|

Getting your Trinity Audio player ready...

|

Dogwifhat (WIF), the memecoin known for its playful branding, took the crypto world by storm a month ago with a meteoric 30% surge in a single day. This massive upswing brought WIF tantalizingly close to shattering its all-time high, only to be met with a brutal correction that sent it crashing back to $2.90. This dramatic reversal highlights the inherent volatility of memecoins and leaves investors wondering: is this the end of the WIF rally, or is a comeback brewing?

A Long Squeeze Thwarts WIF’s All-Time High Dreams

The saying “timing is everything” rings true in the cryptocurrency space, and WIF bears capitalized on this principle perfectly. After WIF’s impressive surge, the Relative Strength Index (RSI) reached overbought territory, indicating potential market overenthusiasm. Interestingly, this coincided with Bitcoin’s (BTC) first close above $90,000 during the “Trump pump,” further fueling investor panic.

The result? While Bitcoin dipped by a modest 3% the following day, WIF took a punishing fourfold hit in comparison. Since then, WIF bulls have attempted numerous rebounds, but the $3.80 resistance level has proven to be an insurmountable wall.

What’s Holding WIF Back?

Two key factors are at play. Firstly, the broader market volatility is dragging memecoins like WIF down as investors chase the allure of “quick money” elsewhere. Secondly, large investors (whales) are cashing out, capitalizing on the Fear of Missing Out (FOMO) before the market takes a turn for the worse. These combined forces are capping WIF’s price potential.

A Turning Point on the Horizon?

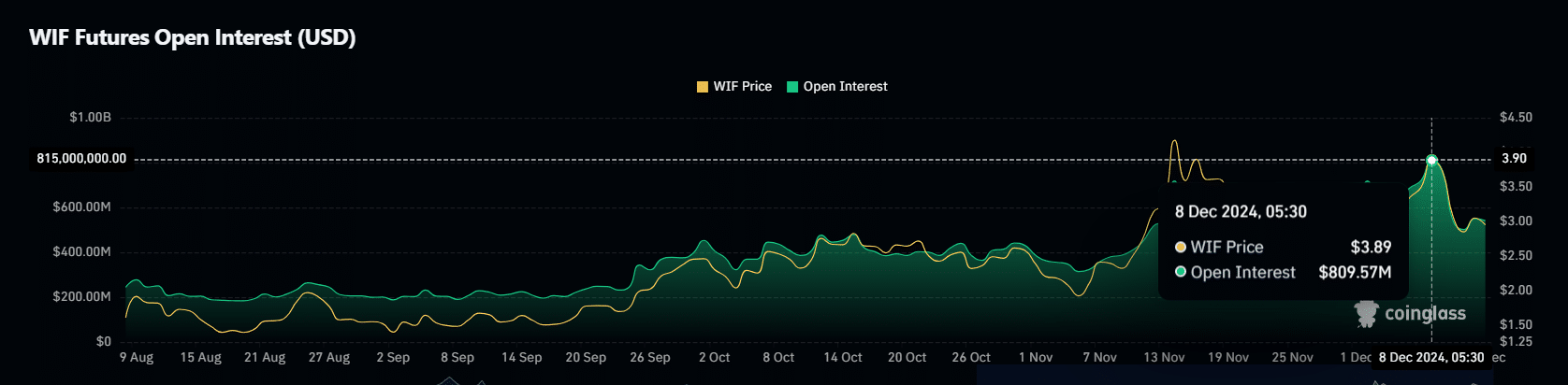

Every time WIF approaches the $3.80 resistance point, a significant number of long positions are liquidated, forcing investors to sell their holdings and further suppressing the price. This is evident in the sharp drop in Open Interest (OI), which has shrunk from nearly $1 billion at $3.80 to $541 million at the time of writing.

However, there’s a flicker of hope for WIF bulls. The RSI has cooled down, suggesting the market is no longer overheated. Retail investors (spot traders) are stepping in to buy the dip, and short-sellers are starting to become overexposed. This could be the setup for a potential comeback, but with a caveat: big players need to return.

When whales accumulate WIF, it attracts both spot and futures traders looking to capitalize on the discounted price. However, if buying momentum picks up and spot traders manage to push the price higher, the overleveraged short positions will be squeezed out, potentially triggering a chain reaction that propels WIF towards a significant rise.

Also Read: Dogwifhat ( WIF) Whale Dumps $3M Worth of Tokens to Coinbase , What’s Next for WIF Price?

So, the key to WIF’s future lies in the hands of the whales. If they re-enter the accumulation space, it could spark another major upswing. For investors, closely monitoring buying pressure from whales, spot traders, and the movement of key resistance levels like $3.80 will be crucial in the coming days.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Crypto and blockchain enthusiast.