|

Getting your Trinity Audio player ready...

|

Ethereum (ETH) has lost more than half of its post-election gains, caught in a high-stakes tug-of-war that could determine its future price trajectory. While Bitcoin (BTC) remains in a consolidation phase, preventing a significant breakout, altcoins—Ethereum included—are struggling. In the past week, 70% of the top 10 high-cap cryptocurrencies have experienced double-digit losses, underscoring the tough landscape for investors.

Ethereum, down by 12% over the week, is facing pressure not only from a broader market downturn but also from strong U.S. economic data. The ETH/BTC pair has reached daily lows, highlighting the struggles ETH faces in regaining momentum. As the broader market recovery seems tied to ETH’s potential rebound, the stakes are higher than ever.

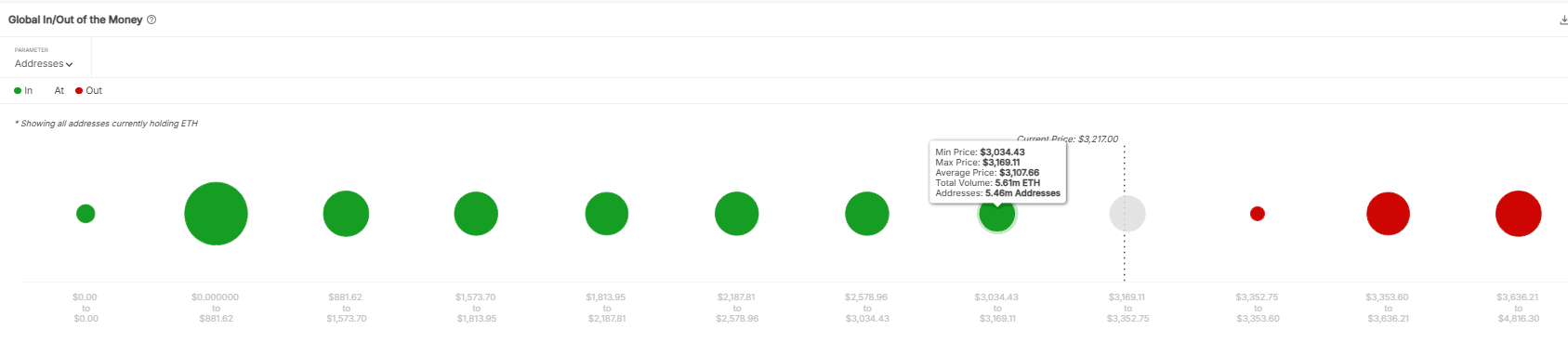

A notable development has been the movement of Ethereum whales. Recently, a large sale of 10,070 ETH at $3,280 locked in a $1M loss, pushing the token down to $3,227. Should this capitulation continue, ETH may dip to $3,169, a key price point where 5.46 million addresses, holding 5.61 million ETH, were acquired. The behavior of these HODLers will be pivotal in determining Ethereum’s next move—whether they will hold through potential market recovery or sell before further losses.

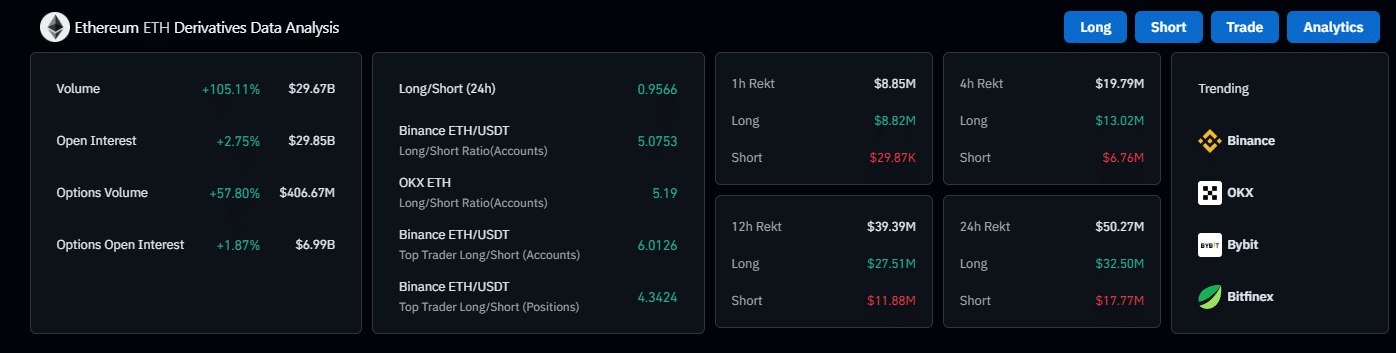

Currently, ETH is 33% above its post-election levels, a historically significant support level. Futures markets are buzzing, with derivative volumes surging by 105% and Open Interest (OI) climbing by 2%. However, investor confidence remains a key concern. Unlike the Q4 rally driven by Trump’s election, which sent Ethereum soaring to $4K, a similar catalyst may not be enough to spark a strong recovery this time.

In conclusion, caution is warranted. Ethereum’s path forward is intricately tied to the broader market recovery, and despite the allure of a potential ‘Trump pump,’ it is crucial not to let hype overshadow the reality of a volatile market.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Ethereum’s Crucial Support at $2,809: Will ETH Rebound or Face Deeper Losses?

Crypto and blockchain enthusiast.