|

Getting your Trinity Audio player ready...

|

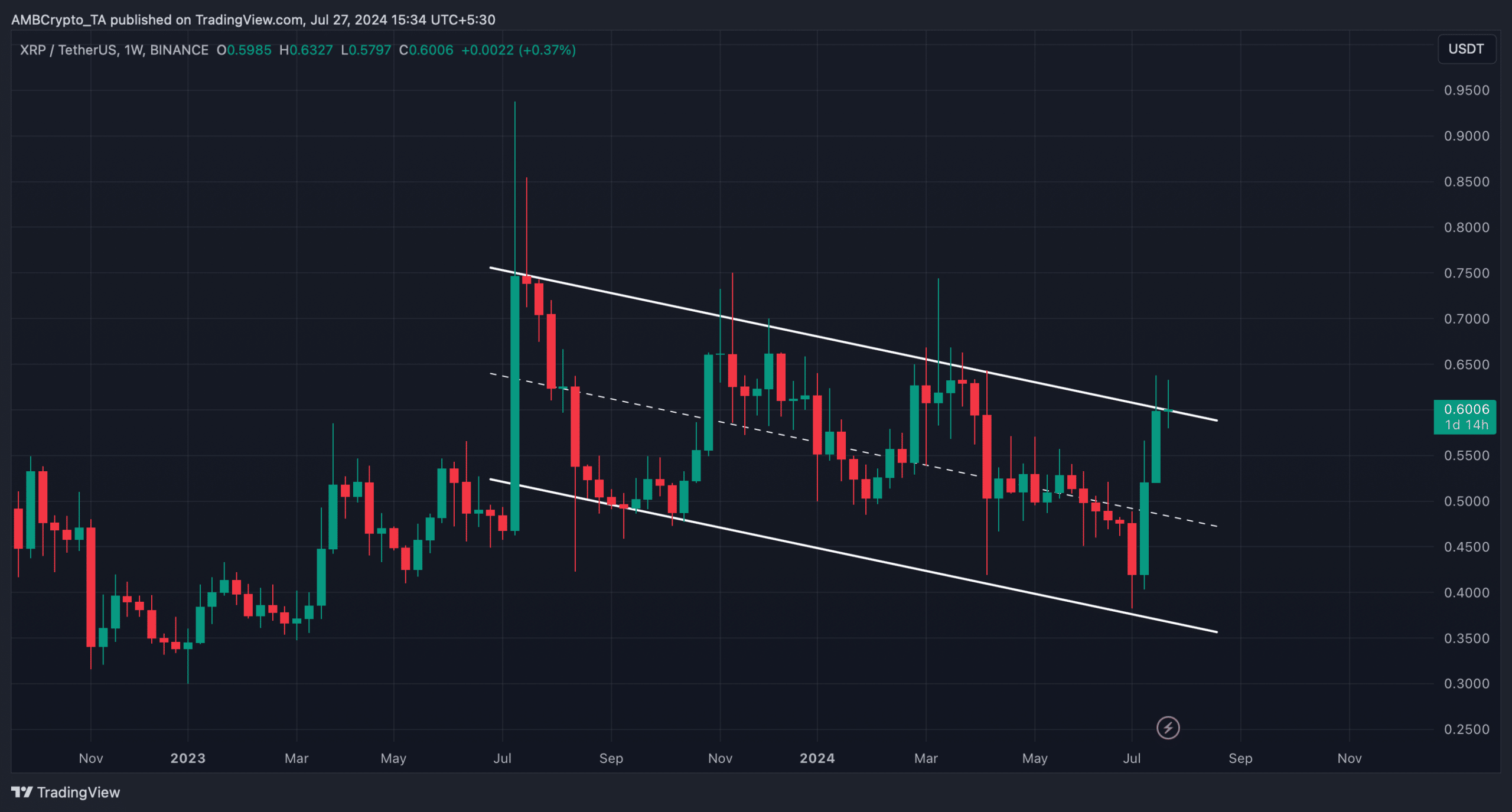

The cryptocurrency market has entered a period of consolidation, with XRP trading sideways in recent days. While the lack of significant price movement might be disappointing for investors, a closer look at the long-term chart reveals a potential bullish breakout.

