|

Getting your Trinity Audio player ready...

|

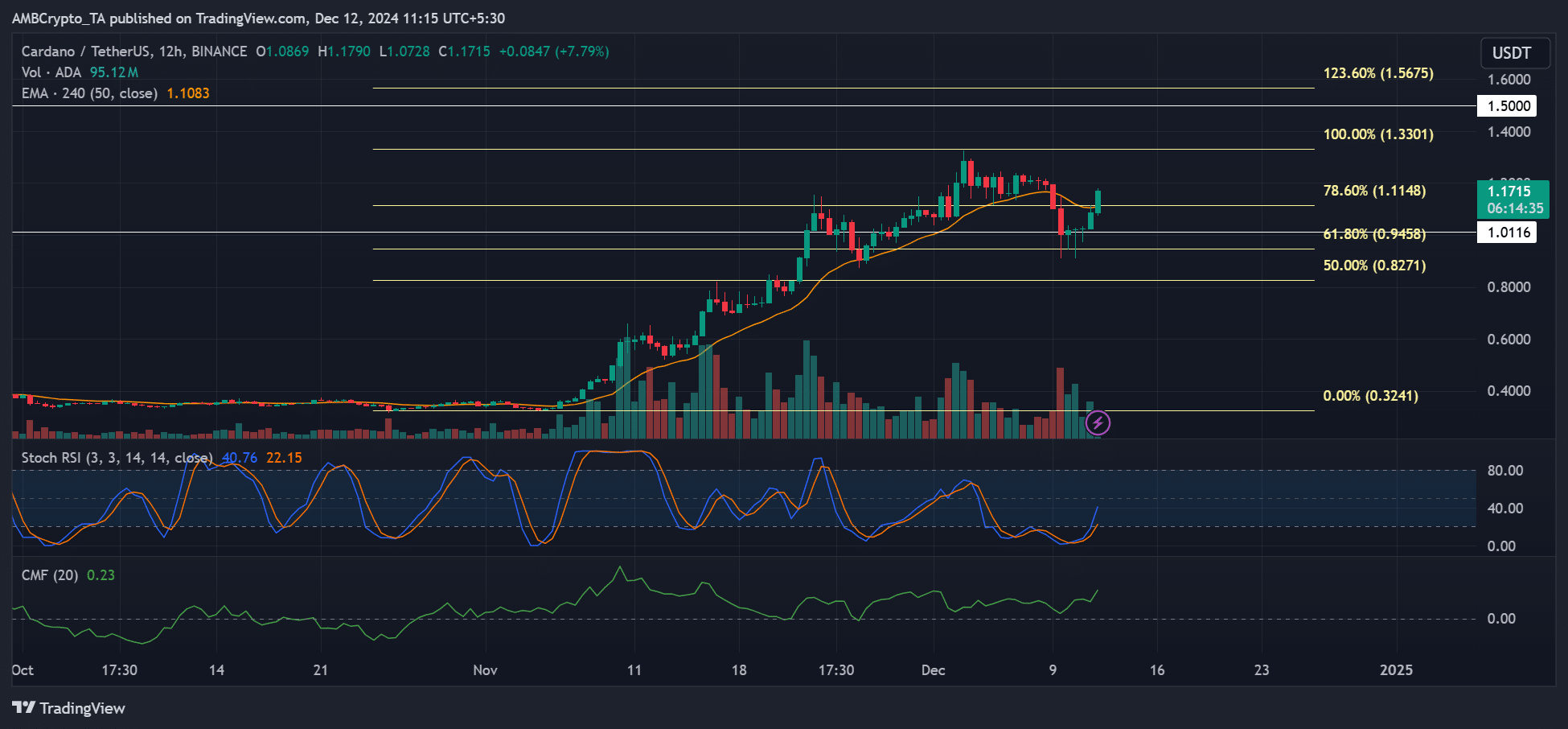

Altcoins staged a robust recovery this week as Bitcoin’s [BTC] dominance (BTC.D) slipped from 57.8% to 56%, creating room for capital inflows into other cryptocurrencies. Among them, Cardano [ADA] emerged as a standout performer, rallying nearly 30% after rebounding from a week of market turbulence.

ADA’s Resilient Rebound

Cardano’s resurgence saw its price reclaim the 4-hour 50-EMA (Exponential Moving Average), signaling a short-term bullish trend. This strong recovery highlights ADA’s ability to defend the critical $1 support level, a pattern reminiscent of its 2021 performance.

During that period, ADA fluctuated between $1 and $1.5 for weeks before surging toward its all-time high of $3. If history repeats itself, the $1.5 target could soon be within reach. However, immediate resistance at $1.24, a level packed with leveraged short positions, could pose a challenge. A decisive move through this zone might pave the way for further gains.

