|

Getting your Trinity Audio player ready...

|

Worldcoin (WLD) has flipped the $2.5 resistance zone into a solid support level, propelling its sights on the $4.5 mark. The daily and weekly market structures for WLD remain bullish, though a bearish divergence hints at a potential short-term retracement. Despite this, strong capital inflows suggest that any dip may be shallow, reinforcing bullish momentum.

Bullish Momentum Backed by Moving Average Crossover

WLD has undergone a remarkable recovery, surging 198% since its September lows. This dramatic rise followed a prolonged downtrend from March to September and a month-long consolidation phase. The rally gained significant traction over the past ten days, fueled by a decisive breach of the $2.5 resistance zone.

The $2.5-$2.9 area, now a critical demand zone, has been successfully defended by buyers. This defense enabled WLD to overcome the $3.26 resistance, which had marked a lower high in July. The breach flipped the weekly market structure bullish, complementing the bullish daily structure established earlier in November after the late October pullback to $1.589.

Adding to the bullish outlook, a crossover of the 20 and 50-day moving averages highlights growing upward momentum. These moving averages now act as potential support zones, fortifying the case for sustained price strength. However, caution is warranted as the Money Flow Index (MFI) has reached 81, suggesting overbought conditions. A bearish divergence in the MFI could signal a short-term correction.

The Road to $4.5: Bullish Sentiment and Risks

With its next target set at $4.5, WLD eyes a critical level that served as robust support between April and June. While a rally to this level is feasible, consolidation beneath $4.5 is expected as traders gauge market strength.

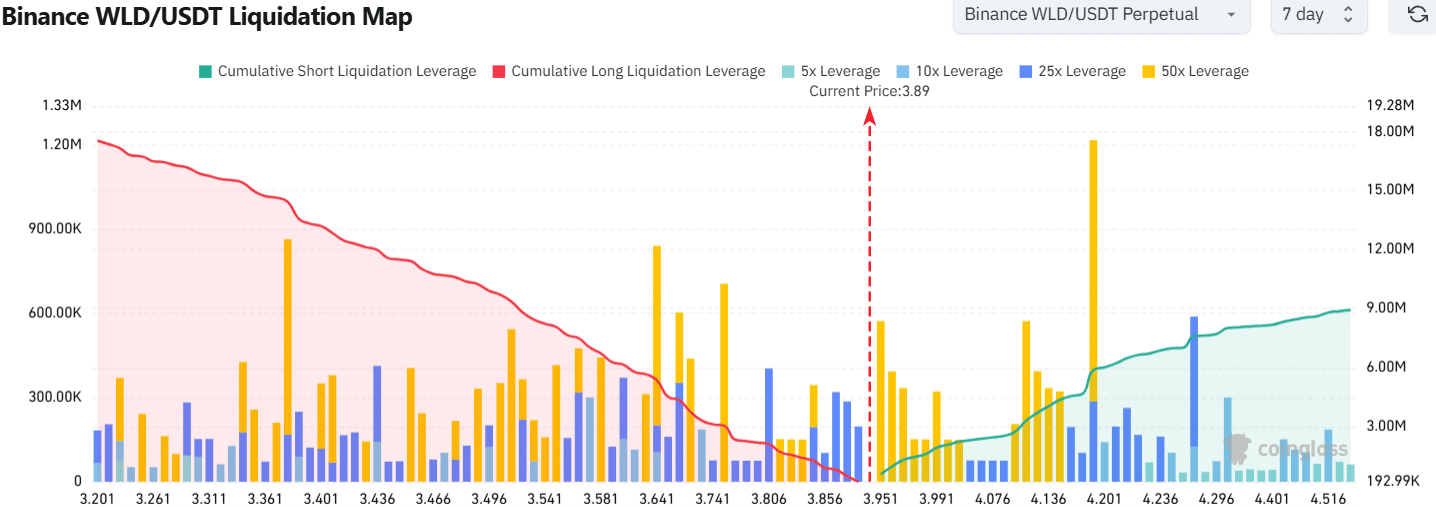

Short-term sentiment remains firmly bullish, as evidenced by liquidation maps showing substantial short positions around $4 and $4.15. The high cumulative leverage near $4.13 increases the likelihood of a move to sweep this liquidity zone before any significant retreat.

Despite these bullish indicators, traders should remain cautious about overextension. A breakout beyond $4 could face resistance as market momentum might wane. Monitoring buyer strength at key levels will be crucial in determining whether WLD can achieve its $4.5 target in the near term.

Also Read: Worldcoin (WLD) Climbs 15% in 24 Hours: Is a Pullback Looming or a Continued Rally Ahead?

Worldcoin’s bullish recovery underscores its potential for further growth, but traders should approach the market with a balanced perspective. While the $4.5 target is in sight, the bearish divergence in momentum indicators suggests a pullback is possible. Strong support at $2.5 and $3.26 provides a solid foundation, positioning WLD well for continued upward movement in the long run.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!