|

Getting your Trinity Audio player ready...

|

- Whale-to-exchange flow dropped 94%, easing downward pressure on XRP.

- HODL wave data shows growing mid-term conviction among new holders.

- XRP faces a critical breakout point at $3.59, with targets near $4.64 if momentum holds.

Fresh on-chain data reveals a surprising shift in XRP market dynamics. Despite fears of a major sell-off, key indicators now suggest that large investors and new holders alike may be gearing up for a potential breakout rather than bracing for a pullback.

The drop in whale-to-exchange transfers and the rise in mid-term HODLing signals renewed conviction among XRP holders—just as the asset nears critical resistance at $3.59.

Whale-to-Exchange Flow Drops 94%: Selling Pressure Eases

XRP whales appear to be pulling back from selling. On July 11, more than 43,575 XRP were transferred to exchanges, likely in preparation for liquidation. By July 21, that number had plunged to just 2,339 XRP—a staggering 94% decline.

This shift suggests that major holders are content to hold rather than sell, reducing sell-side pressure and allowing price consolidation. Historically, such slowdowns in whale activity have preceded strong bullish moves, particularly when supported by retail demand.

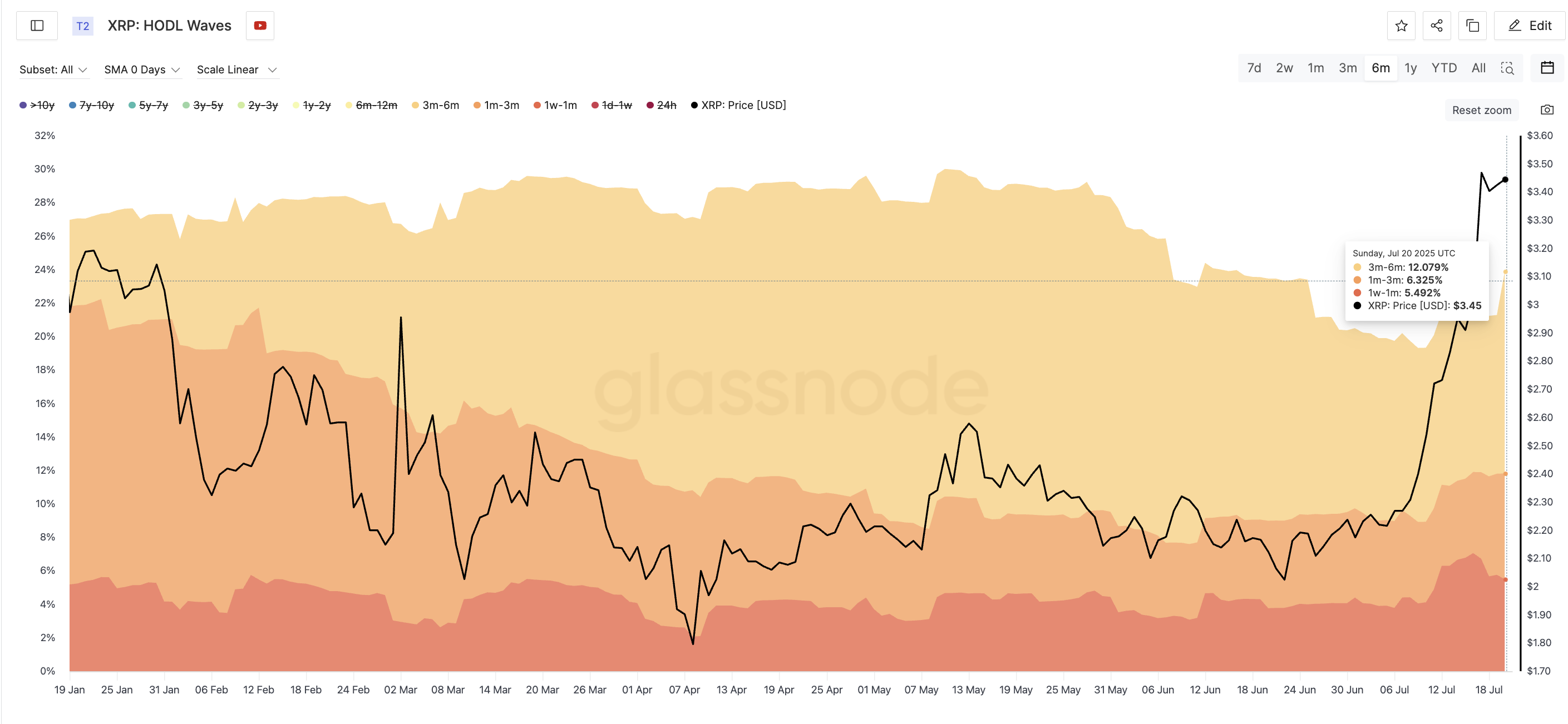

HODL Waves Reveal Growing Confidence Among New Investors

While whales are sitting tight, smaller investors are stepping in with conviction. Between July 10 and July 20, Glassnode’s HODL Wave data shows a notable increase in the coin held for 1 week to 6 months:

- 3–6 months: 10.4% → 12.08%

- 1–3 months: 4.8% → 6.3%

- 1 week–1 month: 4.1% → 5.4%

This uptick indicates that new buyers are not engaging in short-term speculation but are instead holding onto their tokens. This growing base of steady holders can act as a buffer against price volatility and support upward momentum.

XRP Eyes Breakout Above Key $3.59 Resistance

Technically, XRP remains locked below a critical resistance zone near $3.59, a level that previously halted bullish attempts. If the coin manages to close above this ceiling, analysts point to $4.64 as the next potential target—aligned with the 2.618 Fibonacci extension from the April–June move.

Still, caution remains warranted. XRP must stay above the $2.95 support to maintain its bullish trajectory. If that level fails, eyes turn to $3.13 as the next defensive line before any bullish invalidation.

With whales pausing their selling and newer investors showing stronger hands, XRP seems to be in a consolidation phase with bullish potential. Price action remains tethered to key resistance and support levels, but sentiment is leaning toward a breakout rather than a breakdown.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses

Also Read: XRP Eyes New ATH as Whale Accumulation and On-Chain Metrics Strengthen Bullish Case

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!