Key Levels to Watch

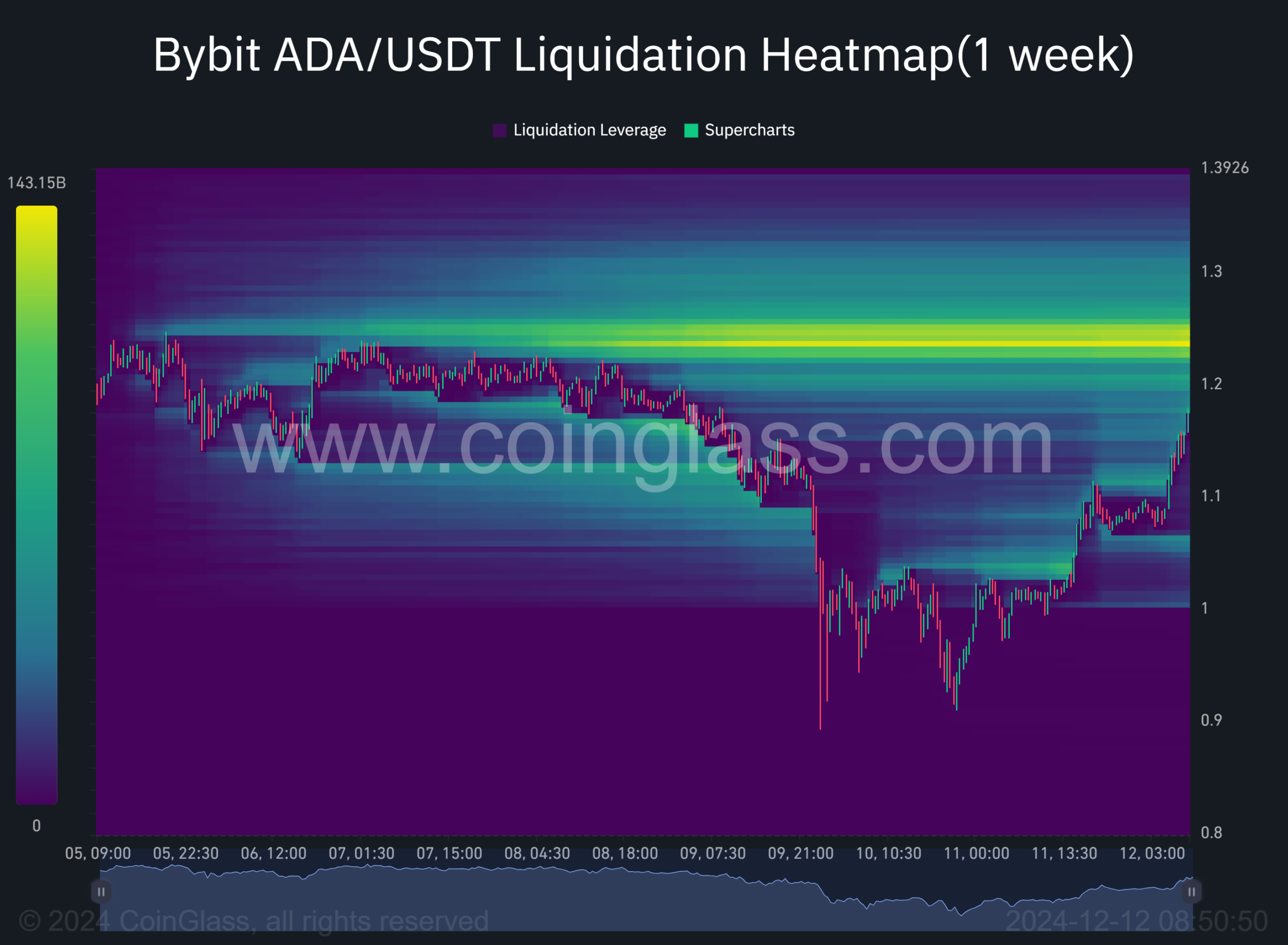

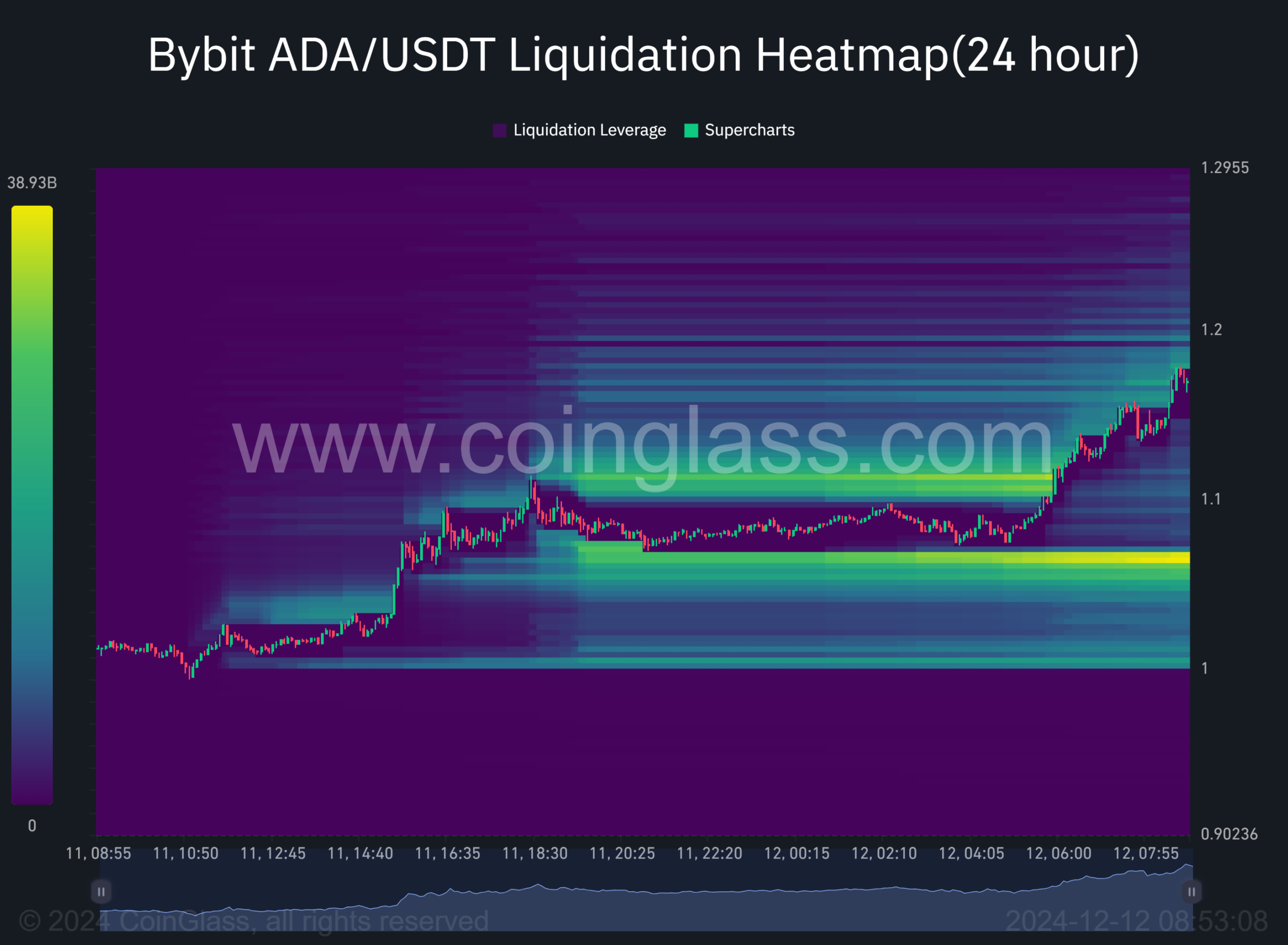

Cardano’s liquidation heatmap on the Bybit exchange reveals significant liquidity at critical levels. Over $143 billion in leveraged short positions are concentrated between $1.23 and $1.25, creating a potential magnet for price action. On the flip side, leveraged long positions worth over $40 billion are stacked at the $1.0 support level.

This dual liquidity dynamic positions $1.0 as a strong support zone and $1.25 as a critical resistance level. If ADA can sustain its upward momentum and breach the $1.25 threshold, the next targets could be $1.3 and $1.5. However, failure to overcome resistance might prompt a retracement to $1.0, aligning with liquidity trends.

Bullish Prospects or Temporary Rally?

The broader market sentiment will play a crucial role in ADA’s trajectory. A potential short squeeze above $1.3 could trigger a rally to $1.5, reinforcing Cardano’s bullish outlook. Conversely, any significant Bitcoin recovery might dampen altcoin momentum, leading to another consolidation phase for ADA.

With Bitcoin dominance easing and altcoins gaining ground, ADA’s short-term outlook appears promising. However, traders should remain cautious, as the $1.25 resistance level could determine the strength of the rally. A break above this zone would validate the bullish momentum and open the door for a test of $1.5, a level that holds historical significance for Cardano.

Also Read: Cardano (ADA) Price Analysis: Two Potential Paths to $1.72 or a Larger Correction

For now, ADA’s ability to maintain its position above $1 while targeting $1.25 and beyond showcases its resilience in a volatile market. Whether this marks the beginning of a sustained rally or a temporary uptick remains to be seen.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.