|

Getting your Trinity Audio player ready...

|

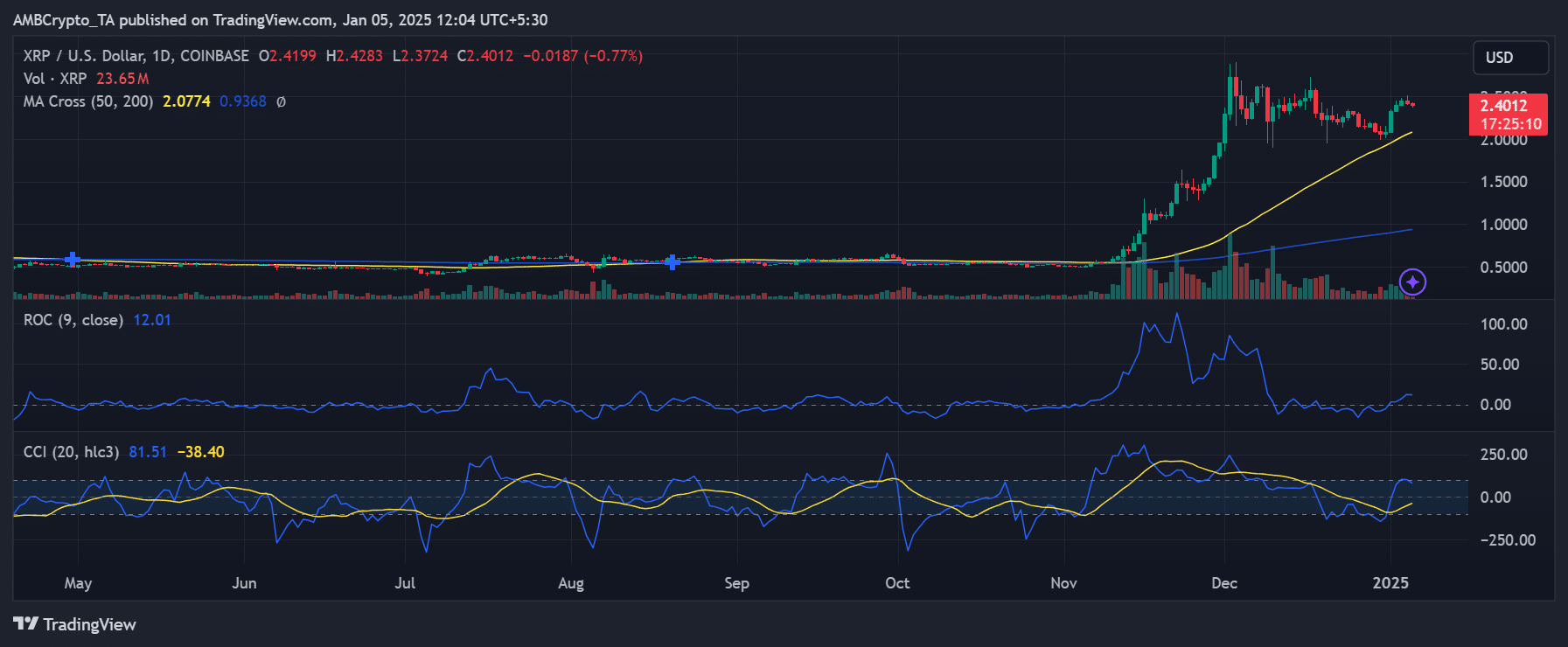

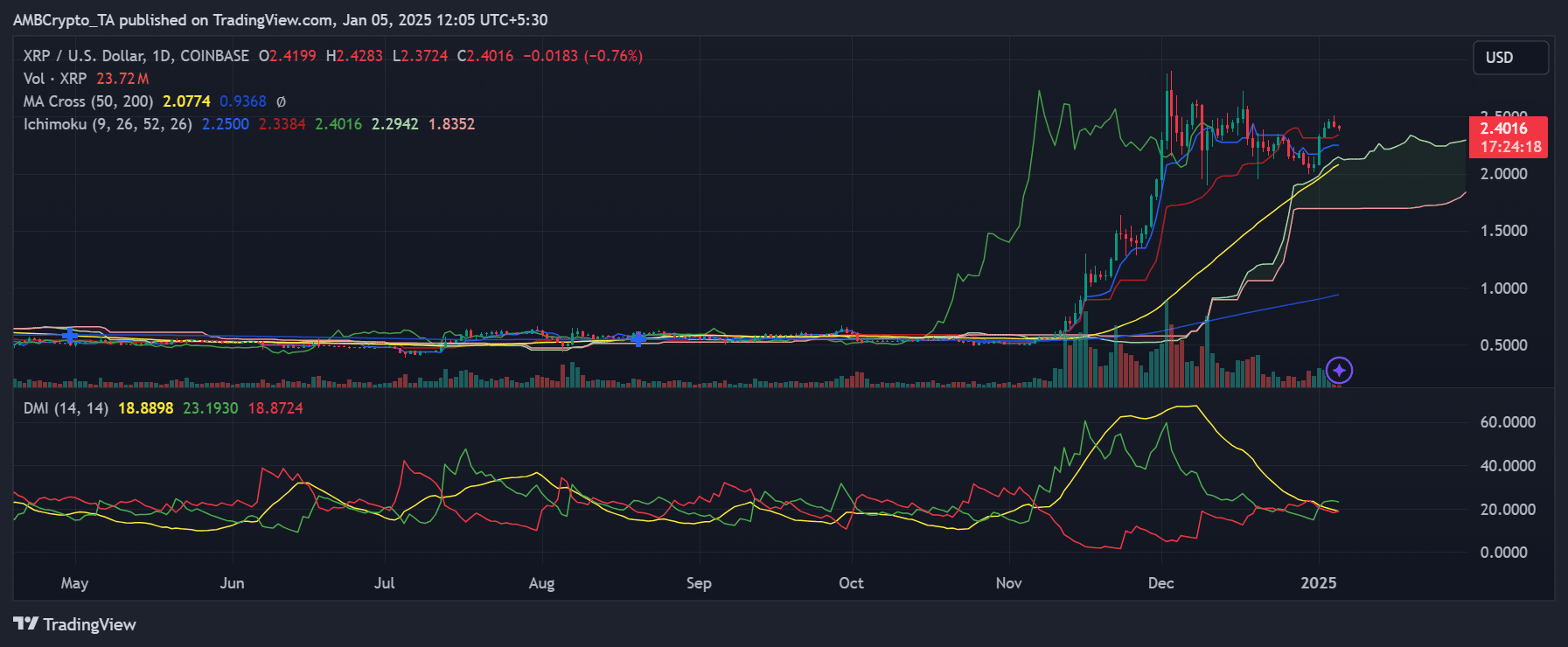

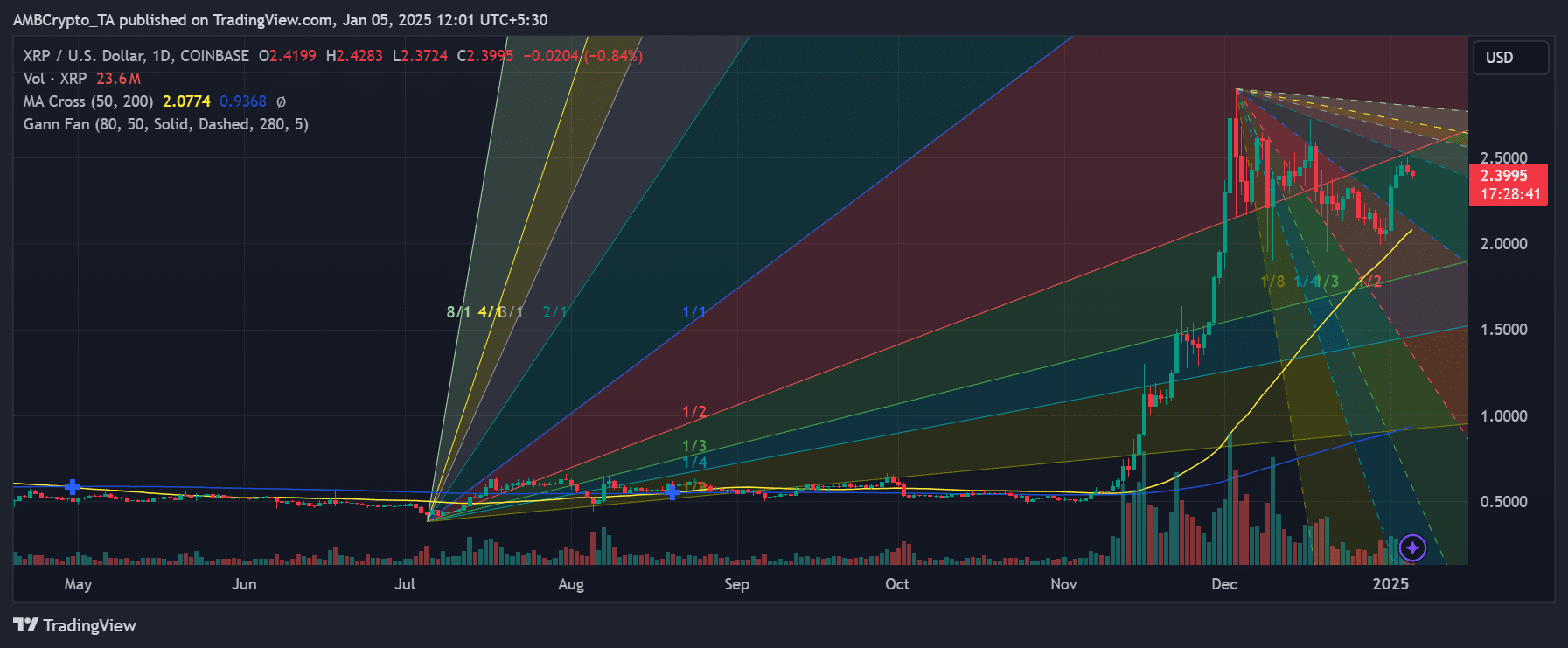

XRP was trading at approximately $2.40 at press time, showing a modest pullback from recent highs. The cryptocurrency is in a pivotal consolidation phase, with its next major move hinging on critical technical indicators.

Overbought Signals Raise Caution

The Commodity Channel Index (CCI) is signaling overbought conditions with a value of 101.77, suggesting potential short-term selling pressure. However, in strong uptrends, such signals don’t always lead to immediate corrections. Complementing this, the Rate of Change (ROC) highlights positive price momentum, affirming that buyers retain some control. These mixed signals underline the importance of sustaining bullish momentum to prevent a reversal.

