|

Getting your Trinity Audio player ready...

|

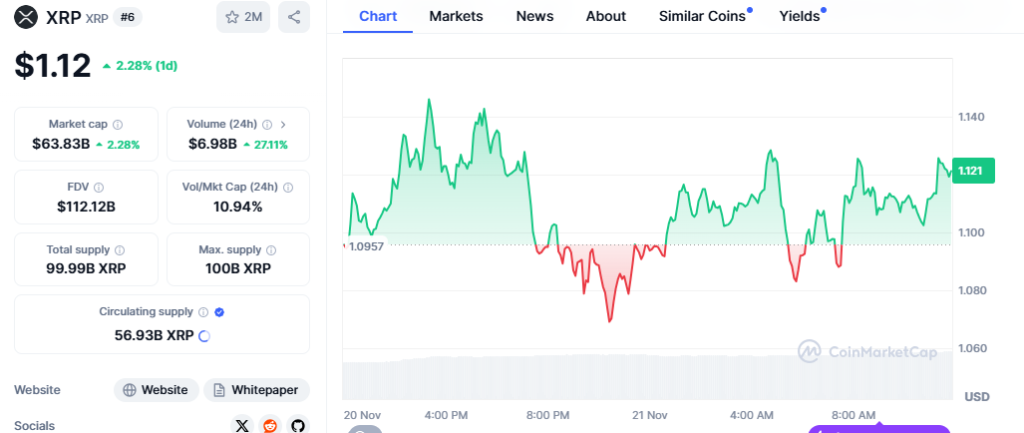

Ripple’s native cryptocurrency, XRP, has achieved a significant milestone by surpassing the crucial psychological level of $1. This remarkable feat comes after years of struggle and volatility, marking a bullish period for the broader cryptocurrency market. However, amidst the prevailing optimism and the explosive growth of altcoins, investors must exercise caution. The potential for a Bitcoin price peak could rapidly shift market sentiment, leading to a potential downturn in XRP’s price.

To navigate this uncertain landscape, it’s essential to consider the following five warning signs that could trigger an XRP price crash:

1. Overbought Conditions:

The Relative Strength Index (RSI) has surged above 81, indicating that XRP is significantly overbought. Historically, RSI levels exceeding 70 often precede price corrections or pullbacks.

2. Weakening Momentum:

The Moving Average Convergence Divergence (MACD) exhibits a potential bearish crossover. The downward convergence of the MACD line and the signal line suggests waning momentum, which can often foreshadow downward price movement.

3. Diverging Open Interest and Price:

Open interest has increased since November 16, while the price remains stagnant. This unusual divergence signals potential market instability and could lead to sudden price fluctuations.

4. Declining Cumulative Volume Delta:

The Cumulative Volume Delta (CVD) is decreasing as XRP’s price rises. This divergence indicates potential bearish momentum, suggesting that a cryptocurrency sell-off may be imminent.

5. Diminishing Volume:

Volume has significantly decreased to $6,561,072,311, indicating reduced market activity. This decline suggests that investors may be adopting a cautious approach, potentially leading to a price correction.

While XRP’s recent rally of over 20% in a week is impressive, profit-taking activity has begun to dampen its momentum. Investors are likely capitalizing on recent gains, creating a cautious sentiment that could impact XRP’s short-term trajectory.

In the past 24 hours, Ripple’s value has decreased by 0.54% to $1.09. The daily price range has fluctuated between $1.06 and $1.15. Currently, XRP is trading significantly below its all-time high of $3.84, representing a 71% decline from its peak value.

Although XRP’s breakthrough above $1 is a significant achievement, the prevailing overbought conditions, weakening momentum, and diverging market indicators raise concerns about its short-term outlook. Investors should closely monitor technical indicators and market trends to make informed decisions and mitigate potential risks associated with a potential price correction.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.