|

Getting your Trinity Audio player ready...

|

Avalanche (AVAX), a blockchain platform known for its lightning-fast transactions, is experiencing a significant price correction. As of press time, AVAX was valued at $36.72 against USDT, with market indicators showing signs of a bearish trend.

Resistance Levels and Technical Indicators Point to Decline

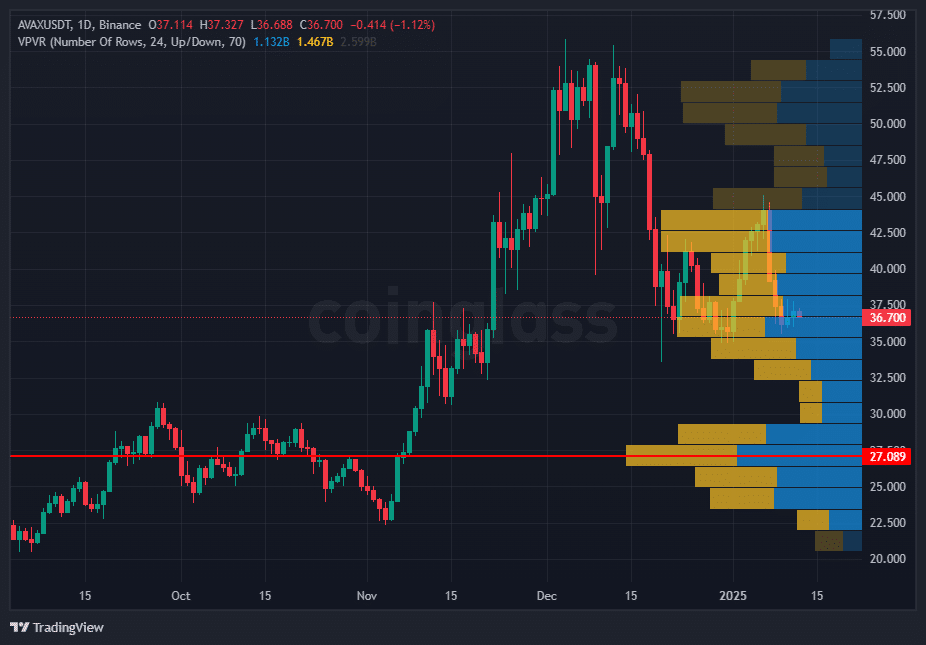

A closer analysis reveals substantial resistance between the $40 and $42 levels, as indicated by the Volume Profile Visible Range (VPVR). This area reflects high trading volume, where numerous buy and sell orders were executed, and despite efforts to break through during December’s rally, AVAX faced repeated rejections. This rejection has reinforced the bearish sentiment surrounding the altcoin.

On the downside, VPVR highlights a key support level around $27. This region, formed during an earlier accumulation phase, could attract buying interest. However, if this support is breached, AVAX may target the $25 range, further intensifying the bearish outlook.

Market Participation Declines Amid Bearish Sentiment

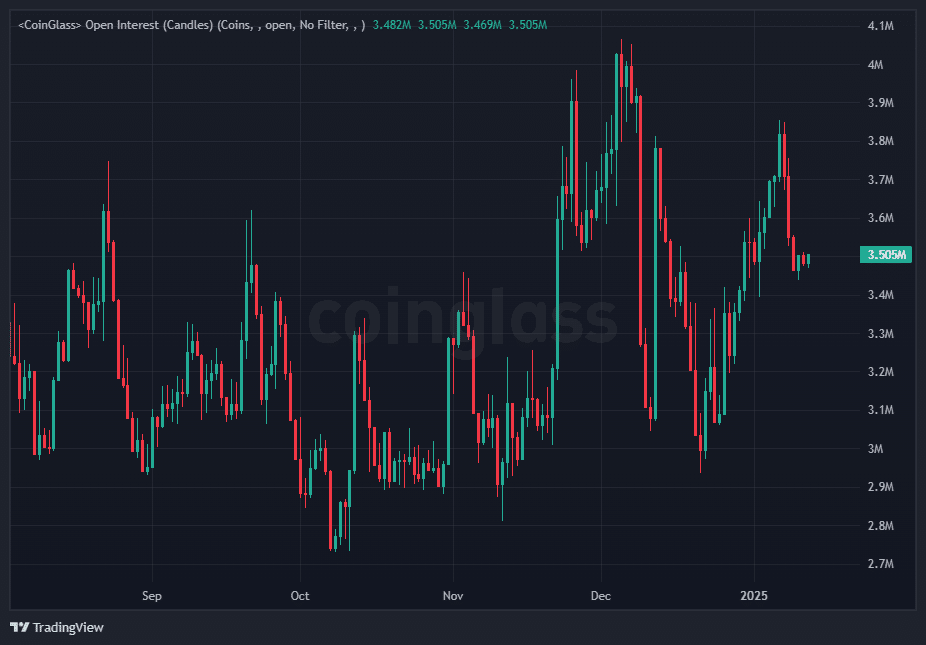

The recent decrease in Open Interest (OI) aligns with the price drop, signaling reduced speculative interest. This decline suggests that traders may be exiting positions, reflecting waning confidence in AVAX’s short-term recovery. If OI continues to fall, alongside price testing lower support levels, the bearish momentum will likely persist.

