’s overall cautious sentiment has prevented DOGE from breaching the crucial $0.28 resistance level.

If DOGE successfully breaks above this resistance and closes a daily candle above $0.28, historical price patterns suggest a potential 35% rally, bringing it closer to $0.39. Additionally, DOGE remains above the 200 Exponential Moving Average (EMA) on both daily and weekly time frames, reinforcing its long-term uptrend.

Also Read: XRP & Dogecoin ETFs Under SEC Review: Who Will Secure Approval First?

While short-term price action remains bearish, the combination of on-chain accumulation, trader sentiment, and key technical levels suggests that DOGE could be gearing up for a breakout. A close above $0.28 could trigger a strong upward movement, making DOGE a cryptocurrency to watch amid ongoing market fluctuations.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!