|

Getting your Trinity Audio player ready...

|

WisdomTree Investments, Inc., a prominent global asset manager, has taken a significant step into the cryptocurrency investment space by filing an S-1 registration statement with the U.S. Securities and Exchange Commission (SEC) for its proposed WisdomTree XRP Fund. This move positions WisdomTree alongside other major financial institutions like Bitwise, 21Shares, and Canary Capital, all of whom have expressed interest in launching XRP-based exchange-traded funds (ETFs).

A Strategic Move

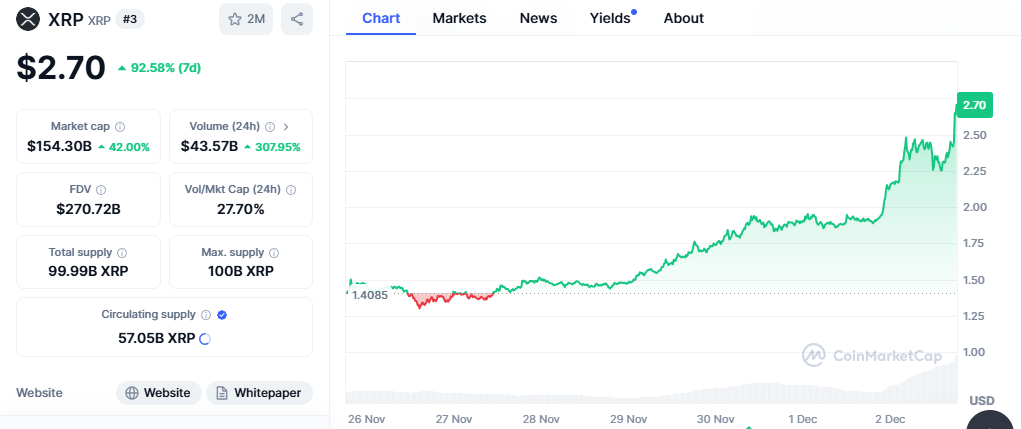

The proposed fund aims to track the price of XRP, the third-largest cryptocurrency by market capitalization. By offering an XRP ETF, WisdomTree seeks to provide investors with a convenient and regulated way to gain exposure to this digital asset. Bank of New York Mellon has been appointed as the administrator for the proposed trust, underscoring the institutional interest in XRP and the broader cryptocurrency market.

Navigating Regulatory Hurdles

However, the regulatory landscape for cryptocurrencies, particularly XRP, remains complex. The ongoing legal battle between Ripple Labs and the SEC has cast a shadow over the potential launch of XRP ETFs. The SEC’s classification of XRP as a security could pose significant challenges to the approval of such products.

A New Era for Crypto Regulation?

With the impending departure of SEC Chair Gary Gensler, there is growing anticipation for a potential shift in the agency’s approach to crypto regulation. Industry experts speculate that a new leadership could usher in a more favorable regulatory environment for cryptocurrencies, including XRP.

Also Read: WisdomTree Launches XRP ETP in Europe Amid Surging Institutional Demand: What’s Next for XRP?

While the future of XRP ETFs remains uncertain, WisdomTree’s filing signals a strong belief in the long-term potential of XRP and the broader crypto market. As the regulatory landscape continues to evolve, investors and industry participants alike will be closely watching the developments surrounding XRP and its potential to become a mainstream investment asset.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

A lifelong learner with a thirst for knowledge, I am constantly seeking to understand the intricacies of the crypto world. Through my writing, I aim to share my insights and perspectives on the latest developments in the industry. I believe that crypto has the potential to create a more inclusive and equitable financial system, and I am committed to using my writing to promote its positive impact on the world.