|

Getting your Trinity Audio player ready...

|

- Crypto ETPs gained $716M, marking a second week of institutional inflows.

- Chainlink ETPs saw record weekly inflows, equal to 54% of AUM.

- Analysts say Bitcoin’s pullback is a healthy reset, not the start of a bear market.

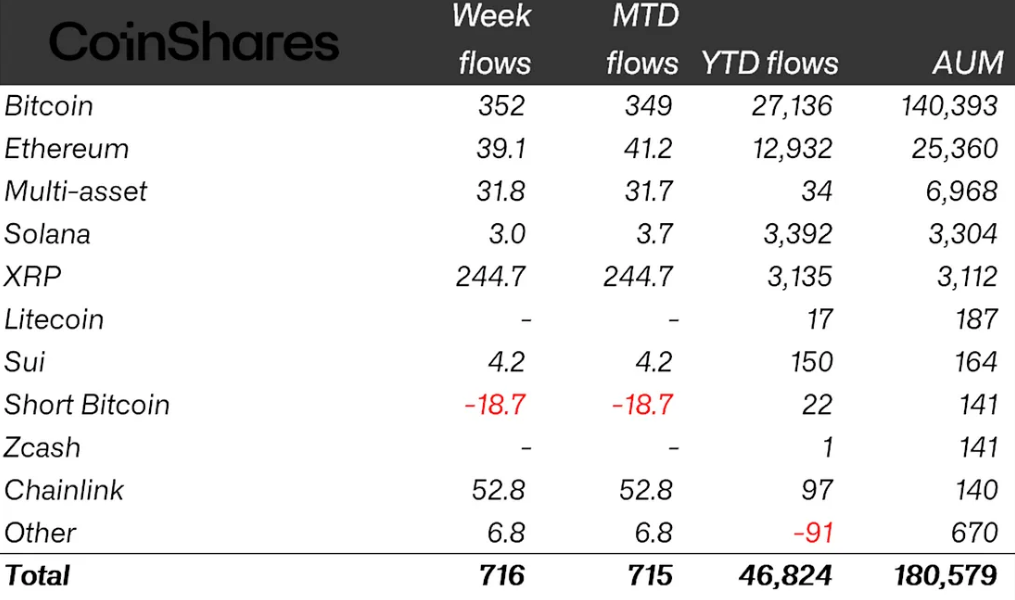

Global crypto investment products staged a decisive rebound last week, absorbing $716 million in inflows as institutional capital returned to the market after a month-long correction. Bitcoin led the resurgence while Chainlink posted its strongest weekly inflow on record, reinforcing renewed risk appetite across digital asset markets despite lingering macroeconomic uncertainty.

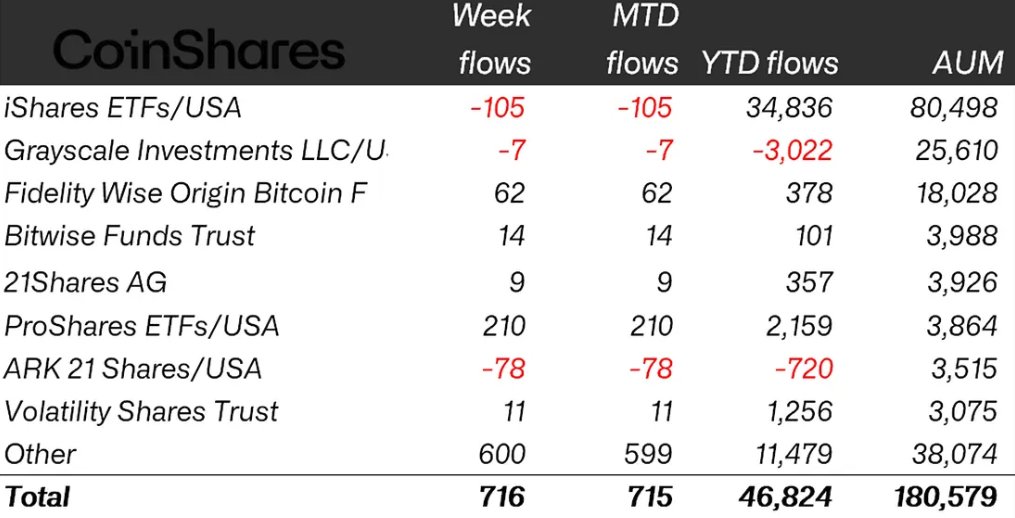

The data, published Monday by European asset manager CoinShares, marks the second consecutive positive week for exchange-traded crypto products (ETPs), following the prior week’s $1 billion haul. The momentum has lifted total assets under management (AUM) back above $180 billion, an 8% recovery from November lows, though still well below the $264 billion peak set earlier this year.

Inflows Resume as Inflation Concerns Ease

CoinShares’ head of research James Butterfill noted that minor outflows late in the week were likely driven by U.S. inflation signals, but emphasized that broader investor positioning has turned constructive. After four weeks of $5.5 billion in cumulative outflows, institutions appear to be rotating back into crypto exposure as year-end positioning stabilizes.

Bitcoin once again dominated overall flows, attracting $352 million last week. XRP followed with $244 million, reinforcing the trend of multi-asset inflows rather than narrow BTC-led cycles. Ether saw more modest demand at $39 million, while short-Bitcoin products shed $19 million, suggesting a softening of bearish sentiment.

But the standout performer was Chainlink (LINK). The oracle protocol’s ETPs recorded $52.8 million in inflows, equivalent to 54% of its total AUM, the largest proportional increase of any major altcoin product. The surge reflects a wave of institutional interest in real-world asset tokenization and data-driven infrastructure—segments in which Chainlink has been increasingly active.

