|

Getting your Trinity Audio player ready...

|

The cryptocurrency market has been on a wild ride lately, leaving investors wondering if the good times are over for Bitcoin and altcoins. Analysts are offering a mixed bag of predictions, with some anticipating a continuation of the bull run and others bracing for a downturn.

Bitcoin’s Price: A Crossroads?

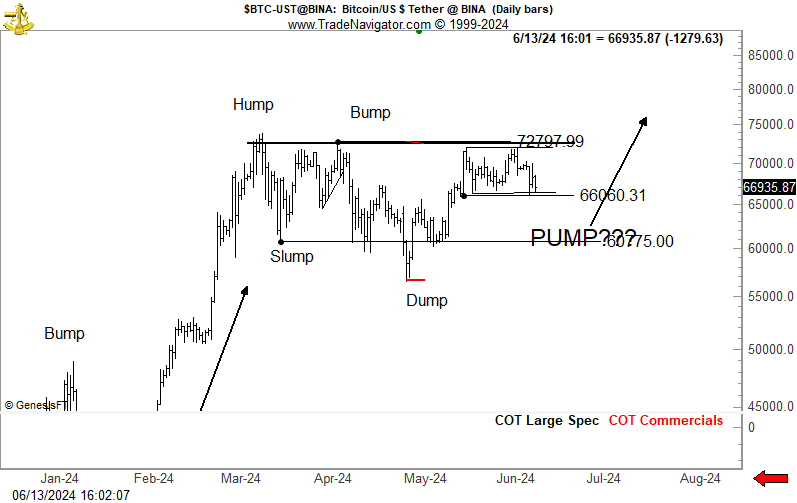

Bitcoin, the undisputed king of crypto, sits at a critical juncture. Murad Mahmudov, a prominent Bitcoin investor, outlines two potential scenarios. If the price holds above $60,000, the bull market might very well continue, adhering to its historical four-year cycle. However, a global recession triggered by macroeconomic factors could send Bitcoin plummeting to $30,000.

Julio Moreno, from CryptoQuant, echoes the significance of the $60,000 mark. This level represents the average price at which short-term Bitcoin holders bought in. A drop below this point could trigger an 8-12% correction, potentially dragging Bitcoin down to $60,000.

Veteran trader Peter Brandt injects a note of caution. A breach of the $60,000 support could lead to a steeper decline, potentially reaching $48,000. Market analyst Bob Loukas, on the other hand, suggests a period of consolidation similar to last summer, emphasizing the need for patience as the market finds its footing.

Altcoin Outlook: Sharing the Spotlight?

The fate of altcoins remains intertwined with Bitcoin’s trajectory. Andrew Kang, co-founder of Mechanism Capital, is unsure if the potential approval of a Bitcoin exchange-traded fund (ETF) will translate to similar excitement for altcoins like Ethereum. While Bitcoin might see a surge in interest, Ethereum ETFs might not enjoy the same tailwinds.

Fear Gauge: A Buying Opportunity in Disguise?

Analysts at Santiment, a blockchain analytics firm, highlight the current investor sentiment. With Bitcoin’s price dipping below $65,000, fear is palpable. However, this fear could create a temporary buying opportunity if panic selling subsides. As Santiment suggests, a surge in “selling” or “taking profit” mentions often follows price drops. This could pave the way for a temporary bounce, enticing investors back into the market.

Also Read: Michael Saylor’s MicroStrategy (MSTR) Doubles Down on Bitcoin, Ups Debt Offering to $700 Million

The Verdict: Buckle Up

The future of the bull market remains uncertain. Whether we see significant corrections, consolidation periods, or a continuation of the upward trend depends largely on external factors and investor behavior. As always, in the fast-paced world of crypto, one thing is for sure: buckle up, it’s going to be a bumpy ride.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!