|

Getting your Trinity Audio player ready...

|

The crypto market has recently experienced a notable decline, with XRP, Ripple Labs’ native token, emerging as a focal point for both whales and long-term holders. According to on-chain analytics from Coinglass, these large investors are showing renewed interest in XRP, using the market dip as an opportunity to accumulate more tokens.

$155 Million XRP Outflow: A Sign of Confidence

Recent data reveals a significant outflow of $155 million worth of XRP tokens from exchanges, signaling a potential accumulation phase. This massive outflow is happening as XRP experiences a sharp price drop, with the altcoin declining over 16% in the past 24 hours. As a result, XRP is now trading around the $2.50 mark, sparking increased interest from traders and investors alike. This surge in trading activity led to a striking 210% increase in XRP’s trading volume, further solidifying the notion that whales are actively positioning themselves for a rebound.

Traders Betting Against XRP: Shorting Pressure Mounts

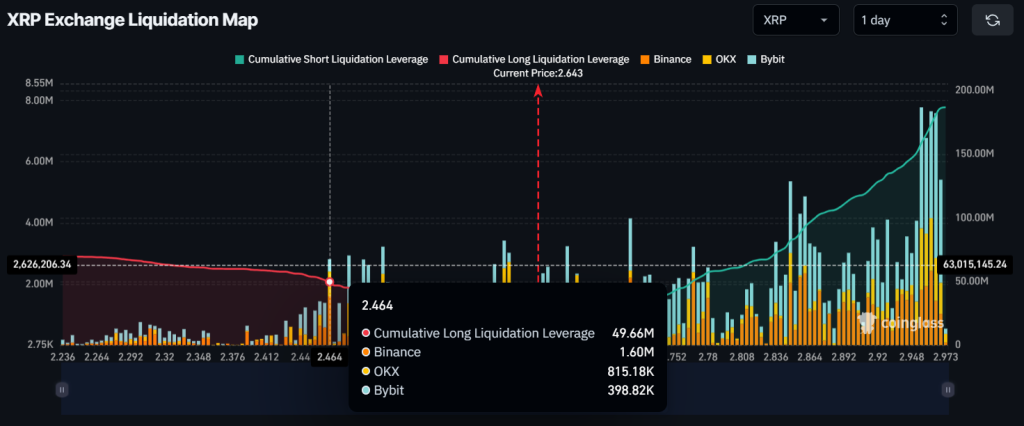

While whales and long-term holders are accumulating, short-term traders are betting against XRP’s recovery. Data indicates that at the $2.50 price level, traders are holding $14 million worth of long positions, anticipating that XRP will not drop further. However, short sellers dominate the scene, with a hefty $111 million in short positions at the $2.85 level. The over-leveraged short sellers could cause significant liquidations if XRP fails to break key resistance levels, intensifying the downward pressure.

XRP’s Technical Outlook: Bearish Signals Loom

From a technical standpoint, XRP is currently facing a critical juncture. Having breached its crucial support level, the token could face further declines. If the $2.55 level fails to hold, analysts predict that XRP may fall as low as $1.90, marking a 25% drop in the coming days. Traders are closely monitoring these levels for any signs of reversal or continuation of the downtrend.

Also Read: XRP Hits Potential Generational Bottom After 42% Drop: Is a Legendary Bounce Ahead? – Analyst

As XRP continues to struggle, its price movements will be key in determining whether the whales’ accumulation will pay off or if further declines are inevitable.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.