ProShares Leads Inflows While BlackRock Sees Withdrawals

The weekly flow breakdown revealed a rare divergence among issuers. ProShares topped the leaderboard with $210 million in inflows, benefiting from sustained volume in its high-liquidity ETP suite. Meanwhile, BlackRock, the industry’s largest issuer by AUM, posted $105 million in outflows, its largest weekly decline in months.

ARK Invest and Grayscale also saw outflows of $78 million and $7 million, respectively—an indication that investors may be rotating away from legacy products toward more fee-efficient or derivatives-linked structures.

Regionally, inflows were widespread, led by the United States ($483M), Germany ($97M) and Canada ($80.7M). The geographic spread supports the view that the recent downturn was driven less by broad risk aversion and more by localized U.S. positioning, including tax-loss harvesting, December rebalancing, and derivatives exposure.

Analysts: Bitcoin Pullback Is a ‘Cool-Off,’ Not a Trend Reversal

While institutional inflows recover, Bitcoin’s spot market continues to trade near $89,000, down from its recent highs. Analysts argue the decline reflects a cycle-normal cooling phase, not the beginning of a broader bear market.

Bloomberg ETF analyst Eric Balchunas dismissed comparisons to historical bubbles, noting that Bitcoin rose 122% last year, and that its recent retreat merely unwinds “excess heat” built during parabolic phases.]

Balchunas added that Bitcoin’s 17-year survival through multiple crises, from exchange failures to regulatory crackdowns, distinguishes it from speculative manias such as the tulip bubble. He emphasized that non-productive assets—from gold to fine art—retain long-term value through scarcity and investor confidence, conditions Bitcoin continues to meet.

US-Driven Selling Shows Signs of Exhaustion

On-chain data from CryptoQuant indicates the early-December decline was largely U.S.-driven. The Coinbase Premium Index, which tracks price differences between Coinbase and global exchanges, briefly turned negative as selling accelerated. Historically, such dips correspond with tax-driven rotations or liquidity squeezes among U.S. institutions.

However, the premium flipped back to positive within days, signaling renewed domestic demand. CryptoQuant analysts say this rebound typically marks the fading of downside pressure.

Whether Bitcoin stabilizes or revisits recent lows will depend on U.S. liquidity conditions, derivatives behavior, and ongoing ETP flows, all of which currently show signs of normalization.

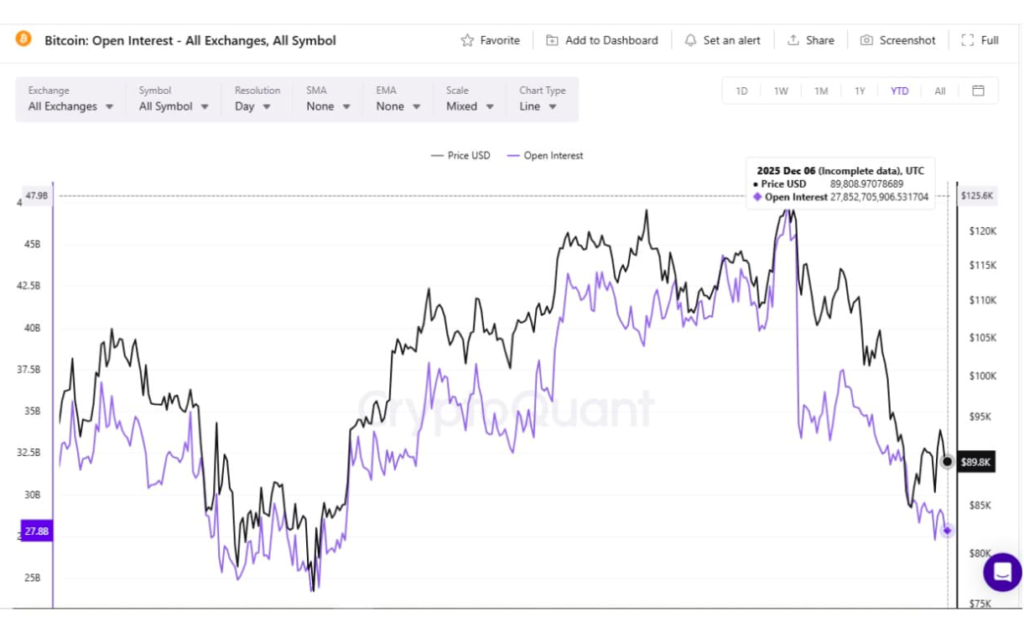

Open Interest Declines, Signaling Leverage Reset

Another supportive data point comes from derivatives markets. Analyst Carmelo Alemán highlighted a synchronized decline in both price and open interest (OI) across exchanges—an indication of futures unwinding rather than spot selling.

Sharp drops in OI are often associated with deleveraging phases that clear excess risk from the system. Alemán noted that rallies fueled by rising OI tend to be fragile, while OI reductions paired with resilient price levels often precede more sustainable upside.

A Market Reset, Not a Breakdown

The combination of renewed ETP inflows, stabilizing U.S. participation, and derivatives cooling points to a market in recalibration rather than retreat. While macro headwinds—particularly inflation and rate expectations—continue to sway sentiment, institutional capital appears increasingly willing to re-enter on pullbacks.

If current flow patterns continue into year-end, Bitcoin’s consolidation may set the foundation for the next leg of accumulation, supported by improving supply dynamics and rising global participation.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.