|

Getting your Trinity Audio player ready...

|

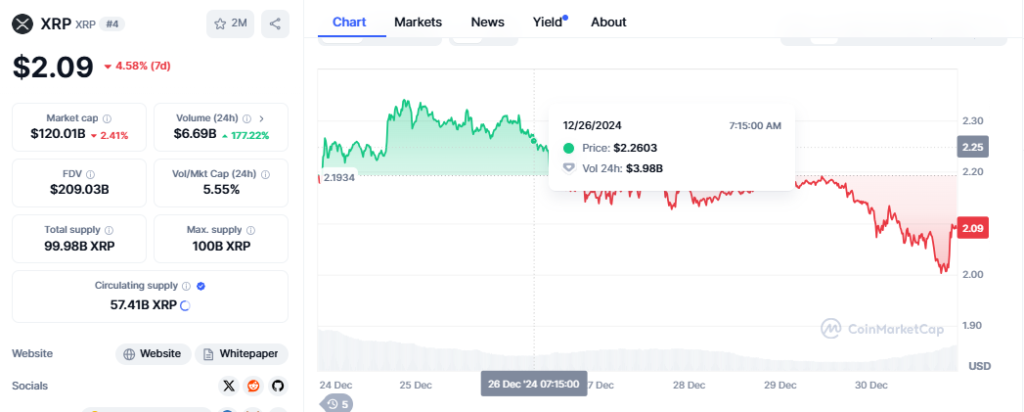

XRP has been stuck under a critical resistance level at $2.73 for over a month, frustrating investors and stalling its upward momentum. This prolonged consolidation has dented traders’ confidence, leading to reduced participation and market withdrawals.

In the past 24 hours, Open Interest in XRP Futures experienced a dramatic decline, shedding $1 billion from its peak of $2.9 billion. This sharp drop reflects bearish sentiment and growing doubts about XRP’s ability to overcome its resistance. The lack of significant price movement has only amplified uncertainty, with many investors fearing further declines.

Adding to the challenges, XRP’s macro momentum indicators signal weakness. The Price DAA Divergence highlights reduced investor participation and stagnant price action, suggesting a bearish trend. These factors could drive profit-taking, potentially dragging XRP below its crucial $2.00 support level, exacerbating the bearish outlook.

Optimistic Projections Amid Bearish Trends

Despite the current gloom, some analysts remain hopeful. Dark Defender, a prominent crypto analyst, pointed to a bull flag pattern on XRP’s weekly chart, projecting a long-term target of $8.67 once the correction phase concludes. He identified key support zones between $2.03 and $2.17 and resistance levels approaching $2.69 as critical areas to watch.

Meanwhile, crypto analyst Egrag offered a more ambitious forecast, predicting XRP could surge to $15 by May 2025. Adding to the optimism, veteran trader Peter Brandt shared a bullish wedge pattern on XRP’s weekly chart, suggesting the potential for a 100x rally in the future.

Broader Market Sentiment Holds the Key

For now, XRP’s price trajectory hinges on shifting market sentiment and broader crypto trends. A bullish breakout could propel XRP past its $2.73 resistance, potentially targeting its all-time high of $3.31. However, the altcoin must first maintain its critical $2.00 support level to prevent further sell-offs.

As traders watch closely, XRP’s ability to overcome its current challenges could determine its long-term viability in the competitive crypto market.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may

Also Read: XRP Leads Crypto Market Slump as Stronger Dollar Sinks Global Assets

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.