|

Getting your Trinity Audio player ready...

|

AAVE, the governance token of the decentralized finance (DeFi) lending protocol Aave, has surged 12% in the past 24 hours, fueled by discussions to integrate Chainlink’s Smart Value Recapture (SVR). This development has energized the AAVE community, driving both price and trading activity higher.

Aave Eyes Chainlink’s SVR for Fair MEV Distribution

On December 23, Chainlink unveiled its Smart Value Recapture (SVR) oracle, designed to redistribute profits from Maximum Extractable Value (MEV) across DeFi ecosystems. MEV refers to the additional value extractable by liquidators and searchers during blockchain transactions, particularly in liquidation events.

Aave’s governance forum quickly picked up on this innovation. A community member proposed integrating Chainlink’s SVR to address the imbalance in liquidation profits, ensuring fairer distribution among all participants, including protocol users.

This proposal has sparked excitement among AAVE investors, with the token’s price climbing to $369.10 and inching closer to its three-year high of $399.85.

Also Read: AAVE Price Consolidates Near $400, Can It Break $460 and Reach New All-Time Highs?

Technical Indicators Show Growing Market Confidence

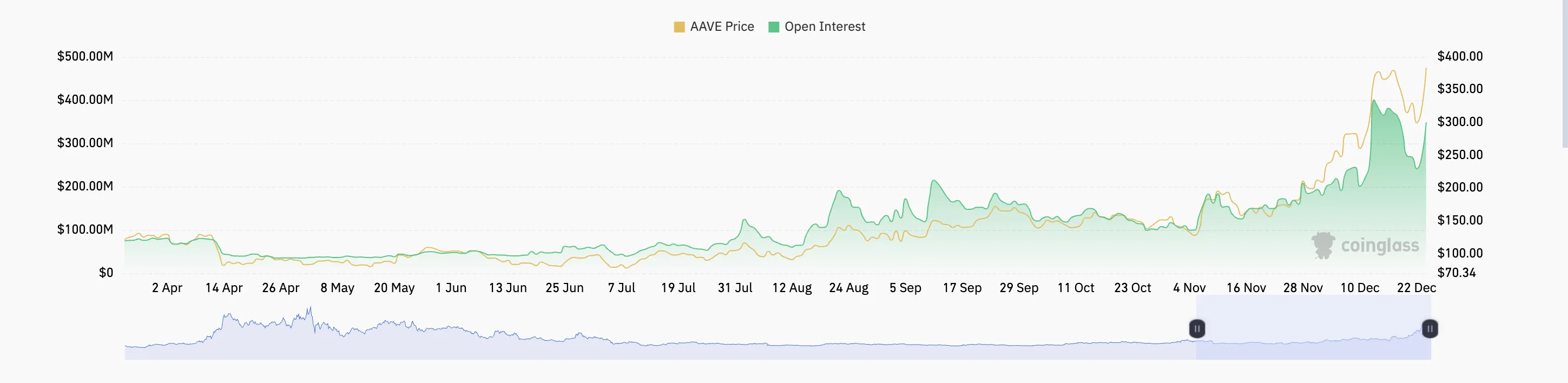

The surge in AAVE’s open interest—now at $376 million, a 32% increase—indicates heightened trading activity and market confidence. Open interest reflects the number of outstanding contracts in derivatives markets. Its growth alongside AAVE’s price rally suggests traders are taking bullish positions, expecting continued upward momentum.

On the daily chart, AAVE’s Relative Strength Index (RSI) has risen to 62.88, signaling strong buying activity. The uptrend in RSI confirms that demand for AAVE is outpacing supply, adding weight to the bullish sentiment.

AAVE Price Prediction: $400 Breakout on the Horizon?

Currently trading below its critical resistance level of $399.85, AAVE is well-positioned for a potential breakout. If buying pressure persists, the token could surpass $400, establishing a new support level and marking its first return to this price since 2021.

However, caution is warranted. Any significant selloff could invalidate this bullish outlook, pushing AAVE back to its next support at $323.46.

With strong market indicators and community optimism, AAVE’s trajectory remains one to watch closely.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!