The cryptocurrency market is showing signs of recovery, but Ethena (ENA) struggles to sustain its bullish momentum. Despite recent optimism, ENA has failed to break out of the range seen in December, leading to an intensified pullback. Traders and investors are now left wondering: will the price dip below the psychological $1 mark, or is a bullish continuation on the horizon?

Ethena Price Action and Technical Analysis

Examining the 4-hour chart, Ethena’s price action reveals a minor pullback, creating a falling wedge pattern as ENA drops to the $1.15 level. This downturn follows a 7.19% drop last night, followed by an additional 1.62% intraday pullback, signaling increased selling pressure. The pullback marks the end of a strong 5-day bullish streak that saw Ethena surge nearly 40% last week.

However, this pullback could be temporary, with the possibility of the bullish trend resuming. For now, ENA remains within the $1.3291 range, which aligns with December’s price movement. The price has been showing signs of lower price rejections, hinting at a potential reversal. Key resistance lies at the $1.20 level, near the 78.60% Fibonacci retracement, making it a critical area for potential price action.

A breakout above this level could trigger an uptrend, with price targets extending to the psychological $1.50 mark and potentially $1.75, surpassing the current all-time high.

Whale Activity and Institutional Offloading

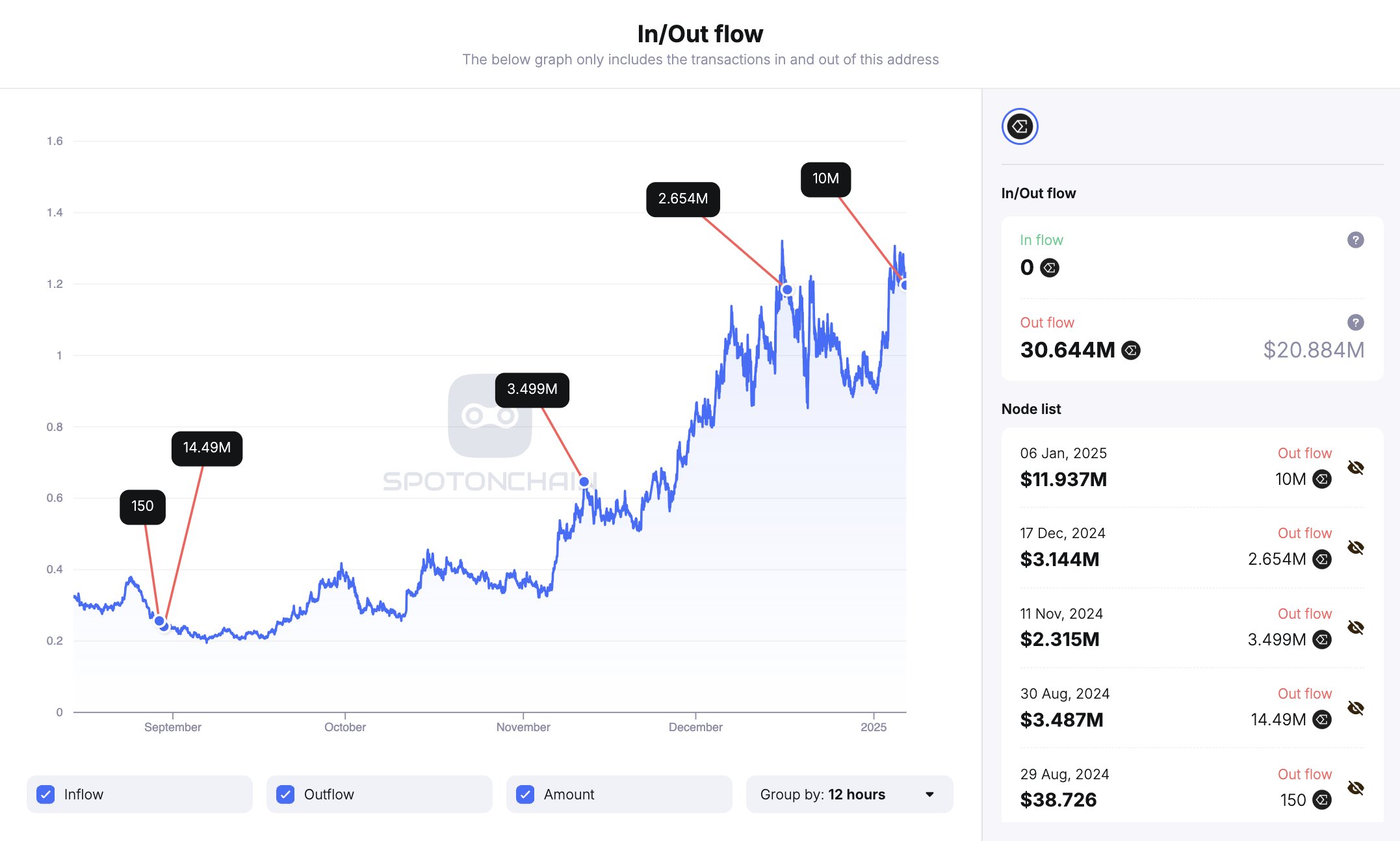

Despite some bullish indicators, Ethena faces a decline in institutional support. Over the past 24 hours, major players like whales and institutions have been offloading ENA tokens. A multi-signature wallet deposited 10 million ENA tokens worth $11.9 million on Bybit, while Galaxy Digital moved 6.38 million ENA tokens on Binance. These movements suggest waning confidence from larger investors.

Support Levels and Future Outlook

On the bearish side, Ethena faces strong support near the $1 psychological mark, which aligns with the 38.20% Fibonacci level and the 200 EMA line. If the market remains bullish, the likelihood of ENA breaking below $1 appears low. However, continued selling pressure and offloading could force a deeper correction.

Also Read: Ethena Reveals 2025 Roadmap: Telegram Payments App, TradFi Adoption, and New Stablecoin Innovations

The coming days will be crucial for Ethena, as its ability to reclaim bullish momentum or break down below $1 will determine its short-term price direction.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.