RSI Analysis: Oversold or Further Decline?

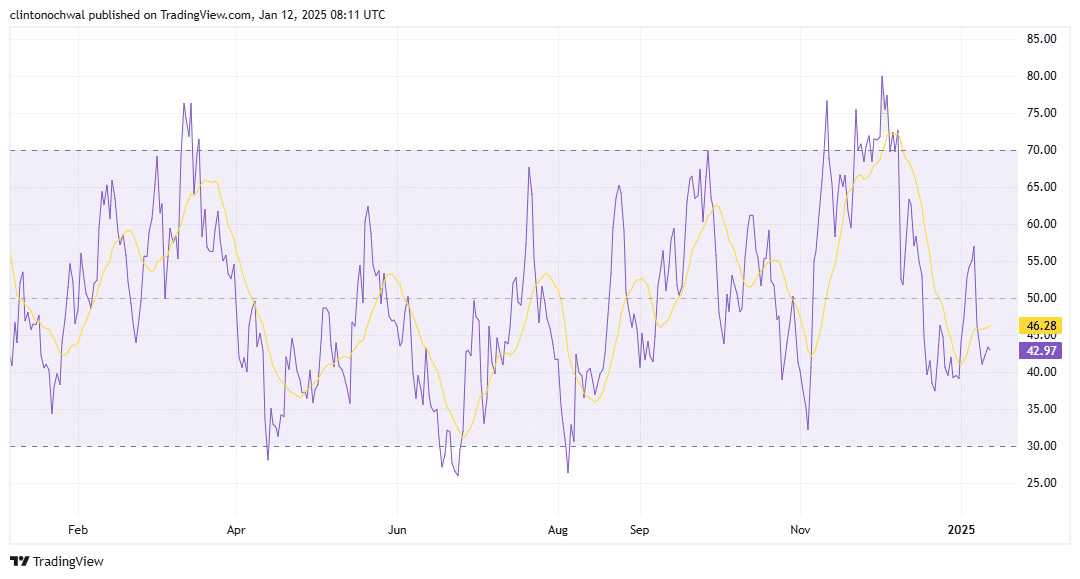

AVAX’s Relative Strength Index (RSI) is currently hovering around 35, indicating weakening buying pressure and confirming the downtrend. With the RSI nearing the oversold threshold of 30, some traders might view this as a potential opportunity for a short-term bounce. However, the lack of strong bullish catalysts suggests that upside potential remains limited in the immediate term.

Short Positions Surge, Bearish Sentiment Dominates

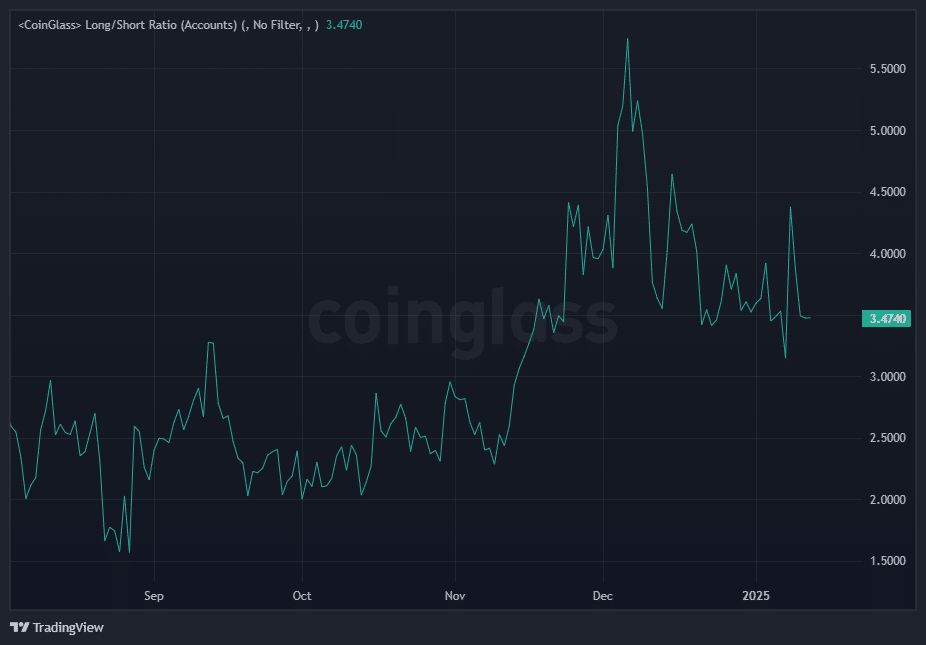

Recent data indicates a rise in short positions relative to long positions, further pointing to bearish sentiment. This growing short interest, combined with rejections at the $40-$42 resistance zone, strengthens the prevailing market bias.

In conclusion, for AVAX to shift its momentum, it would need to break through resistance levels and see a sustained increase in both price and OI. Until then, bearish forces are likely to dominate, with key support levels like $27 remaining crucial in the near-term outlook.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Avalanche9000 Launches on Mainnet: A Game-Changing Upgrade for Blockchain Developers

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!