|

Getting your Trinity Audio player ready...

|

- Spot investors are selling WLFI, but Derivatives traders are adding $230M in new positions.

- Liquidation clusters above price suggest upside potential if momentum holds.

- A buyback-and-burn vote with 99% approval could spark a supply squeeze.

Stay ahead with real-time updates and insights—Join our Telegram channel!

World Liberty Financial (WLFI) emerged as one of the crypto market’s strongest performers in the past 24 hours, soaring by double digits to reach $0.2339. However, this rally came even as Spot market traders sold into strength, suggesting profit-taking rather than fresh accumulation.

According to CoinGlass data, Spot exchange netflows showed a second consecutive day of WLFI inflows, signaling that holders were actively moving tokens to exchanges. Roughly $5.1 million worth of WLFI was sold during this period—a stark reversal from last week’s $24 million in net buys. If this trend continues and inflows climb further, it could confirm growing bearish pressure among Spot participants.

Derivatives Traders Fuel Bullish Momentum

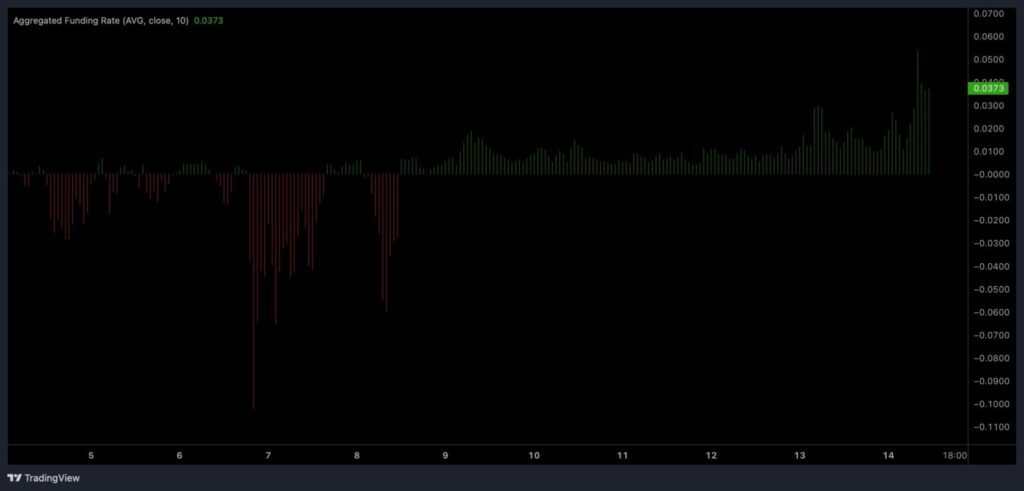

Despite the selling on Spot markets, WLFI’s Derivatives market painted a much more optimistic picture. Data from Coinalyze revealed the Aggregated Funding Rate rose to 0.0373, meaning long traders are paying funding fees to maintain positions—typically a sign of bullish conviction.

Open Interest also jumped to $1.04 billion, with $230 million added within just 24 hours. This surge in new liquidity suggests traders are positioning for further upside, not retreat. The divergence between Spot selling and Derivatives buying highlights a tug-of-war over WLFI’s next direction.

Also Read: Trump Family’s World Liberty Financial Burns 47 Million Tokens as WLFI Price Plummets

Liquidation Clusters and Governance Vote Could Drive Next Move

CoinGlass liquidation data suggests WLFI has higher probability of rallying than declining in the short term. Most liquidation clusters are stacked above current prices, acting as near-term targets if bullish momentum holds.

Adding to the optimism, WLFI’s community governance vote on a proposed buyback-and-burn mechanism for protocol-owned liquidity has so far received 99.73% approval from over 5,600 voters. If passed, the proposal would permanently remove WLFI from circulation, reducing supply and reinforcing bullish scarcity dynamics. With four days left, its likely success could accelerate WLFI’s ongoing rally.

While Spot traders lock in gains, Derivatives traders and governance tailwinds are keeping WLFI’s bullish fire alive. If buyback plans pass and liquidity stays elevated, WLFI could be primed for further upside.

Stay ahead with real-time updates and insights—Join our Telegram channel!

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.