Long-Term Indicators Show Promise

XRP’s trend indicators provide an optimistic long-term perspective. The 50-day Simple Moving Average (SMA) is positioned above the 200-day SMA, signaling a sustained bullish trend. Additionally, XRP’s price remains above the Ichimoku Cloud, with strong support evident at $2.00. Yet, the Directional Movement Index (DMI) shows the trend is not fully established, with an Average Directional Index (ADX) reading of 19.55, indicating moderate strength.

Key Levels to Watch

Gann Fan analysis reveals XRP is testing a critical support angle around $2.00, a crucial level to maintain for continued upward momentum. On the resistance front, both Gann Fan and Fibonacci projections identify $2.50 as a key hurdle. Breaking this resistance could propel XRP toward the $3.00 mark, while failing to hold $2.00 might trigger a deeper correction.

Volatility Tightens: A Breakout Ahead?

Bollinger Bands on the charts indicate narrowing volatility, hinting at an impending breakout. Whether bulls or bears will dominate this move remains uncertain, but the tightening price action demands traders’ attention as XRP approaches critical thresholds.

Also Read: XRP Price Set for a Pullback Before Skyrocketing to $11, Experts Predict

XRP stands at a critical juncture. With support at $2.00 and resistance at $2.50, the battle between bulls and bears is intensifying. A breakout above $2.50 could ignite a rally to $3.00, while losing $2.00 support may invite further selling pressure. For now, traders should closely monitor these levels as XRP’s consolidation phase unfolds.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.