|

Getting your Trinity Audio player ready...

|

- Bitcoin historically struggles in September but 2025 may defy the trend.

- Technical signals suggest BTC could reach $124K within weeks.

- Fed rate cuts and a weaker dollar could fuel a major crypto rally.

Bitcoin (BTC) is entering September under pressure after closing August in the red, its first monthly loss since April. Historically, September has been one of Bitcoin’s weakest months, but analysts argue this year could break the trend thanks to a weaker U.S. dollar and upcoming Federal Reserve rate cuts.

The “September Effect” Looms Over Bitcoin

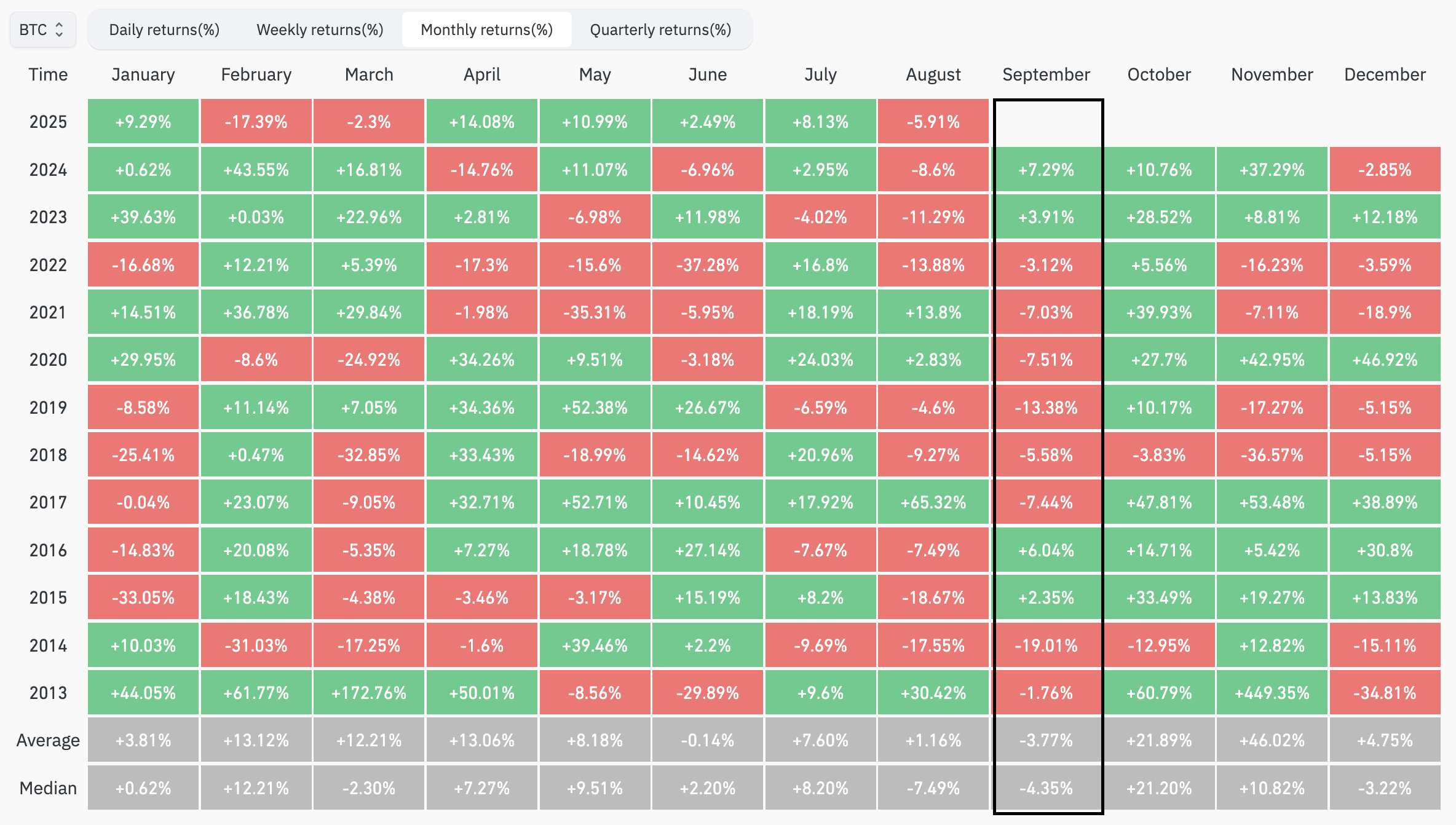

Since 2013, Bitcoin has posted negative returns in September in eight out of twelve years, with average losses of around −3.8%, according to CoinGlass. This pattern mirrors Wall Street’s long-running “September Effect,” where the S&P 500 also tends to dip, averaging −1.2% since 1928.

Traders often take profits from summer rallies or shift capital ahead of the year’s final quarter, pressuring both equities and crypto.

Why 2025 Could Defy the Pattern

Despite seasonal weakness, some analysts are optimistic. Rekt Fencer points to a striking similarity between Bitcoin’s 2017 cycle and today’s price action. In both cases, BTC fell sharply in late August before stabilizing at support levels. In 2017, that reset paved the way for a surge to $20,000.

Currently, Bitcoin is consolidating between $105,000 and $110,000—a zone that has flipped from resistance into support. Technical signals, including a “hidden bullish divergence” on the Relative Strength Index (RSI), suggest underlying buying strength. Analyst ZYN projects Bitcoin could retest its all-time high near $124,500 within the next 4–6 weeks.

Dollar Weakness Could Boost BTC Prices

Macro conditions may also favor Bitcoin. Currency traders expect the U.S. dollar to decline further as slowing economic growth and looming Fed rate cuts weigh on sentiment. With Bitcoin showing a negative correlation to the dollar, a greenback slump could act as a tailwind for crypto.

Analyst Ash Crypto believes two Fed rate cuts later this year could inject trillions into risk assets, fueling what he calls a “parabolic phase” for Bitcoin and altcoins alike.

While September has historically spelled trouble for Bitcoin, 2025 could prove different. A softer dollar, supportive technicals, and echoes of past bull cycles give BTC a chance to defy the seasonal slump. If history repeats the bullish side of 2017, Bitcoin may be closer to new highs than a fresh correction.

Also Read: Elon Musk’s Lawyer to Chair $200M Dogecoin Treasury as Institutions Eye DOGE

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.