|

Getting your Trinity Audio player ready...

|

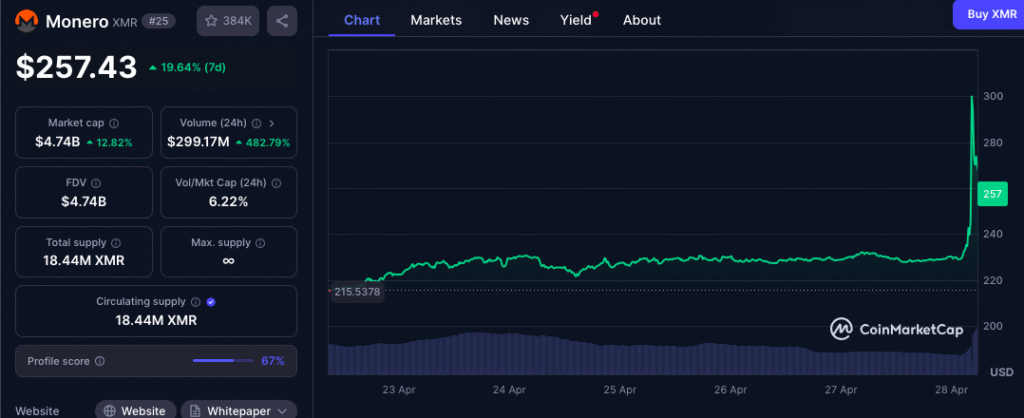

Monero (XMR), a cryptocurrency known for its privacy features, has experienced a dramatic 50% surge in its price over the past 24 hours, capturing the attention of investors. However, this impressive rally appears to be fueled by illicit activity rather than organic market demand. On-chain security expert ZachXBT has pointed to a significant Bitcoin theft and subsequent attempts to launder the stolen funds through Monero as the primary driver behind the price spike.

Data from CoinMarketCap reveals that the XMR price reached a daily high of $339 before settling at around $280 at the time of writing. This price surge was accompanied by an extraordinary 380% increase in Monero’s trading volume, reaching a substantial $304 million within the same 24-hour period. This unusual trading activity has left many investors questioning the underlying reasons for such a rapid appreciation.

Bitcoin Heist Suspected as Catalyst for XMR Rally

According to ZachXBT, the sudden and substantial increase in Monero’s value is directly linked to the theft of 3,520 Bitcoin, valued at approximately $330.7 million. The on-chain analyst detailed in an X post how, shortly after the suspicious Bitcoin transaction, the stolen funds began to be moved to various instant cryptocurrency exchanges. The perpetrators then allegedly initiated a series of swaps, converting the Bitcoin into Monero in an apparent attempt to obscure the trail of the stolen assets due to Monero’s enhanced privacy features.

Nine hours ago a suspicious transfer was made from a potential victim for 3520 BTC ($330.7M)

— ZachXBT (@zachxbt) April 28, 2025

Theft address

bc1qcrypchnrdx87jnal5e5m849fw460t4gk7vz55g

Shortly after the funds began to be laundered via 6+ instant exchanges and was swapped for XMR causing the XMR price to spike…

ZachXBT highlighted the unusual pattern of the fund transfers, noting that the Bitcoin was moved in smaller batches to multiple instant exchanges, where hundreds of orders were created. This method of moving funds in a fragmented manner, according to the expert, is likely to result in significant losses for the launderers but underscores a determined effort to obfuscate the origin of the stolen Bitcoin.

Also Read: Monero Price Soars 113% in 2024: Tornado Cash Victory Sparks Rally

On-Chain Evidence Points to Long-Term Bitcoin Holder as Victim

Further analysis by ZachXBT suggests that the victim of the substantial Bitcoin theft is likely a long-term holder of the cryptocurrency, potentially holding BTC since before 2015. While the specific exchange used by the victim remains unconfirmed, ZachXBT mentioned Gemini, Coinbase, or River as possibilities. The security expert also clarified that there is no indication of North Korean involvement in this particular heist, despite their recent alleged targeting of cryptocurrency developers.

Interestingly, while Monero‘s price has witnessed a significant upswing following this incident, Bitcoin’s price has remained relatively stable, trading sideways around the $94,000 mark. Despite broader market optimism fueled by Bitcoin potentially nearing the $100,000 threshold, this incident serves as a stark reminder of the risks associated with cryptocurrency and the lengths to which malicious actors will go to launder illicitly obtained funds. The Monero price surge, therefore, appears to be an anomaly driven by criminal activity rather than genuine investor interest in the privacy coin.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!