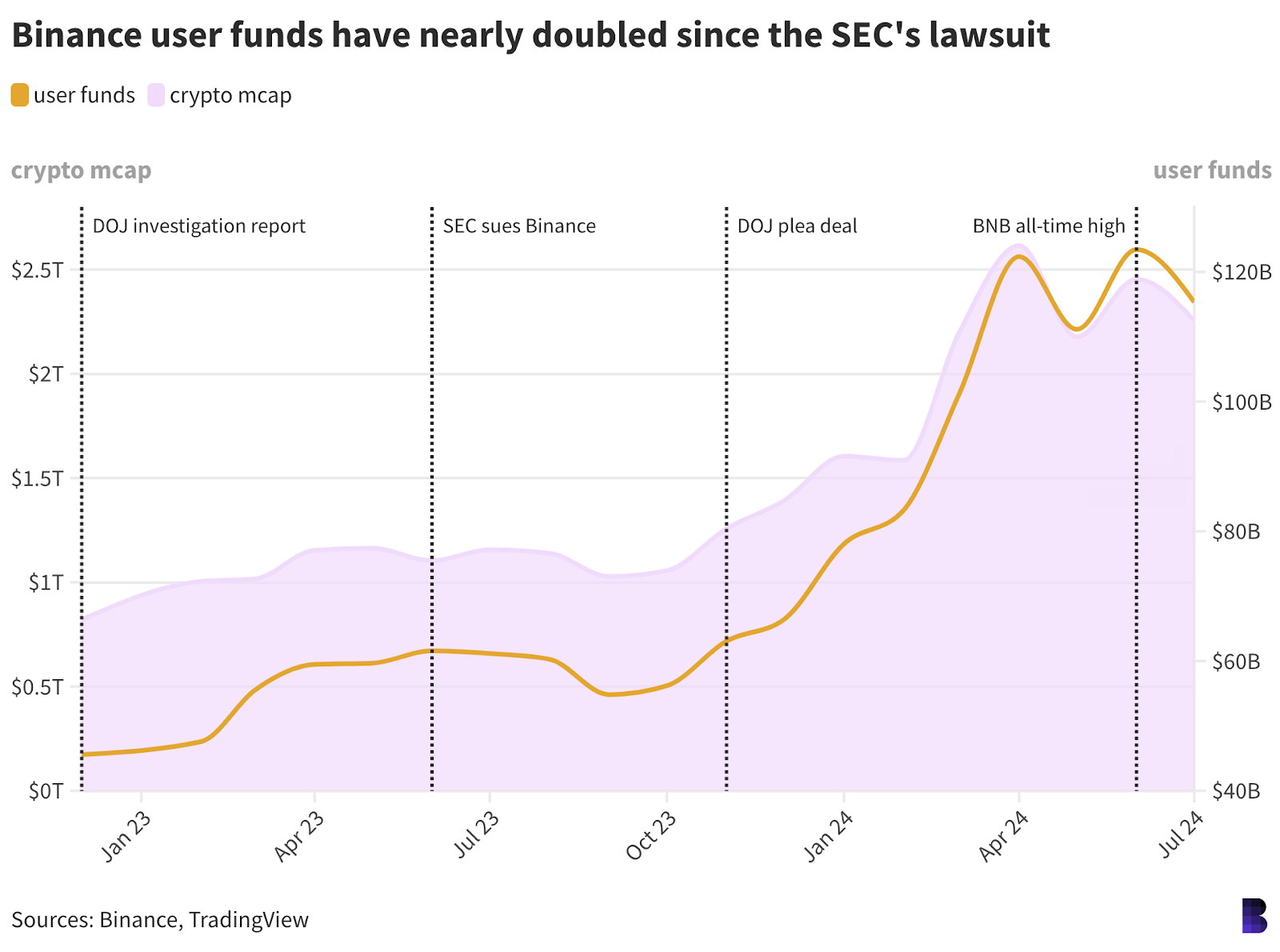

Despite facing investigations from the US Department of Justice (DOJ) and Securities and Exchange Commission (SEC) in late 2022, Binance, the world’s largest cryptocurrency exchange, has seen a surprising surge in user funds.

Funds Up 150% Since Probe Began

A comparison of Binance’s monthly proof-of- reserves reports reveals a staggering 150% increase in user holdings. In July 2023, at the height of the investigations, the exchange reported $61 billion. Fast forward to July 2024, that number has ballooned to a whopping $115 billion. This growth coincides with the DOJ investigation and the SEC’s probe into Paxos, the issuer of Binance’s branded stablecoin BUSD.

BUSD Loses Luster, But Other Assets Gain Traction

The SEC’s investigation into Paxos significantly impacted BUSD, once the seventh-largest cryptocurrency. After the SEC issued a Wells notice in February 2023, Paxos halted the minting of new tokens, leading to a mass redemption that halved its supply. While the dollar value of user deposits naturally rises with crypto prices, the sustained growth in user funds suggests a lack of significant user exodus.

Interestingly, the decline of BUSD seems to have been offset by a rise in other stablecoins like USDT and USDC, both headquartered outside the US. This shift indicates a preference for non-US dollar-pegged assets.

Bitcoin and BNB See Increased User Appetite

The composition of user holdings on Binance has also shifted. Bitcoin, which made up 18% of user funds in December 2022, now accounts for over a third. Similarly, Binance’s native token BNB has grown from 14% to 20%. Conversely, Ethereum (ETH) has remained relatively stagnant, possibly due to its lackluster price performance compared to Bitcoin and BNB.

Confidence or Crypto Mania?

The data paints a fascinating picture. Despite facing regulatory scrutiny, Binance has witnessed a surge in user funds and a shift towards non-dollar-pegged assets. This could be interpreted as a show of confidence in Binance or a broader trend within the crypto market. Notably, only 20% of user funds are currently held in stablecoins, down from over 50% before the investigations began. This suggests a strong preference for cryptocurrencies themselves.

Further analysis of user holdings reveals a growing interest in specific tokens like Curve DAO (CRV), Arbitrum, Aptos, and Optimism. These tokens have seen significant increases in user holdings, exceeding 70% in some cases. Conversely, meme coins like Shiba Inu (SHIB) have experienced a decline.

Looking Ahead: Cold Storage or Crypto Bull Run?

While the data suggests user confidence in Binance, it’s important to consider alternative explanations. The decline in CHZ and SHIB holdings could simply indicate users transferring them to long-term cold storage.

Overall, the data from Binance paints a complex picture. While user funds have grown significantly despite regulatory pressure, it remains unclear whether this signifies unwavering confidence in the exchange or a broader crypto market sentiment. Only time will tell if this is a genuine show of faith or a prelude to a future correction.

Also Read: Ex-Binance CEO CZ Owns 64% of BNB (Conflict of Interest? $61 Billion at Stake!)

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.