|

Getting your Trinity Audio player ready...

|

Charles Hoskinson, co-founder of Cardano, has raised concerns about the potential centralization risks of Bitcoin becoming a US reserve asset.

The idea, recently floated by presidential candidate Robert F. Kennedy Jr., would see the US Treasury acquire 4 million Bitcoin, representing a staggering 19% of the total supply. While this massive purchase could significantly boost Bitcoin’s price, Hoskinson warns of the broader implications.

“It’s a mixed bag,” Hoskinson told Cointelegraph. “On one hand, it would be great for the price of Bitcoin, and it would be great for US regulation of Bitcoin because the United States would be pro-Bitcoin in a certain respect.”

However, the centralization risks are profound. Bitcoin’s decentralized nature is a cornerstone of its appeal, ensuring its security and resistance to manipulation. With the US holding nearly a fifth of the supply, this fundamental principle would be compromised.

“On the other hand, it also means that if things happen the US disagrees with, because it has a strategic interest in the asset, it may use its geopolitical power to change that,” Hoskinson cautioned. “So be careful who you welcome in, and be careful of the powers of those people.”

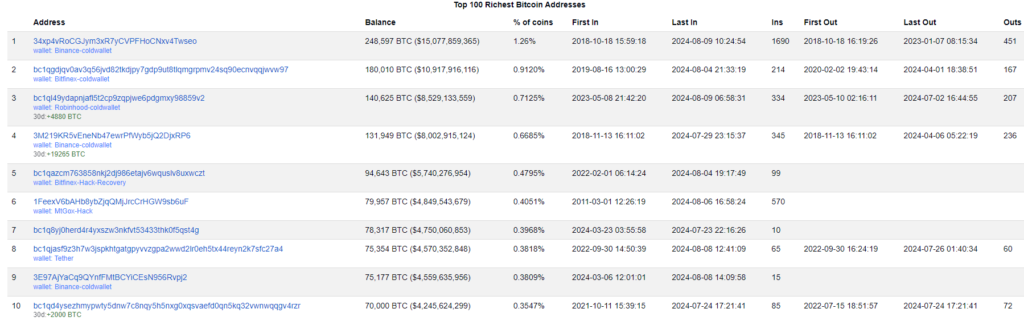

The implications of such a massive holding are unprecedented. While the largest individual Bitcoin wallet currently holds just 1.26% of the supply, belonging to Binance, the US government’s ownership would dwarf this by a significant margin.

Hoskinson drew parallels to traditional markets, noting that controlling a substantial portion of a commodity like oil is often associated with cartel-like behavior.

Beyond the Bitcoin debate, Hoskinson also weighed in on the burgeoning ETF market. He sees the recent wave of Bitcoin and Ethereum ETFs as a positive development, increasing accessibility to cryptocurrencies for a wider investor base. However, he anticipates a proliferation of ETFs, including for Cardano’s ADA token, as the market matures.

Also Read: Bitcoin ETFs Soar $192.56M in a Day: BlackRock, WisdomTree Lead the Charge

The cryptocurrency landscape is evolving rapidly, with both opportunities and challenges emerging. The potential for Bitcoin to become a US reserve asset highlights the complex interplay between decentralization, government influence, and market dynamics.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.