XRP has been trading within a specific pattern since July of last year, according to CoinMarketCap data. However, a recent breakthrough above this pattern has ignited speculation about a potential price surge. If the breakout holds, XRP could retest its 2023 highs in the coming months.

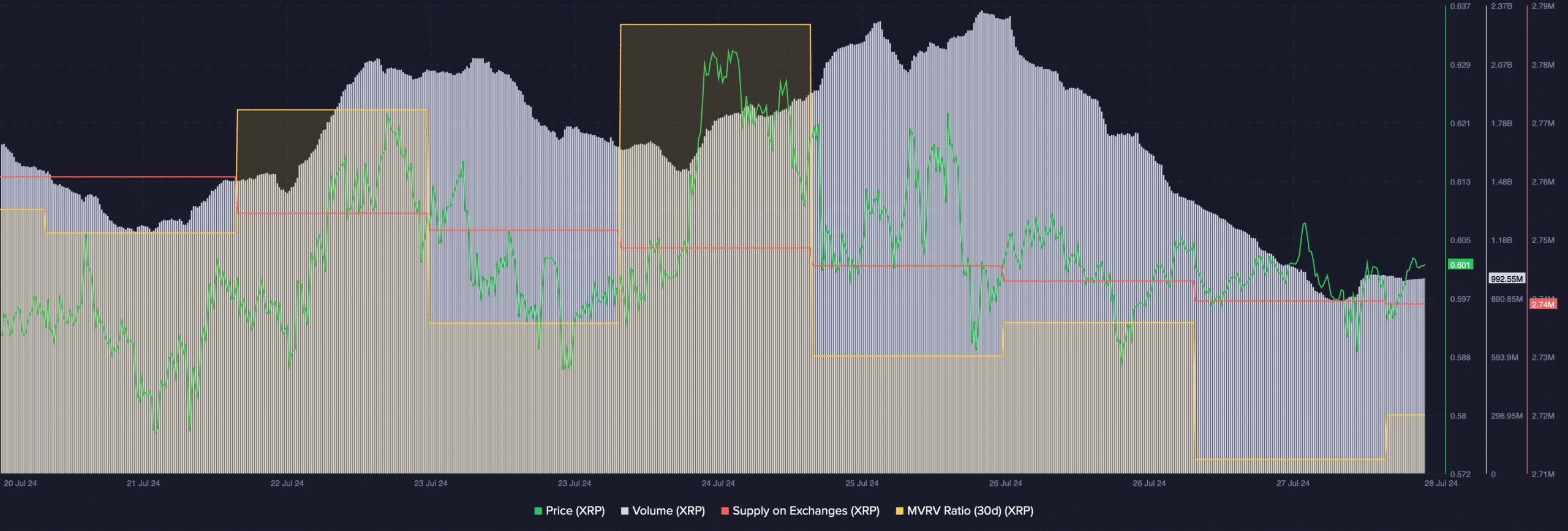

To gauge the potential for a bull rally, it’s essential to analyze on-chain metrics. While XRP’s supply on exchanges is decreasing, indicating potential buying pressure, other indicators paint a more cautious picture. The MVRV ratio, which compares the market value of XRP to its realized value, has declined, suggesting a potential price drop. Additionally, the fear and greed index is currently in the “greed” zone, which historically precedes price corrections.

Technical indicators like the RSI and Chaikin Money Flow are also showing bearish signals. However, it’s crucial to remember that these metrics can sometimes indicate a potential retest of a breakout before a sustained uptrend.

While the recent breakout is encouraging, investors should approach the XRP market with caution. The cryptocurrency market is highly volatile, and past performance is not indicative of future results. It’s essential to conduct thorough research and consider multiple factors before making investment decisions.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.